There Is A Reason Ariston Holding N.V.'s (BIT:ARIS) Price Is Undemanding

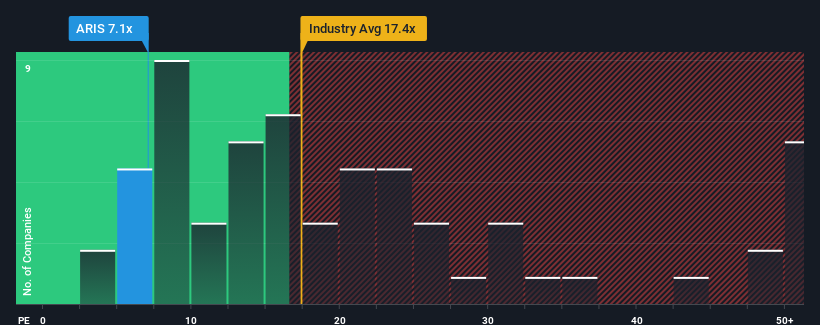

When close to half the companies in Italy have price-to-earnings ratios (or "P/E's") above 15x, you may consider Ariston Holding N.V. (BIT:ARIS) as a highly attractive investment with its 7.1x P/E ratio. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so limited.

Recent times have been advantageous for Ariston Holding as its earnings have been rising faster than most other companies. One possibility is that the P/E is low because investors think this strong earnings performance might be less impressive moving forward. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

View our latest analysis for Ariston Holding

What Are Growth Metrics Telling Us About The Low P/E?

In order to justify its P/E ratio, Ariston Holding would need to produce anemic growth that's substantially trailing the market.

If we review the last year of earnings growth, the company posted a terrific increase of 21%. Despite this strong recent growth, it's still struggling to catch up as its three-year EPS frustratingly shrank by 84% overall. So unfortunately, we have to acknowledge that the company has not done a great job of growing earnings over that time.

Shifting to the future, estimates from the nine analysts covering the company suggest earnings should grow by 0.9% per annum over the next three years. That's shaping up to be materially lower than the 17% per annum growth forecast for the broader market.

In light of this, it's understandable that Ariston Holding's P/E sits below the majority of other companies. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

What We Can Learn From Ariston Holding's P/E?

We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

As we suspected, our examination of Ariston Holding's analyst forecasts revealed that its inferior earnings outlook is contributing to its low P/E. At this stage investors feel the potential for an improvement in earnings isn't great enough to justify a higher P/E ratio. It's hard to see the share price rising strongly in the near future under these circumstances.

It is also worth noting that we have found 3 warning signs for Ariston Holding (1 is a bit unpleasant!) that you need to take into consideration.

Of course, you might also be able to find a better stock than Ariston Holding. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BIT:ARIS

Ariston Holding

Through its subsidiaries, produces and distributes hot water and space heating solutions in the Netherlands, Germany, Italy, Switzerland, and internationally.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026