- Italy

- /

- Auto Components

- /

- BIT:BRE

Why Investors Shouldn't Be Surprised By Brembo S.p.A.'s (BIT:BRE) Low P/E

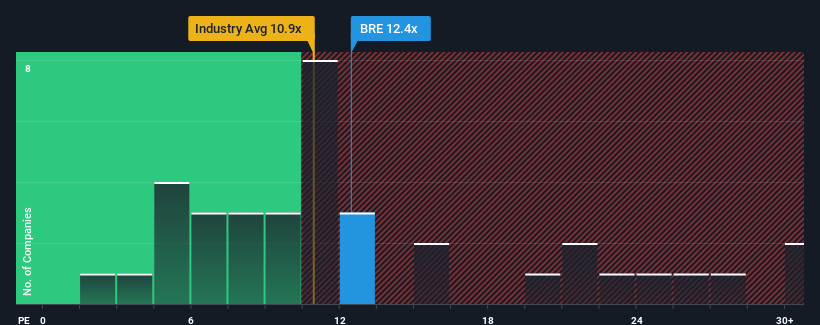

With a price-to-earnings (or "P/E") ratio of 12.4x Brembo S.p.A. (BIT:BRE) may be sending bullish signals at the moment, given that almost half of all companies in Italy have P/E ratios greater than 15x and even P/E's higher than 27x are not unusual. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's limited.

With earnings growth that's inferior to most other companies of late, Brembo has been relatively sluggish. It seems that many are expecting the uninspiring earnings performance to persist, which has repressed the P/E. If you still like the company, you'd be hoping earnings don't get any worse and that you could pick up some stock while it's out of favour.

View our latest analysis for Brembo

Does Growth Match The Low P/E?

The only time you'd be truly comfortable seeing a P/E as low as Brembo's is when the company's growth is on track to lag the market.

Taking a look back first, we see that there was hardly any earnings per share growth to speak of for the company over the past year. However, a few strong years before that means that it was still able to grow EPS by an impressive 129% in total over the last three years. Accordingly, shareholders would have probably welcomed those medium-term rates of earnings growth.

Turning to the outlook, the next three years should bring diminished returns, with earnings decreasing 31% per year as estimated by the six analysts watching the company. With the market predicted to deliver 16% growth per year, that's a disappointing outcome.

In light of this, it's understandable that Brembo's P/E would sit below the majority of other companies. However, shrinking earnings are unlikely to lead to a stable P/E over the longer term. There's potential for the P/E to fall to even lower levels if the company doesn't improve its profitability.

The Bottom Line On Brembo's P/E

While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

As we suspected, our examination of Brembo's analyst forecasts revealed that its outlook for shrinking earnings is contributing to its low P/E. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

Plus, you should also learn about this 1 warning sign we've spotted with Brembo.

If you're unsure about the strength of Brembo's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if Brembo might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BIT:BRE

Brembo

Designs, develops, and distributes braking systems and components for cars, motorbikes, and commercial vehicles.

Excellent balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives