- India

- /

- Renewable Energy

- /

- NSEI:RTNPOWER

Did You Miss RattanIndia Power's (NSE:RTNPOWER) 82% Share Price Gain?

These days it's easy to simply buy an index fund, and your returns should (roughly) match the market. But one can do better than that by picking better than average stocks (as part of a diversified portfolio). To wit, the RattanIndia Power Limited (NSE:RTNPOWER) share price is 82% higher than it was a year ago, much better than the market return of around 19% (not including dividends) in the same period. If it can keep that out-performance up over the long term, investors will do very well! In contrast, the longer term returns are negative, since the share price is 44% lower than it was three years ago.

See our latest analysis for RattanIndia Power

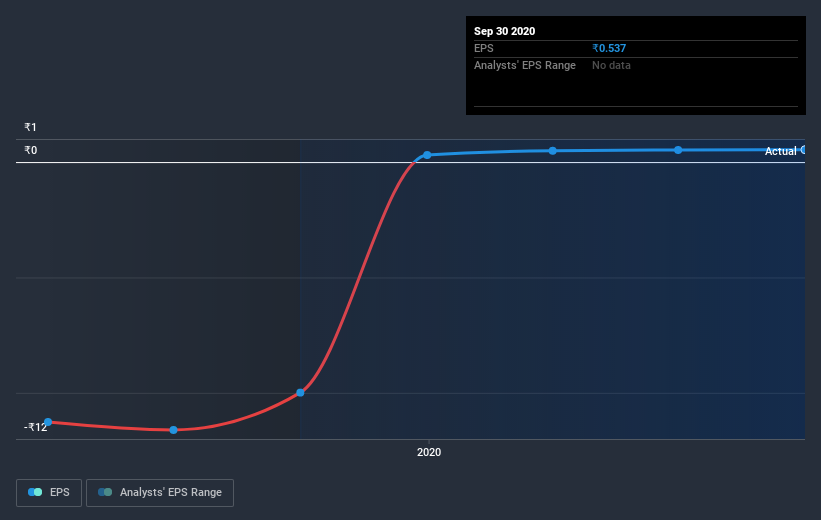

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

RattanIndia Power went from making a loss to reporting a profit, in the last year.

The result looks like a strong improvement to us, so we're not surprised the market likes the growth. Generally speaking the profitability inflection point is a great time to research a company closely, lest you miss an opportunity to profit.

The graphic below depicts how EPS has changed over time (unveil the exact values by clicking on the image).

Dive deeper into RattanIndia Power's key metrics by checking this interactive graph of RattanIndia Power's earnings, revenue and cash flow.

A Different Perspective

It's good to see that RattanIndia Power has rewarded shareholders with a total shareholder return of 82% in the last twelve months. That certainly beats the loss of about 11% per year over the last half decade. We generally put more weight on the long term performance over the short term, but the recent improvement could hint at a (positive) inflection point within the business. It's always interesting to track share price performance over the longer term. But to understand RattanIndia Power better, we need to consider many other factors. Like risks, for instance. Every company has them, and we've spotted 4 warning signs for RattanIndia Power (of which 1 doesn't sit too well with us!) you should know about.

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on IN exchanges.

If you decide to trade RattanIndia Power, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NSEI:RTNPOWER

RattanIndia Power

Together with its subsidiary, Poena Power Development Limited, engages in power generation, distribution, trading and transmission, and other ancillary and incidental activities in India.

Questionable track record with imperfect balance sheet.

Market Insights

Community Narratives