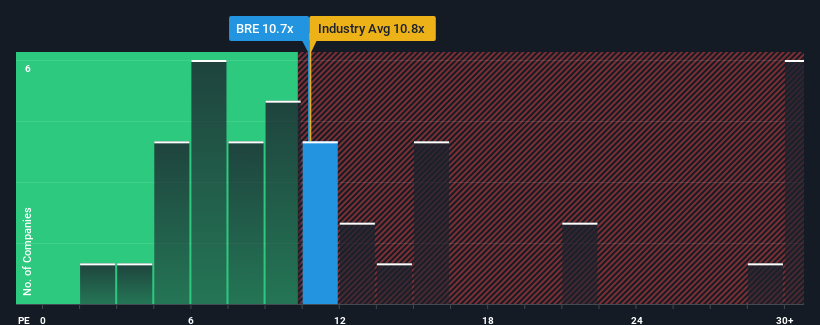

When close to half the companies in Italy have price-to-earnings ratios (or "P/E's") above 15x, you may consider Brembo N.V. (BIT:BRE) as an attractive investment with its 10.7x P/E ratio. However, the P/E might be low for a reason and it requires further investigation to determine if it's justified.

Brembo hasn't been tracking well recently as its declining earnings compare poorly to other companies, which have seen some growth on average. It seems that many are expecting the dour earnings performance to persist, which has repressed the P/E. If you still like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

View our latest analysis for Brembo

Does Growth Match The Low P/E?

In order to justify its P/E ratio, Brembo would need to produce sluggish growth that's trailing the market.

Retrospectively, the last year delivered a frustrating 5.5% decrease to the company's bottom line. This has soured the latest three-year period, which nevertheless managed to deliver a decent 20% overall rise in EPS. Although it's been a bumpy ride, it's still fair to say the earnings growth recently has been mostly respectable for the company.

Shifting to the future, estimates from the nine analysts covering the company suggest earnings should grow by 13% each year over the next three years. Meanwhile, the rest of the market is forecast to expand by 13% per year, which is not materially different.

With this information, we find it odd that Brembo is trading at a P/E lower than the market. Apparently some shareholders are doubtful of the forecasts and have been accepting lower selling prices.

The Key Takeaway

While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

Our examination of Brembo's analyst forecasts revealed that its market-matching earnings outlook isn't contributing to its P/E as much as we would have predicted. There could be some unobserved threats to earnings preventing the P/E ratio from matching the outlook. It appears some are indeed anticipating earnings instability, because these conditions should normally provide more support to the share price.

We don't want to rain on the parade too much, but we did also find 1 warning sign for Brembo that you need to be mindful of.

Of course, you might also be able to find a better stock than Brembo. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if Brembo might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BIT:BRE

Brembo

Designs, develops, and distributes braking systems and components for cars, motorbikes, and commercial vehicles.

Excellent balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives