Here's Why We Think Carel Industries (BIT:CRL) Is Well Worth Watching

The excitement of investing in a company that can reverse its fortunes is a big draw for some speculators, so even companies that have no revenue, no profit, and a record of falling short, can manage to find investors. Unfortunately, these high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson. While a well funded company may sustain losses for years, it will need to generate a profit eventually, or else investors will move on and the company will wither away.

If this kind of company isn't your style, you like companies that generate revenue, and even earn profits, then you may well be interested in Carel Industries (BIT:CRL). While this doesn't necessarily speak to whether it's undervalued, the profitability of the business is enough to warrant some appreciation - especially if its growing.

See our latest analysis for Carel Industries

How Quickly Is Carel Industries Increasing Earnings Per Share?

Generally, companies experiencing growth in earnings per share (EPS) should see similar trends in share price. Therefore, there are plenty of investors who like to buy shares in companies that are growing EPS. Impressively, Carel Industries has grown EPS by 23% per year, compound, in the last three years. As a general rule, we'd say that if a company can keep up that sort of growth, shareholders will be beaming.

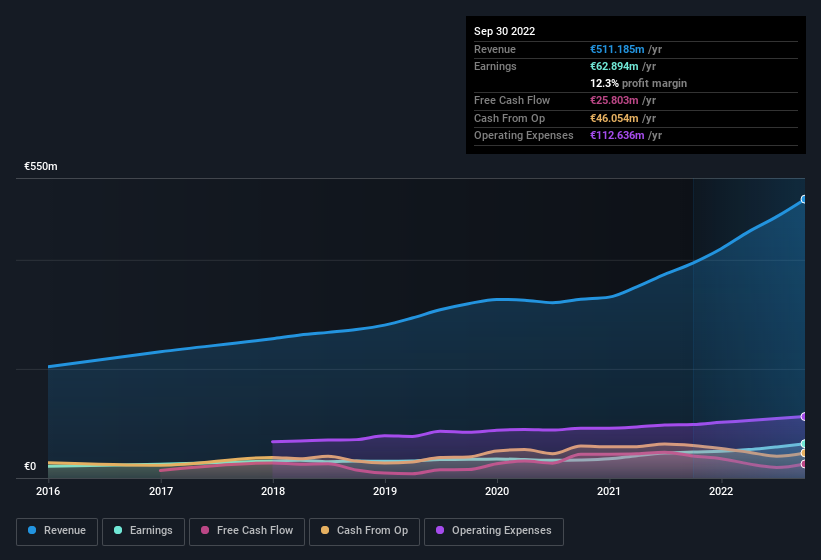

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. Carel Industries maintained stable EBIT margins over the last year, all while growing revenue 30% to €511m. That's encouraging news for the company!

You can take a look at the company's revenue and earnings growth trend, in the chart below. Click on the chart to see the exact numbers.

While it's always good to see growing profits, you should always remember that a weak balance sheet could come back to bite. So check Carel Industries' balance sheet strength, before getting too excited.

Are Carel Industries Insiders Aligned With All Shareholders?

Investors are always searching for a vote of confidence in the companies they hold and insider buying is one of the key indicators for optimism on the market. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

Carel Industries top brass are certainly in sync, not having sold any shares, over the last year. But the real excitement comes from the €84k that Chairman of the Board Luigi Luciani spent buying shares (at an average price of about €24.97). Purchases like this clue us in to the to the faith management has in the business' future.

On top of the insider buying, we can also see that Carel Industries insiders own a large chunk of the company. Indeed, with a collective holding of 56%, company insiders are in control and have plenty of capital behind the venture. Intuition will tell you this is a good sign because it suggests they will be incentivised to build value for shareholders over the long term. at the current share price. That level of investment from insiders is nothing to sneeze at.

Is Carel Industries Worth Keeping An Eye On?

If you believe that share price follows earnings per share you should definitely be delving further into Carel Industries' strong EPS growth. On top of that, insiders own a significant piece of the pie when it comes to the company's stock, and one has been buying more. These things considered, this is one stock worth watching. You still need to take note of risks, for example - Carel Industries has 1 warning sign we think you should be aware of.

Keen growth investors love to see insider buying. Thankfully, Carel Industries isn't the only one. You can see a a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BIT:CRL

Carel Industries

Designs, manufactures, markets, and distributes control and humidification solutions in Europe, the Middle East, Africa, North America, South America, and the Asia Pacific.

Flawless balance sheet with proven track record.

Market Insights

Community Narratives