- Iceland

- /

- Marine and Shipping

- /

- ICSE:EIM

Should Shareholders Reconsider Eimskipafélag Íslands hf.'s (ICE:EIM) CEO Compensation Package?

Key Insights

- Eimskipafélag Íslands hf's Annual General Meeting to take place on 27th of March

- Total pay for CEO Vilhelm Thorsteinsson includes €335.0k salary

- The overall pay is comparable to the industry average

- Over the past three years, Eimskipafélag Íslands hf's EPS fell by 5.7% and over the past three years, the total loss to shareholders 12%

Eimskipafélag Íslands hf. (ICE:EIM) has not performed well recently and CEO Vilhelm Thorsteinsson will probably need to up their game. Shareholders will be interested in what the board will have to say about turning performance around at the next AGM on 27th of March. It would also be an opportunity for shareholders to influence management through voting on company resolutions such as executive remuneration, which could impact the firm significantly. The data we present below explains why we think CEO compensation is not consistent with recent performance.

View our latest analysis for Eimskipafélag Íslands hf

How Does Total Compensation For Vilhelm Thorsteinsson Compare With Other Companies In The Industry?

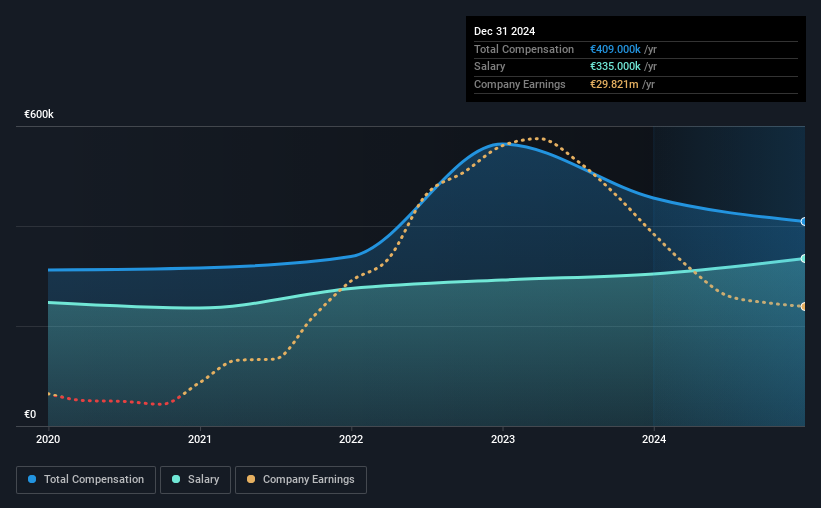

Our data indicates that Eimskipafélag Íslands hf. has a market capitalization of Kr68b, and total annual CEO compensation was reported as €409k for the year to December 2024. That's a notable decrease of 10% on last year. We note that the salary portion, which stands at €335.0k constitutes the majority of total compensation received by the CEO.

On comparing similar companies from the Europe Shipping industry with market caps ranging from Kr27b to Kr107b, we found that the median CEO total compensation was €409k. So it looks like Eimskipafélag Íslands hf compensates Vilhelm Thorsteinsson in line with the median for the industry. What's more, Vilhelm Thorsteinsson holds Kr96m worth of shares in the company in their own name, indicating that they have a lot of skin in the game.

| Component | 2024 | 2023 | Proportion (2024) |

| Salary | €335k | €304k | 82% |

| Other | €74k | €152k | 18% |

| Total Compensation | €409k | €456k | 100% |

On an industry level, roughly 48% of total compensation represents salary and 52% is other remuneration. Eimskipafélag Íslands hf pays out 82% of remuneration in the form of a salary, significantly higher than the industry average. If salary dominates total compensation, it suggests that CEO compensation is leaning less towards the variable component, which is usually linked with performance.

A Look at Eimskipafélag Íslands hf.'s Growth Numbers

Over the last three years, Eimskipafélag Íslands hf. has shrunk its earnings per share by 5.7% per year. In the last year, its revenue is up 3.6%.

The decline in EPS is a bit concerning. And the modest revenue growth over 12 months isn't much comfort against the reduced EPS. It's hard to argue the company is firing on all cylinders, so shareholders might be averse to high CEO remuneration. Although we don't have analyst forecasts, you might want to assess this data-rich visualization of earnings, revenue and cash flow.

Has Eimskipafélag Íslands hf. Been A Good Investment?

Given the total shareholder loss of 12% over three years, many shareholders in Eimskipafélag Íslands hf. are probably rather dissatisfied, to say the least. This suggests it would be unwise for the company to pay the CEO too generously.

In Summary...

Not only have shareholders not seen a favorable return on their investment, but the business hasn't performed well either. Few shareholders would be willing to award the CEO with a pay raise. At the upcoming AGM, the board will get the chance to explain the steps it plans to take to improve business performance.

CEO pay is simply one of the many factors that need to be considered while examining business performance. That's why we did our research, and identified 3 warning signs for Eimskipafélag Íslands hf (of which 1 is significant!) that you should know about in order to have a holistic understanding of the stock.

Arguably, business quality is much more important than CEO compensation levels. So check out this free list of interesting companies that have HIGH return on equity and low debt.

Valuation is complex, but we're here to simplify it.

Discover if Eimskipafélag Íslands hf might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ICSE:EIM

Eimskipafélag Íslands hf

Provides shipping, logistics, and supply chain management services worldwide.

Adequate balance sheet second-rate dividend payer.

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success