- Italy

- /

- Electrical

- /

- BIT:ATON

Investors Still Aren't Entirely Convinced By ATON Green Storage S.p.A.'s (BIT:ATON) Revenues Despite 26% Price Jump

ATON Green Storage S.p.A. (BIT:ATON) shareholders are no doubt pleased to see that the share price has bounced 26% in the last month, although it is still struggling to make up recently lost ground. But the last month did very little to improve the 59% share price decline over the last year.

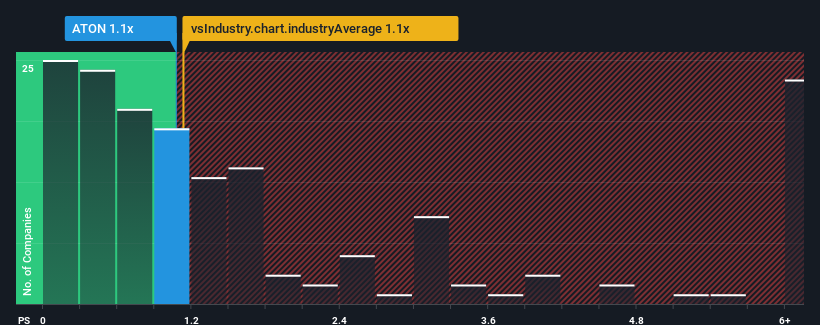

Even after such a large jump in price, there still wouldn't be many who think ATON Green Storage's price-to-sales (or "P/S") ratio of 1.1x is worth a mention when the median P/S in Italy's Electrical industry is similar at about 0.8x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

Our free stock report includes 3 warning signs investors should be aware of before investing in ATON Green Storage. Read for free now.See our latest analysis for ATON Green Storage

How ATON Green Storage Has Been Performing

ATON Green Storage could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. One possibility is that the P/S ratio is moderate because investors think this poor revenue performance will turn around. However, if this isn't the case, investors might get caught out paying too much for the stock.

Want the full picture on analyst estimates for the company? Then our free report on ATON Green Storage will help you uncover what's on the horizon.How Is ATON Green Storage's Revenue Growth Trending?

There's an inherent assumption that a company should be matching the industry for P/S ratios like ATON Green Storage's to be considered reasonable.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 66%. As a result, revenue from three years ago have also fallen 39% overall. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Shifting to the future, estimates from the dual analysts covering the company suggest revenue should grow by 26% each year over the next three years. With the industry only predicted to deliver 6.8% per year, the company is positioned for a stronger revenue result.

With this information, we find it interesting that ATON Green Storage is trading at a fairly similar P/S compared to the industry. Apparently some shareholders are skeptical of the forecasts and have been accepting lower selling prices.

The Final Word

ATON Green Storage appears to be back in favour with a solid price jump bringing its P/S back in line with other companies in the industry Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Looking at ATON Green Storage's analyst forecasts revealed that its superior revenue outlook isn't giving the boost to its P/S that we would've expected. When we see a strong revenue outlook, with growth outpacing the industry, we can only assume potential uncertainty around these figures are what might be placing slight pressure on the P/S ratio. At least the risk of a price drop looks to be subdued, but investors seem to think future revenue could see some volatility.

Don't forget that there may be other risks. For instance, we've identified 3 warning signs for ATON Green Storage (2 are concerning) you should be aware of.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BIT:ATON

ATON Green Storage

Engages in the production and sale of storage systems for photovoltaic systems and battery energy storage system.

High growth potential with mediocre balance sheet.

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026