- India

- /

- Renewable Energy

- /

- NSEI:PTC

3 Indian Dividend Stocks Yielding Up To 7.9%

Reviewed by Simply Wall St

Over the last 7 days, the Indian market has risen 1.0%, driven by gains in the Financials and Information Technology sectors of 1.4% and 3.2%, respectively. As for the past 12 months, the market is up 45%, with earnings expected to grow by 17% per annum over the next few years. In this thriving environment, dividend stocks can offer a reliable income stream while also benefiting from potential capital appreciation in a growing market.

Top 10 Dividend Stocks In India

| Name | Dividend Yield | Dividend Rating |

| Castrol India (BSE:500870) | 3.02% | ★★★★★★ |

| Balmer Lawrie Investments (BSE:532485) | 3.89% | ★★★★★★ |

| D. B (NSEI:DBCORP) | 5.07% | ★★★★★☆ |

| VST Industries (BSE:509966) | 3.28% | ★★★★★☆ |

| Indian Oil (NSEI:IOC) | 7.91% | ★★★★★☆ |

| NMDC (BSE:526371) | 3.25% | ★★★★★☆ |

| Redington (NSEI:REDINGTON) | 3.07% | ★★★★★☆ |

| Balmer Lawrie (BSE:523319) | 3.04% | ★★★★★☆ |

| Bank of Baroda (NSEI:BANKBARODA) | 3.04% | ★★★★★☆ |

| PTC India (NSEI:PTC) | 3.66% | ★★★★★☆ |

Click here to see the full list of 17 stocks from our Top Indian Dividend Stocks screener.

Let's uncover some gems from our specialized screener.

Indian Oil (NSEI:IOC)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Indian Oil Corporation Limited, along with its subsidiaries, engages in refining, pipeline transportation, and marketing of petroleum products both in India and internationally, with a market cap of ₹2.44 trillion.

Operations: Indian Oil Corporation Limited generates revenue primarily from petroleum products (₹8.25 billion) and petrochemicals (₹262.95 million).

Dividend Yield: 7.9%

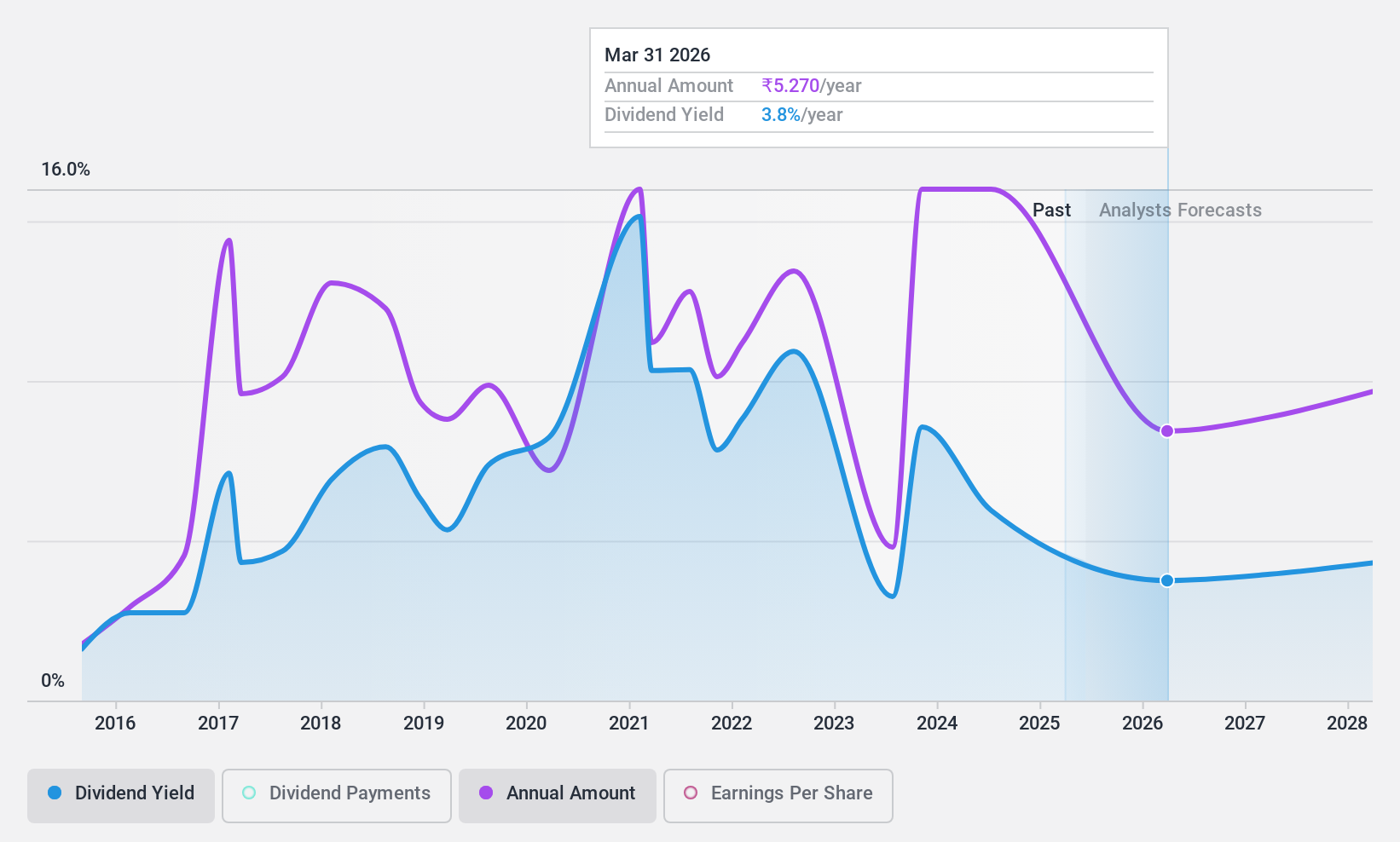

Indian Oil Corporation recently declared a final dividend of INR 7 per share for FY 2023-24. Despite past volatility, the current payout ratio of 39.6% and cash payout ratio of 56.8% indicate dividends are well-covered by earnings and cash flows. However, earnings have declined significantly year-over-year, with net income dropping to INR 35.28 billion from INR 144.37 billion last year, raising concerns about future dividend sustainability amidst high debt levels and forecasted earnings decline.

- Click here and access our complete dividend analysis report to understand the dynamics of Indian Oil.

- Our comprehensive valuation report raises the possibility that Indian Oil is priced lower than what may be justified by its financials.

Oil and Natural Gas (NSEI:ONGC)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Oil and Natural Gas Corporation Limited, along with its subsidiaries, focuses on the exploration, development, and production of crude oil and natural gas both in India and internationally, with a market cap of ₹4.16 trillion.

Operations: Oil and Natural Gas Corporation Limited generates revenue from various segments, including ₹96.69 billion from operations outside India, ₹5.72 billion from refining and marketing within India, ₹441.92 million from onshore exploration and production in India, and ₹953.81 million from offshore exploration and production in India.

Dividend Yield: 3.7%

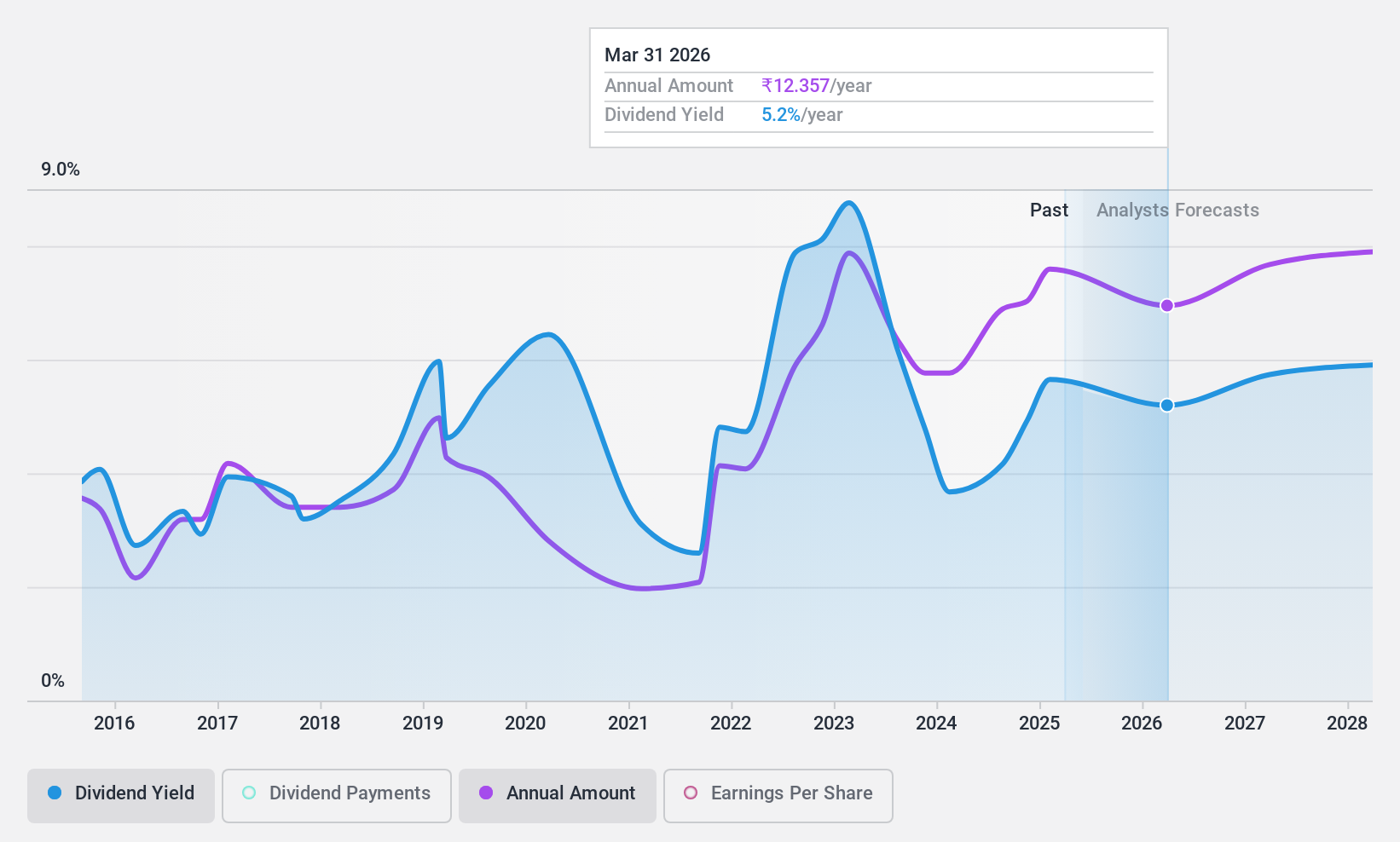

Oil and Natural Gas Corporation (ONGC) declared a final dividend of INR 2.50 per share for FY 2024, reflecting its commitment to shareholders. The company's dividend yield is in the top 25% of Indian market payers, supported by a low payout ratio of 31.3%. Despite a volatile dividend track record, ONGC's dividends are well-covered by both earnings and cash flows. Recent earnings have shown stability with revenue growth, although net income saw a decline compared to the previous year.

- Take a closer look at Oil and Natural Gas' potential here in our dividend report.

- Insights from our recent valuation report point to the potential undervaluation of Oil and Natural Gas shares in the market.

PTC India (NSEI:PTC)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: PTC India Limited, with a market cap of ₹63.05 billion, engages in the trading of power across India, Nepal, Bhutan, and Bangladesh through its subsidiaries.

Operations: PTC India Limited generates revenue primarily from its power trading business, which accounts for ₹159.67 billion, and its financing business, contributing ₹7.35 billion.

Dividend Yield: 3.7%

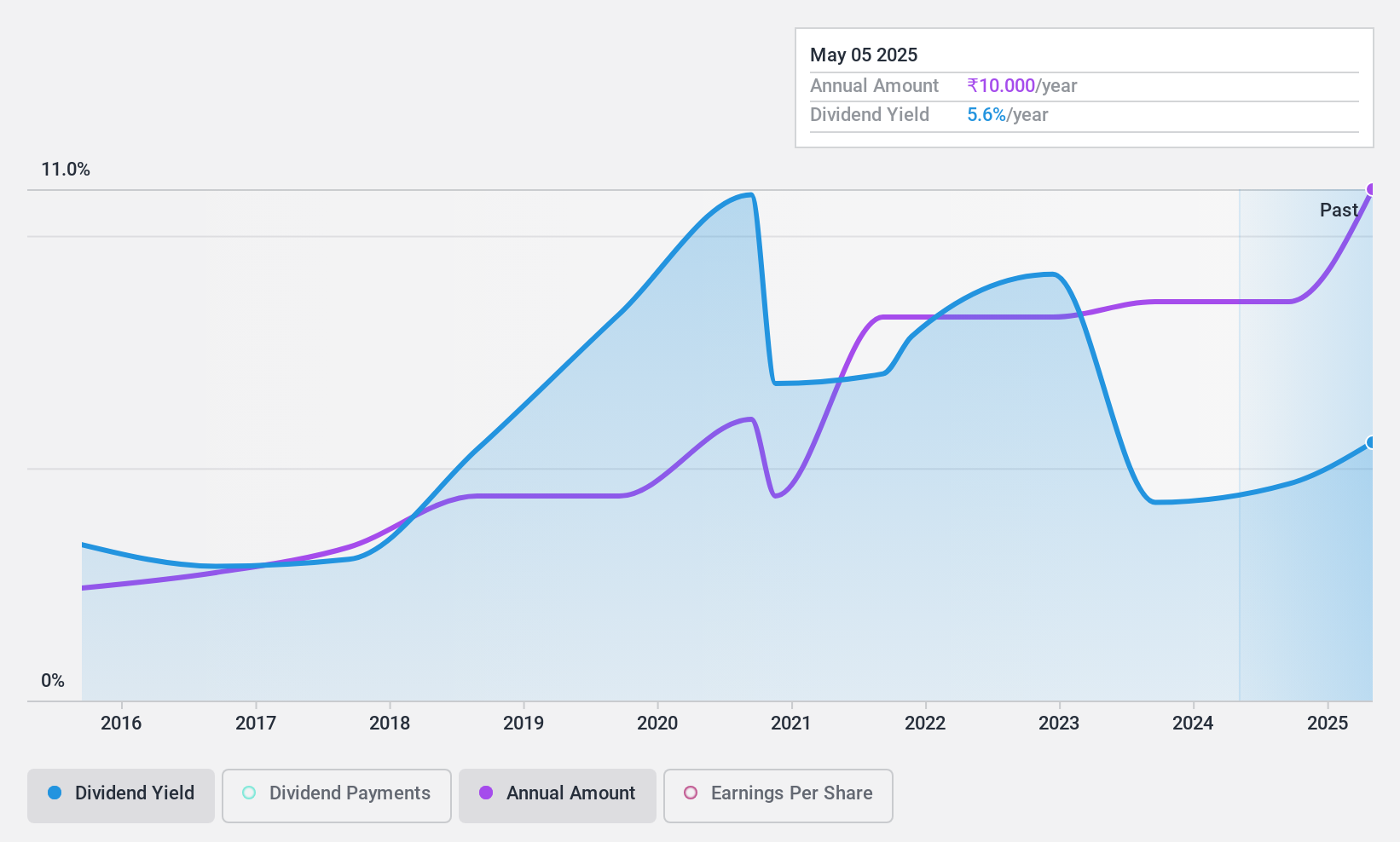

PTC India's recent earnings report showed a slight decline in sales and revenue but an increase in net income to INR 1.74 billion. The company declared a final dividend of INR 7.80 per share for FY 2024, supported by low cash payout ratio (9.4%) and reasonable earnings payout ratio (54%). However, PTC's dividend payments have been volatile over the past decade, raising concerns about reliability despite their current coverage by both earnings and cash flows.

- Click to explore a detailed breakdown of our findings in PTC India's dividend report.

- Our valuation report unveils the possibility PTC India's shares may be trading at a premium.

Summing It All Up

- Dive into all 17 of the Top Indian Dividend Stocks we have identified here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:PTC

PTC India

Engages in the trading and generating of power in India, Nepal, Bhutan, and Bangladesh.

Flawless balance sheet established dividend payer.

Market Insights

Community Narratives