- Italy

- /

- Electrical

- /

- BIT:CMB

Why Cembre (BIT:CMB) Is Up 5.7% After Posting Higher Q3 Sales and Net Income

Reviewed by Sasha Jovanovic

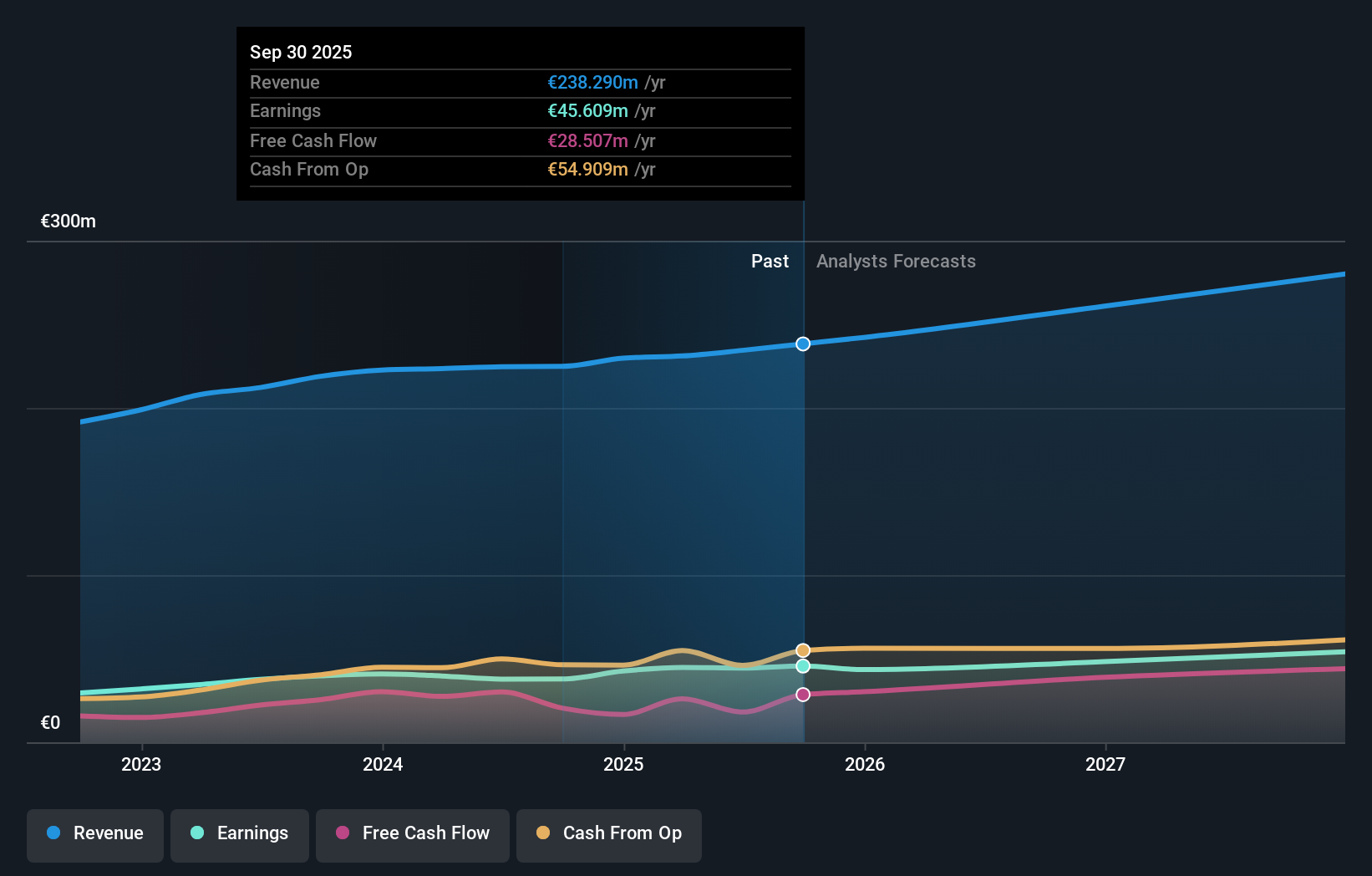

- Cembre S.p.A. has reported earnings results for the third quarter and nine months ended September 30, 2025, showing sales of €55.6 million and net income of €9.54 million for the third quarter, both higher than the same period last year.

- This consistent year-on-year growth in revenue and profitability highlights Cembre’s ongoing ability to expand its business over multiple reporting periods.

- We'll explore how the ongoing increases in sales and net income could shape Cembre’s investment narrative moving forward.

We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

What Is Cembre's Investment Narrative?

Looking at Cembre as a potential investment, most shareholders would need to believe that the company can continue its solid track record of year-on-year growth, both in revenue and profitability. The freshly released Q3 and nine-month numbers support this belief, showing steady gains in sales and net income. This performance may shift the conversation around short-term catalysts, placing even greater attention on margin sustainability and demand resilience across Cembre’s core markets. At the same time, these new results might nudge investors to re-examine risks, such as the company’s relatively high valuation versus both its historical trends and peers, as well as potential gaps in free cash flow coverage for dividends. For now, the latest figures haven’t dramatically changed the big risks or immediate catalysts but do reinforce the consistent operational execution that underpins the Cembre growth story.

On the other hand, high valuation remains a key issue that investors should not overlook. Cembre's shares are on the way up, but could they be overextended? Uncover how much higher they are than fair value.Exploring Other Perspectives

Explore 2 other fair value estimates on Cembre - why the stock might be worth as much as €64.67!

Build Your Own Cembre Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Cembre research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Cembre research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Cembre's overall financial health at a glance.

Ready For A Different Approach?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BIT:CMB

Cembre

Engages in the manufacture and sale of electrical connectors, cable accessories, and tools in Italy, the rest of Europe, and internationally.

Outstanding track record with flawless balance sheet and pays a dividend.

Market Insights

Community Narratives