- India

- /

- Oil and Gas

- /

- BSE:500620

Exploring Dividend Stocks In India For April 2024

Reviewed by Kshitija Bhandaru

In the midst of these market fluctuations, investors are increasingly looking towards dividend stocks as a potential source of steady income. Given the current positive sentiment in the Indian stock market and strong global cues, it may be beneficial to explore dividend-paying stocks that can provide regular returns while also offering potential for capital appreciation.

Top 10 Dividend Stocks In India

| Name | Dividend Yield | Dividend Rating |

| Bhansali Engineering Polymers (BSE:500052) | 3.84% | ★★★★★★ |

| Castrol India (BSE:500870) | 3.60% | ★★★★★☆ |

| HCL Technologies (NSEI:HCLTECH) | 3.53% | ★★★★★☆ |

| ITC (NSEI:ITC) | 3.06% | ★★★★★☆ |

| VST Industries (BSE:509966) | 3.78% | ★★★★★☆ |

| Balmer Lawrie (BSE:523319) | 3.03% | ★★★★★☆ |

| Gujarat Narmada Valley Fertilizers & Chemicals (NSEI:GNFC) | 4.39% | ★★★★★☆ |

| Ruchira Papers (NSEI:RUCHIRA) | 4.14% | ★★★★★☆ |

| PTC India (NSEI:PTC) | 3.46% | ★★★★★☆ |

| Rashtriya Chemicals and Fertilizers (NSEI:RCF) | 3.66% | ★★★★★☆ |

Click here to see the full list of 33 stocks from our Top Dividend Stocks screener.

Let's dive into some prime choices out of from the screener.

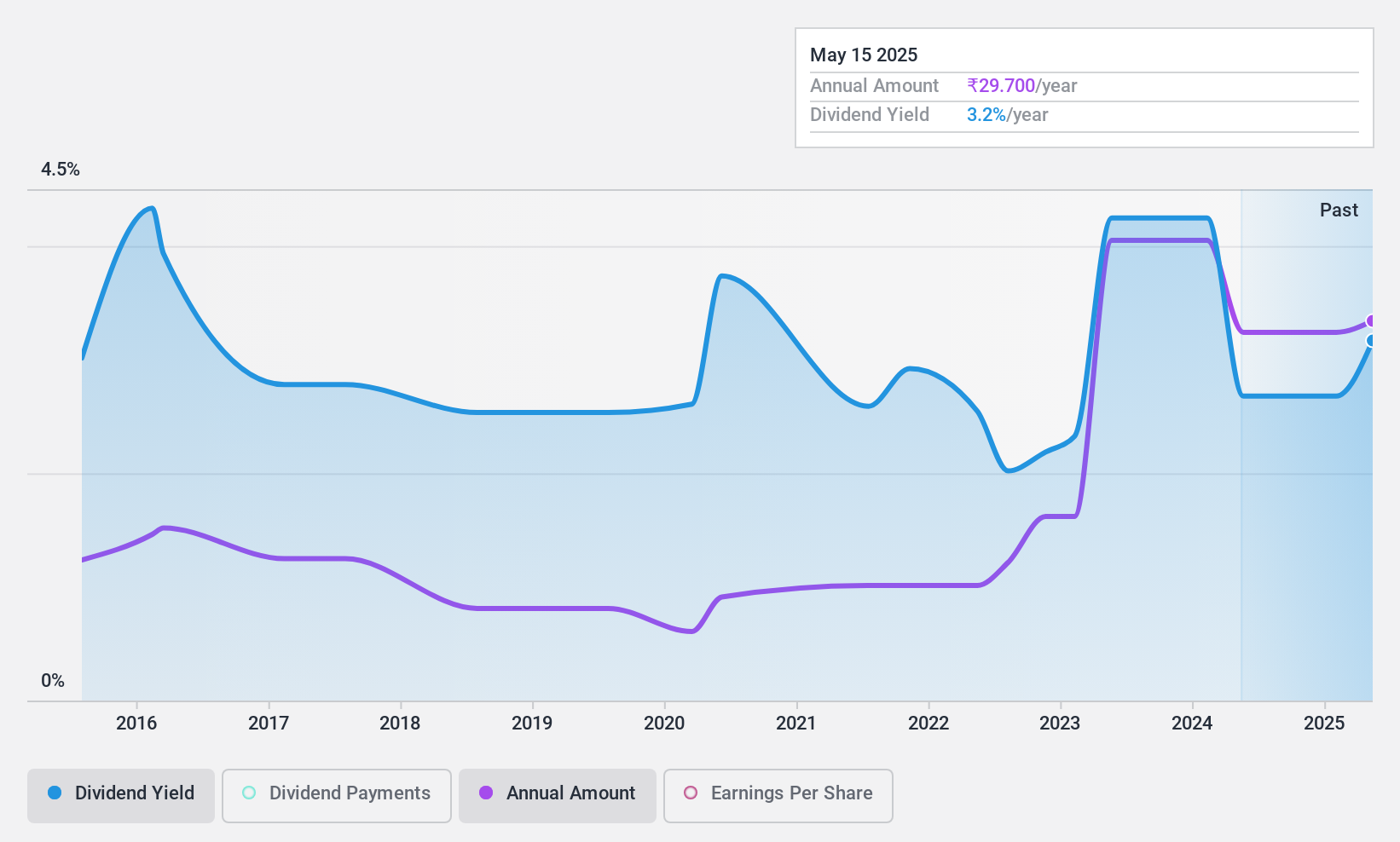

Great Eastern Shipping (BSE:500620)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: The Great Eastern Shipping Company Limited is an Indian multinational company with a diverse portfolio that includes shipping and offshore businesses, operating both domestically and globally, with a market capitalization of ₹147.15 billion.

Operations: The Great Eastern Shipping Company Limited generates its revenue primarily from two segments, with ₹10.19 billion coming from its offshore operations and ₹47.52 billion from its shipping activities.

Dividend Yield: 3.5%

Great Eastern Shipping demonstrates a strong dividend profile, with payments well covered by earnings and cash flows at a payout ratio of 23.3% and cash payout ratio of 21.6%, respectively. The firm's dividends have grown over the past decade, though they have also been volatile. Its dividend yield (3.49%) ranks in the top quartile of Indian market payers (1.22%). Recent business expansions suggest potential for future growth, but earnings are forecast to decline by an average of 11.2% annually over the next three years.

- Get an in-depth perspective on Great Eastern Shipping's performance by reading our dividend report here.

Our valuation report here indicates Great Eastern Shipping may be undervalued.

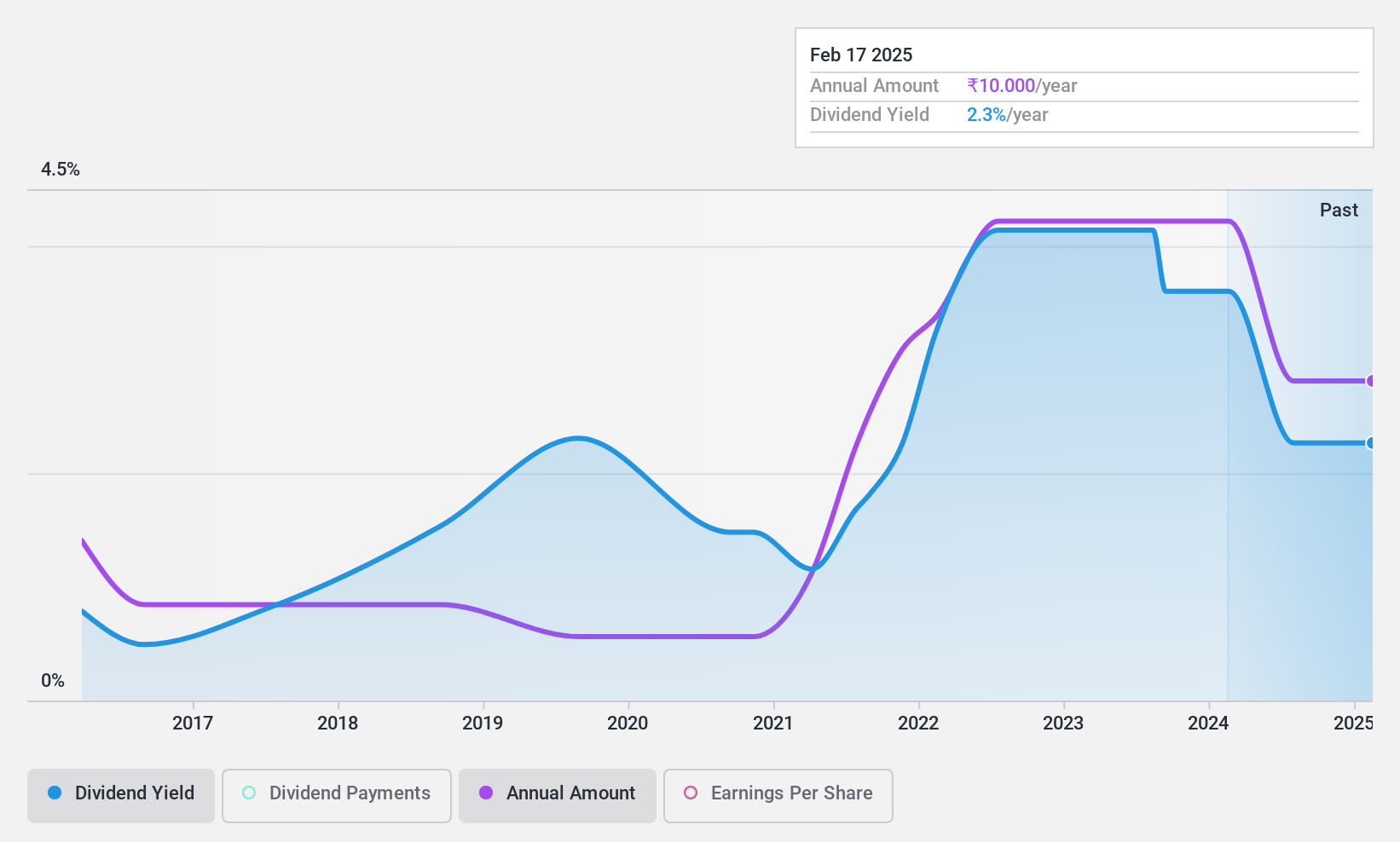

Premco Global (BSE:530331)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Premco Global Limited, with a market cap of ₹14.47 billion, is an international company based in India that specializes in the manufacturing and sale of knitted and woven elastic tapes.

Operations: Premco Global Limited, valued at ₹14.47 billion, generates its revenue predominantly from the sale of elastic tapes, accounting for ₹964.69 million in earnings.

Dividend Yield: 3.4%

Premco Global's Price-To-Earnings ratio (15.8x) is below the Indian market average (30.7x), indicating potential value. Its dividend yield of 3.43% ranks in the top 25% of Indian market payers, but these payments are not well covered by cash flows with a high cash payout ratio of 2831.1%. The company's dividends have increased over the past decade, although they've been volatile and unreliable at times. Recent executive changes and a decrease in interim dividend highlight some instability within the firm.

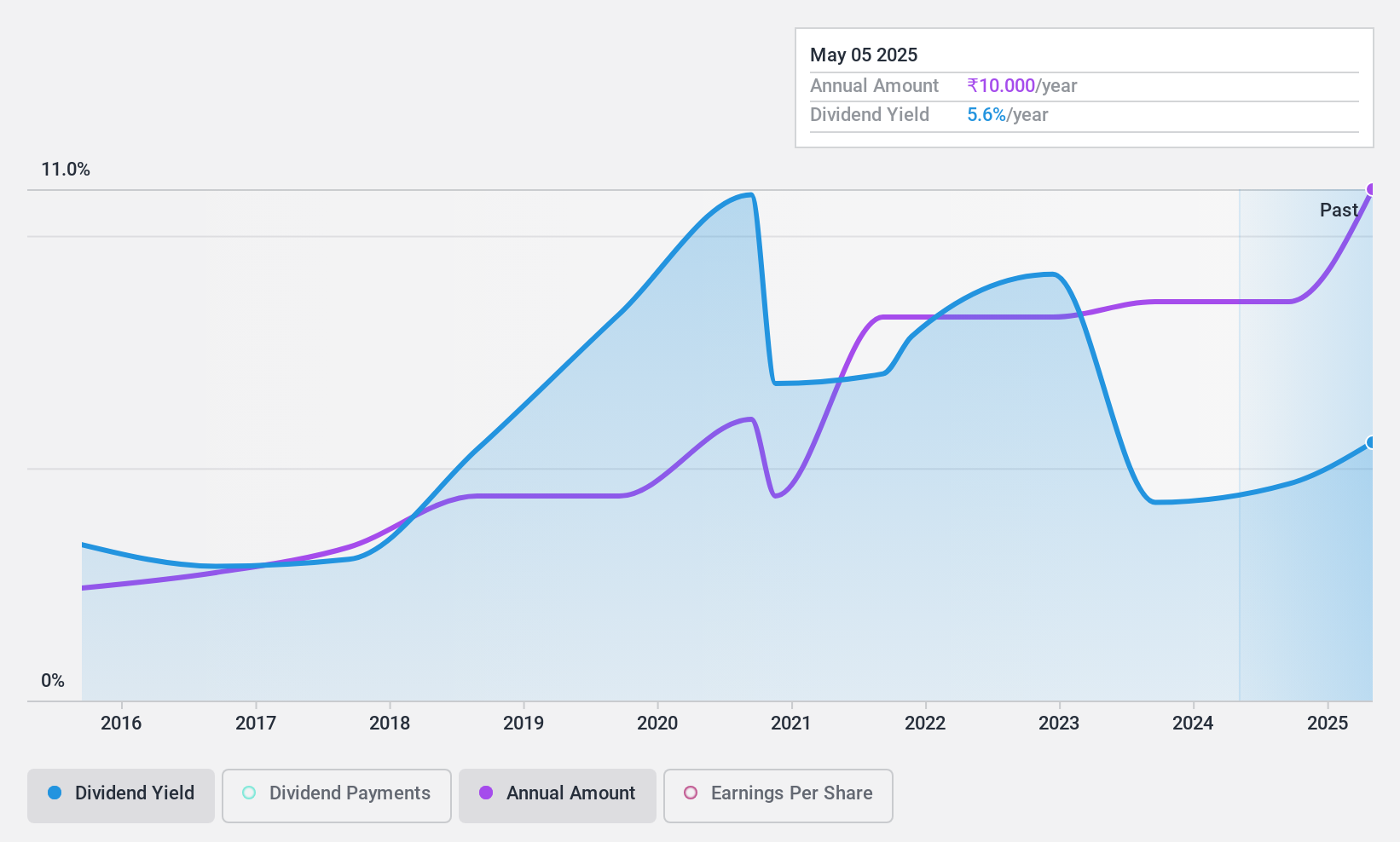

PTC India (NSEI:PTC)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: PTC India Limited, a company with a market capitalisation of ₹66.76 billion, operates in the power trading sector across India, Nepal, Bhutan and Bangladesh along with its subsidiaries.

Operations: PTC India Limited, boasting a market capitalisation of ₹66.76 billion, generates its revenue primarily from two segments: Power trading, which brings in ₹163.77 billion, and Financing Business that contributes ₹7.85 billion.

Dividend Yield: 3.5%

PTC India's dividend payments, with a yield of 3.46%, rank in the top 25% of Indian market payers. Its dividends are covered by earnings and cash flows, with payout ratios at 51.8% and 7.7% respectively, indicating sustainability. The company trades at good value relative to peers, given its Price-To-Earnings ratio of 13.2x against the market average of 30.7x; however, its interest payments aren't well covered by earnings and dividend track record has been unstable over the past decade.

Next Steps

- Click this link to deep-dive into the 33 companies within our Top Dividend Stocks screener.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BSE:500620

Great Eastern Shipping

Through its subsidiaries, engages in the shipping and offshore businesses in India and internationally.

Flawless balance sheet, undervalued and pays a dividend.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

TXT will see revenue grow 26% with a profit margin boost of almost 40%

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026