- India

- /

- Water Utilities

- /

- NSEI:WABAG

Shareholders Will Probably Hold Off On Increasing VA Tech Wabag Limited's (NSE:WABAG) CEO Compensation For The Time Being

In the past three years, shareholders of VA Tech Wabag Limited (NSE:WABAG) have seen a loss on their investment. Per share earnings growth is also poor, despite revenues growing. In light of this performance, shareholders will have a chance to question the board in the upcoming AGM on 25 August 2021, where they can impact on future company performance by voting on resolutions, including executive compensation. Here's why we think shareholders should hold off on a raise for the CEO at the moment.

See our latest analysis for VA Tech Wabag

How Does Total Compensation For Rajiv Mittal Compare With Other Companies In The Industry?

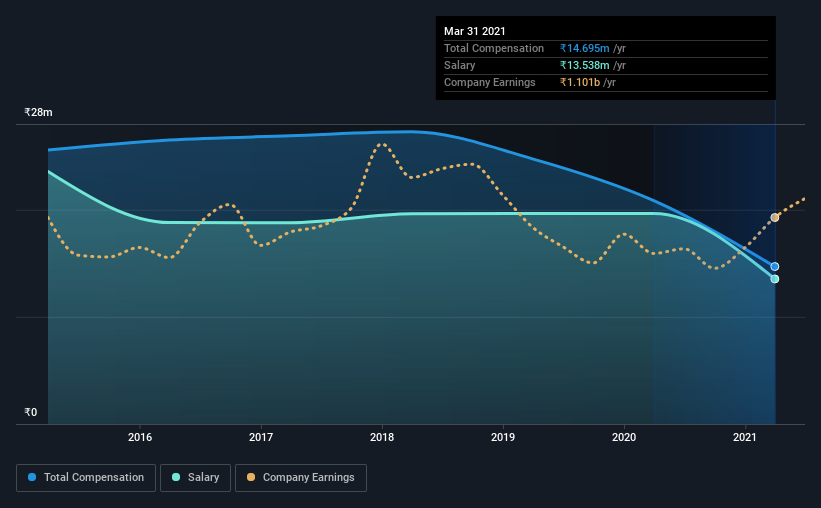

At the time of writing, our data shows that VA Tech Wabag Limited has a market capitalization of ₹21b, and reported total annual CEO compensation of ₹15m for the year to March 2021. Notably, that's a decrease of 30% over the year before. We note that the salary portion, which stands at ₹13.5m constitutes the majority of total compensation received by the CEO.

For comparison, other companies in the same industry with market capitalizations ranging between ₹7.4b and ₹30b had a median total CEO compensation of ₹15m. This suggests that VA Tech Wabag remunerates its CEO largely in line with the industry average. Furthermore, Rajiv Mittal directly owns ₹3.3b worth of shares in the company, implying that they are deeply invested in the company's success.

| Component | 2021 | 2020 | Proportion (2021) |

| Salary | ₹14m | ₹20m | 92% |

| Other | ₹1.2m | ₹1.2m | 8% |

| Total Compensation | ₹15m | ₹21m | 100% |

Speaking on an industry level, nearly 74% of total compensation represents salary, while the remainder of 26% is other remuneration. According to our research, VA Tech Wabag has allocated a higher percentage of pay to salary in comparison to the wider industry. If salary is the major component in total compensation, it suggests that the CEO receives a higher fixed proportion of the total compensation, regardless of performance.

VA Tech Wabag Limited's Growth

Over the last three years, VA Tech Wabag Limited has shrunk its earnings per share by 7.1% per year. Its revenue is up 21% over the last year.

The decrease in EPS could be a concern for some investors. But on the other hand, revenue growth is strong, suggesting a brighter future. It's hard to reach a conclusion about business performance right now. This may be one to watch. Historical performance can sometimes be a good indicator on what's coming up next but if you want to peer into the company's future you might be interested in this free visualization of analyst forecasts.

Has VA Tech Wabag Limited Been A Good Investment?

With a three year total loss of 11% for the shareholders, VA Tech Wabag Limited would certainly have some dissatisfied shareholders. So shareholders would probably want the company to be less generous with CEO compensation.

To Conclude...

The returns to shareholders is disappointing along with lack of earnings growth, which goes some way in explaining the poor returns. Shareholders will get the chance at the upcoming AGM to question the board on key matters, such as CEO remuneration or any other issues they might have and revisit their investment thesis with regards to the company.

While it is important to pay attention to CEO remuneration, investors should also consider other elements of the business. We've identified 1 warning sign for VA Tech Wabag that investors should be aware of in a dynamic business environment.

Important note: VA Tech Wabag is an exciting stock, but we understand investors may be looking for an unencumbered balance sheet and blockbuster returns. You might find something better in this list of interesting companies with high ROE and low debt.

If you decide to trade VA Tech Wabag, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NSEI:WABAG

VA Tech Wabag

Engages in the design, supply, installation, construction, operation, and maintenance of drinking water, waste and industrial water treatment, and desalination plants in India and internationally.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

SLI is share to watch next 5 years

The "Molecular Pencil": Why Beam's Technology is Built to Win

PRME remains a long shot but publication in the New England Journal of Medicine helps.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026