Why Carel Industries (BIT:CRL) Is Up 10.0% After Strong Nine-Month Sales and Profit Growth

Reviewed by Sasha Jovanovic

- On November 13, 2025, Carel Industries S.p.A. announced its earnings for the nine months ended September 30, 2025, reporting sales of €463.69 million and net income of €42.34 million, both higher than the previous year.

- This performance reflects ongoing momentum in the company’s core business segments, with basic earnings per share rising to €0.38 from €0.35 year over year.

- We'll examine how the reported increases in sales and profit shape Carel Industries' investment outlook moving forward.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 27 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

Carel Industries Investment Narrative Recap

To be a shareholder in Carel Industries, you must believe in the company's ability to drive sustainable revenue and earnings growth by delivering energy-efficient and software-enabled building automation solutions, especially as demand for such technologies continues across global HVAC-R markets. The latest earnings report, showing higher sales and net income, reinforces confidence in near-term growth but does not materially reduce the key risk of intensifying global competition, which could weigh on margins if pricing pressure increases.

Among recent announcements, management's 2025 revenue guidance for high single-digit to low double-digit organic growth stands out. This aligns with the upbeat earnings released in November and supports the catalyst that growing demand for energy-efficient and automated systems is currently fueling top-line momentum for Carel Industries.

However, what’s often overlooked is the potential long-term impact of aggressive new entrants in low-cost manufacturing on...

Read the full narrative on Carel Industries (it's free!)

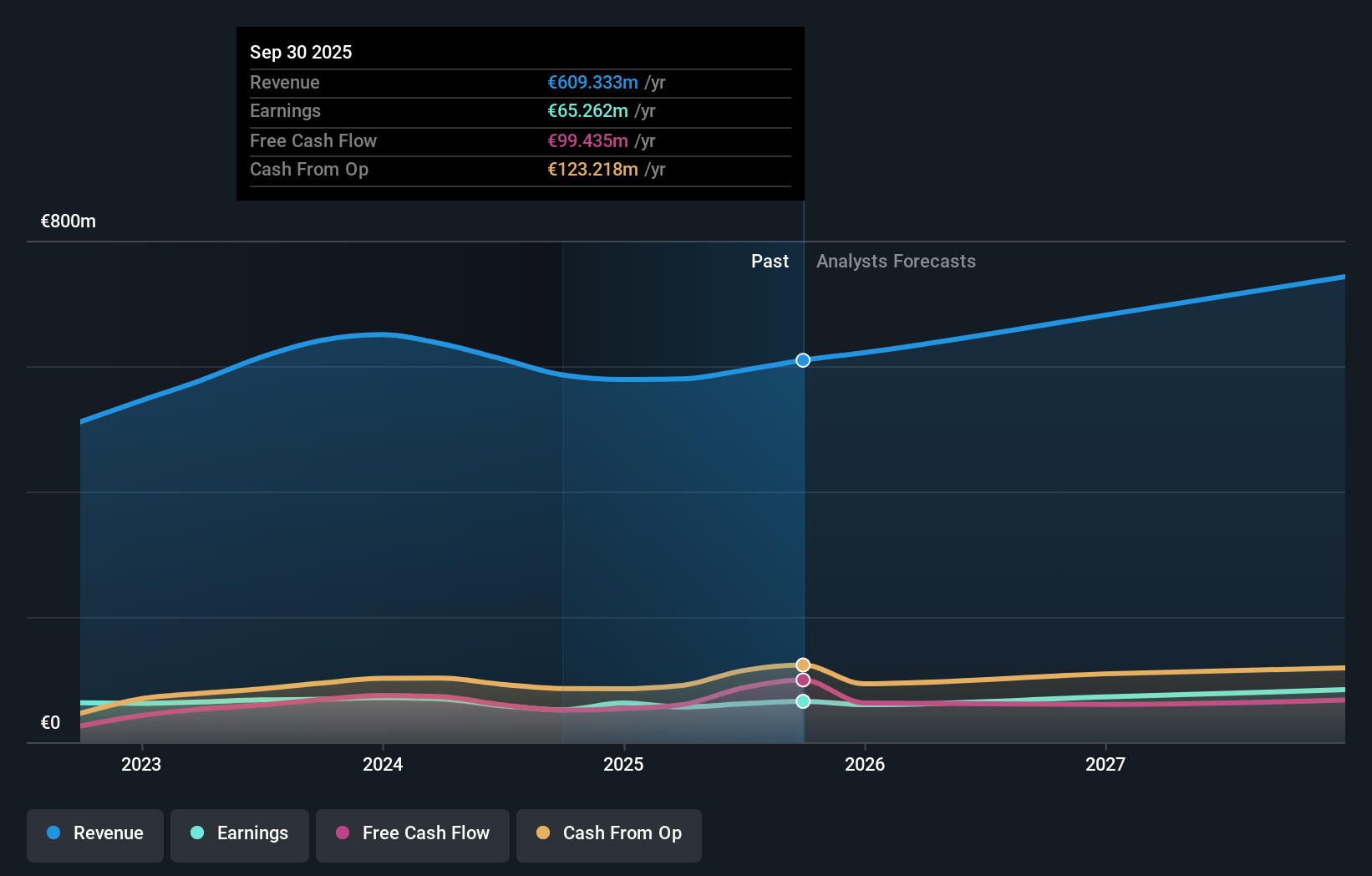

Carel Industries is projected to achieve €773.7 million in revenue and €87.5 million in earnings by 2028. This outlook assumes a 9.3% annual revenue growth rate and represents a €26.2 million increase in earnings from the current €61.3 million.

Uncover how Carel Industries' forecasts yield a €23.87 fair value, in line with its current price.

Exploring Other Perspectives

Only one member of the Simply Wall St Community estimated Carel’s fair value at €23.87, close to recent analyst targets. Despite strong recent sales growth, the real test will be whether Carel can maintain margins amid rising competition and input costs. Check multiple views before deciding.

Explore another fair value estimate on Carel Industries - why the stock might be worth just €23.87!

Build Your Own Carel Industries Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Carel Industries research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free Carel Industries research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Carel Industries' overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Find companies with promising cash flow potential yet trading below their fair value.

- These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BIT:CRL

Carel Industries

Designs, manufactures, markets, and distributes control and humidification solutions in Europe, the Middle East, Africa, North America, South America, and the Asia Pacific.

Flawless balance sheet with solid track record.

Market Insights

Community Narratives