The European markets have shown mixed performance recently, with the pan-European STOXX Europe 600 Index edging up slightly due to dovish signals from the U.S. Federal Reserve and easing trade tensions between the U.S. and China. In this context, investors are exploring diverse opportunities, including those in smaller or newer companies that offer affordability and growth potential. While 'penny stocks' might seem like a term from a bygone era, they continue to represent viable investment possibilities when supported by strong financials; here we highlight three such stocks with promising prospects.

Top 10 Penny Stocks In Europe

| Name | Share Price | Market Cap | Rewards & Risks |

| Lucisano Media Group (BIT:LMG) | €1.11 | €16.49M | ✅ 4 ⚠️ 4 View Analysis > |

| Maps (BIT:MAPS) | €3.32 | €44.1M | ✅ 4 ⚠️ 1 View Analysis > |

| DigiTouch (BIT:DGT) | €1.90 | €26.25M | ✅ 3 ⚠️ 2 View Analysis > |

| Angler Gaming (NGM:ANGL) | SEK3.60 | SEK269.95M | ✅ 4 ⚠️ 2 View Analysis > |

| Angler Gaming (DB:0QM) | €0.37 | €225.7M | ✅ 2 ⚠️ 2 View Analysis > |

| Hove (CPSE:HOVE) | DKK4.58 | DKK115.8M | ✅ 2 ⚠️ 2 View Analysis > |

| Siili Solutions Oyj (HLSE:SIILI) | €4.57 | €37.06M | ✅ 3 ⚠️ 3 View Analysis > |

| High (ENXTPA:HCO) | €4.02 | €79.05M | ✅ 1 ⚠️ 5 View Analysis > |

| Deceuninck (ENXTBR:DECB) | €2.04 | €281.97M | ✅ 4 ⚠️ 1 View Analysis > |

| Dovre Group (HLSE:DOV1V) | €0.0782 | €8.27M | ✅ 2 ⚠️ 3 View Analysis > |

Click here to see the full list of 278 stocks from our European Penny Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Pininfarina (BIT:PINF)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Pininfarina S.p.A., along with its subsidiaries, offers design and engineering services and sells prototypes and special cars globally, with a market cap of €68.43 million.

Operations: The company's revenue is primarily derived from its design segment, which accounts for €75.89 million, followed by the engineering segment at €14.99 million.

Market Cap: €68.43M

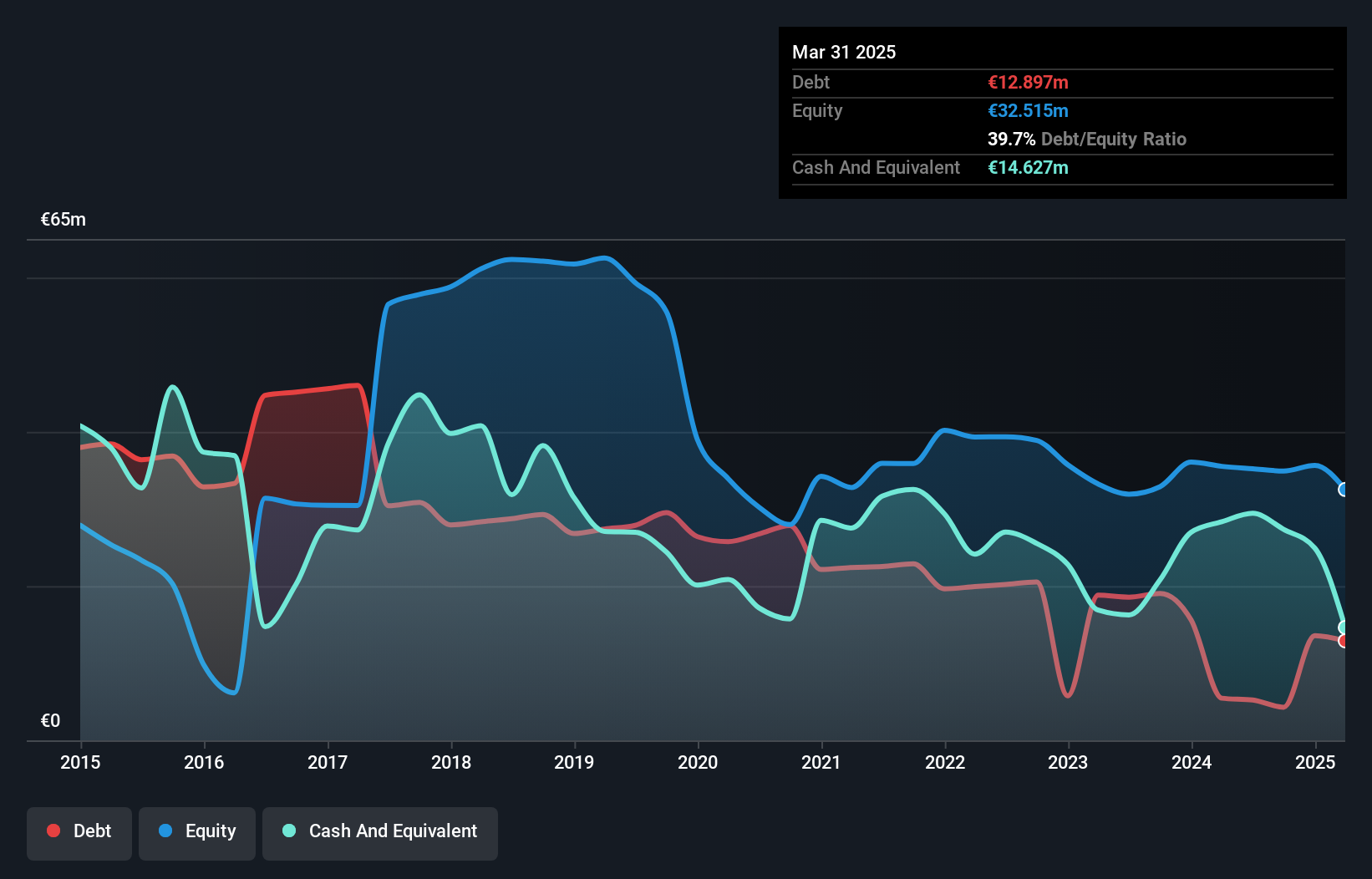

Pininfarina S.p.A., with a market cap of €68.43 million, is navigating the penny stock landscape by leveraging its design and engineering services. Despite being unprofitable, the company has reduced losses over the past five years and maintains more cash than debt, offering financial stability. Its short-term assets exceed long-term liabilities but fall short of covering short-term liabilities entirely. Recent collaborations, such as with Phelon & Moore for an exclusive motorcycle project celebrating Pininfarina's 95th anniversary, highlight its strategic efforts to enhance brand prestige and explore new markets amidst industry challenges.

- Take a closer look at Pininfarina's potential here in our financial health report.

- Explore historical data to track Pininfarina's performance over time in our past results report.

Hove (CPSE:HOVE)

Simply Wall St Financial Health Rating: ★★★★★★

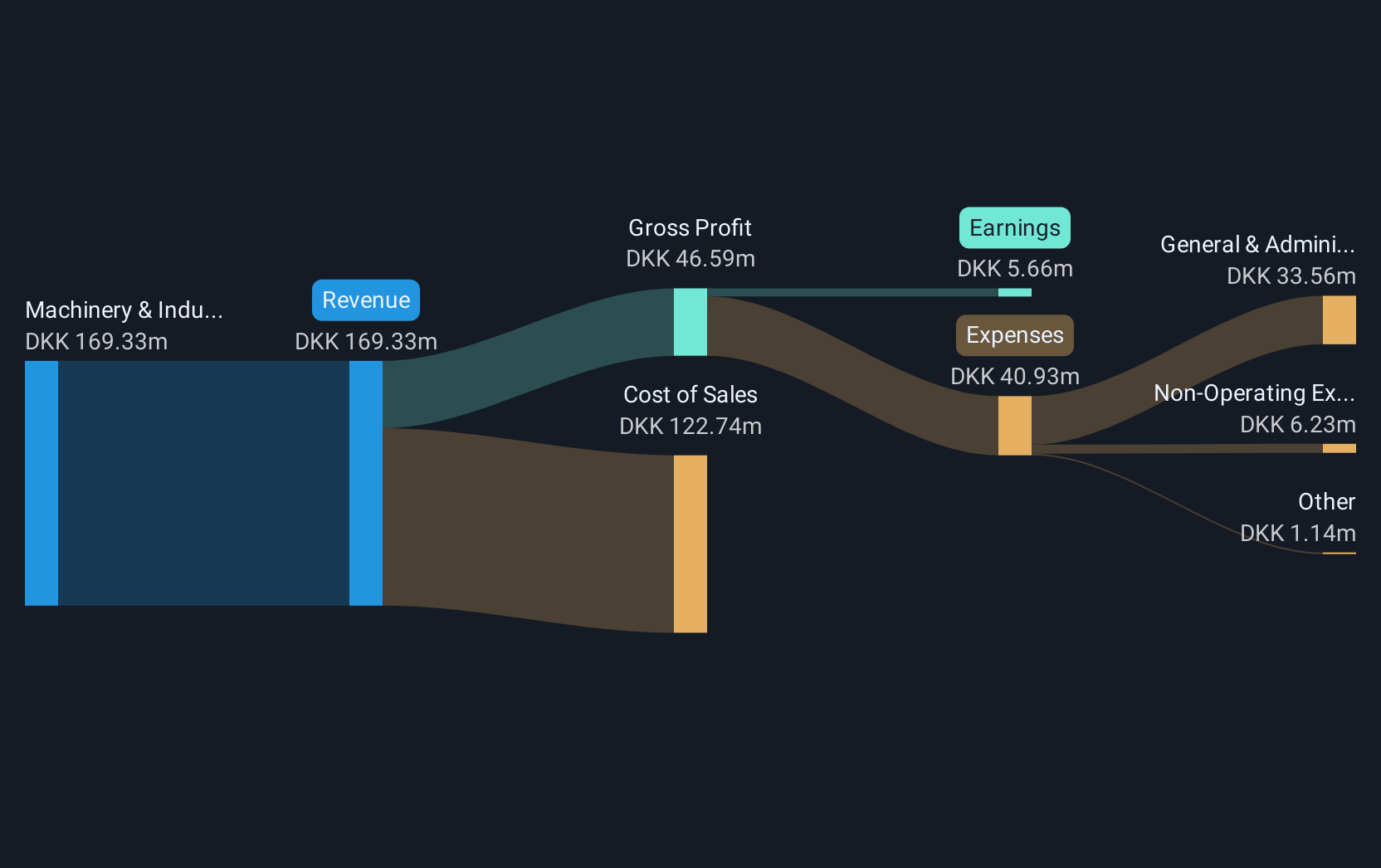

Overview: Hove A/S develops, produces, and supplies advanced lubrication solutions for heavy machinery in Denmark and internationally, with a market cap of DKK115.80 million.

Operations: The company generates revenue from its Machinery & Industrial Equipment segment, amounting to DKK191.99 million.

Market Cap: DKK115.8M

Hove A/S, with a market cap of DKK115.80 million, demonstrates strong financial health in the penny stock sector through its robust operating cash flow, which covers debt significantly. The company’s short-term assets comfortably exceed both short and long-term liabilities. Recent earnings announcements reveal a substantial increase in sales to DKK108.31 million for the half year ended June 2025, up from DKK85.65 million last year, alongside improved net income and earnings per share. Hove's strategic focus on expanding orders in new industries aligns with its upgraded revenue guidance for 2025 between DKK180 million and DKK200 million.

- Click here to discover the nuances of Hove with our detailed analytical financial health report.

- Learn about Hove's historical performance here.

Safeture (OM:SFTR)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Safeture AB (publ) operates as a software as a service company with a market cap of SEK175.23 million.

Operations: The company generates SEK68.26 million in revenue from its Security Services segment.

Market Cap: SEK175.23M

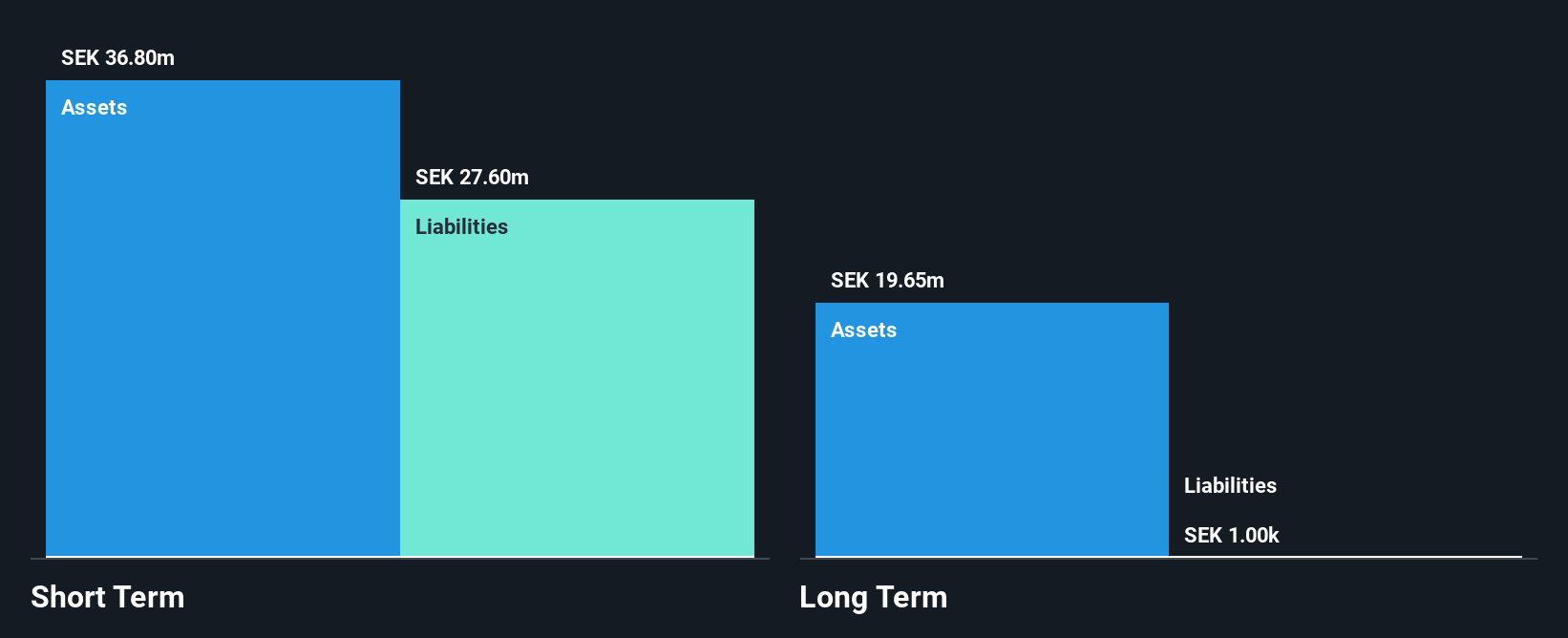

Safeture AB, with a market cap of SEK175.23 million, has recently become profitable and operates without debt, showcasing financial stability uncommon in its sector. Its short-term assets (SEK41.9M) exceed both short and long-term liabilities, indicating sound financial management. The strategic partnership with Sicuro Group enhances Safeture's service offerings by integrating real-time risk information and crisis communication capabilities into its SaaS platform. Additionally, the launch of the Safety Check feature strengthens its product suite by enabling organizations to manage critical incidents effectively. Despite trading below estimated fair value, Safeture's low return on equity highlights room for operational improvement.

- Jump into the full analysis health report here for a deeper understanding of Safeture.

- Assess Safeture's future earnings estimates with our detailed growth reports.

Turning Ideas Into Actions

- Click through to start exploring the rest of the 275 European Penny Stocks now.

- Seeking Other Investments? Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BIT:PINF

Pininfarina

Provides design and engineering services and sells prototypes and special cars worldwide.

Excellent balance sheet with minimal risk.

Similar Companies

Market Insights

Community Narratives