It's only natural that many investors, especially those who are new to the game, prefer to buy shares in 'sexy' stocks with a good story, even if those businesses lose money. Unfortunately, high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson.

So if you're like me, you might be more interested in profitable, growing companies, like Indraprastha Gas (NSE:IGL). Now, I'm not saying that the stock is necessarily undervalued today; but I can't shake an appreciation for the profitability of the business itself. Loss-making companies are always racing against time to reach financial sustainability, but time is often a friend of the profitable company, especially if it is growing.

See our latest analysis for Indraprastha Gas

How Quickly Is Indraprastha Gas Increasing Earnings Per Share?

As one of my mentors once told me, share price follows earnings per share (EPS). That makes EPS growth an attractive quality for any company. As a tree reaches steadily for the sky, Indraprastha Gas's EPS has grown 23% each year, compound, over three years. As a general rule, we'd say that if a company can keep up that sort of growth, shareholders will be smiling.

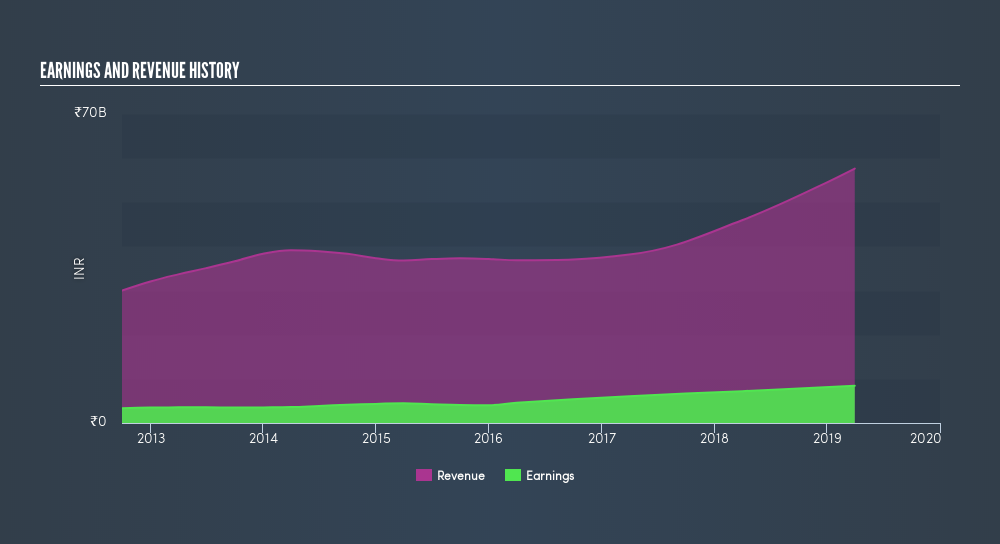

I like to see top-line growth as an indication that growth is sustainable, and I look for a high earnings before interest and taxation (EBIT) margin to point to a competitive moat (though some companies with low margins also have moats). On the one hand, Indraprastha Gas's EBIT margins fell over the last year, but on the other hand, revenue grew. So if EBIT margins can stabilize, this top-line growth should pay off for shareholders.

The trick, as an investor, is to find companies that are going to perform well in the future, not just in the past. To that end, right now and today, you can check our visualization of consensus analyst forecasts for future Indraprastha Gas EPS 100% free.

Are Indraprastha Gas Insiders Aligned With All Shareholders?

I always like to check up on CEO compensation, because I think that reasonable pay levels, around or below the median, can be a sign that shareholder interests are well considered. For companies with market capitalizations between ₹138b and ₹441b, like Indraprastha Gas, the median CEO pay is around ₹50m.

The CEO of Indraprastha Gas only received ₹6.8m in total compensation for the year ending March 2018. That looks like modest pay to me, and may hint at a certain respect for the interests of shareholders. CEO compensation is hardly the most important aspect of a company to consider, but when its reasonable that does give me a little more confidence that leadership are looking out for shareholder interests. It can also be a sign of good governance, more generally.

Does Indraprastha Gas Deserve A Spot On Your Watchlist?

You can't deny that Indraprastha Gas has grown its earnings per share at a very impressive rate. That's attractive. With swiftly growing earnings, it probably has its best days ahead, and the modest CEO pay suggests the company is careful with cash. So I'd venture it may well deserve a spot on your watchlist, or even a little further research. Of course, just because Indraprastha Gas is growing does not mean it is undervalued. If you're wondering about the valuation, check out this gauge of its price-to-earnings ratio, as compared to its industry.

Although Indraprastha Gas certainly looks good to me, I would like it more if insiders were buying up shares. If you like to see insider buying, too, then this free list of growing companies that insiders are buying, could be exactly what you're looking for.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About NSEI:IGL

Excellent balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives