- India

- /

- Gas Utilities

- /

- NSEI:GSPL

Gujarat State Petronet Limited (NSE:GSPL) Looks Inexpensive But Perhaps Not Attractive Enough

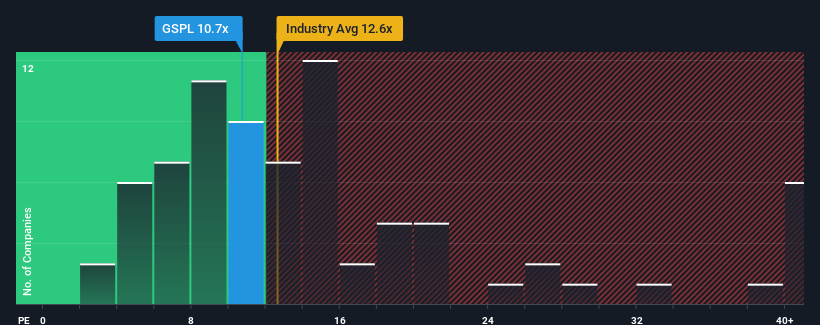

When close to half the companies in India have price-to-earnings ratios (or "P/E's") above 34x, you may consider Gujarat State Petronet Limited (NSE:GSPL) as a highly attractive investment with its 10.7x P/E ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly reduced P/E.

Recent times haven't been advantageous for Gujarat State Petronet as its earnings have been rising slower than most other companies. It seems that many are expecting the uninspiring earnings performance to persist, which has repressed the P/E. If you still like the company, you'd be hoping earnings don't get any worse and that you could pick up some stock while it's out of favour.

Check out our latest analysis for Gujarat State Petronet

Does Growth Match The Low P/E?

Gujarat State Petronet's P/E ratio would be typical for a company that's expected to deliver very poor growth or even falling earnings, and importantly, perform much worse than the market.

Retrospectively, the last year delivered virtually the same number to the company's bottom line as the year before. That's essentially a continuation of what we've seen over the last three years, as its EPS growth has been virtually non-existent for that entire period. Therefore, it's fair to say that earnings growth has definitely eluded the company recently.

Shifting to the future, estimates from the analysts covering the company suggest earnings growth is heading into negative territory, declining 21% per year over the next three years. With the market predicted to deliver 22% growth per annum, that's a disappointing outcome.

In light of this, it's understandable that Gujarat State Petronet's P/E would sit below the majority of other companies. Nonetheless, there's no guarantee the P/E has reached a floor yet with earnings going in reverse. There's potential for the P/E to fall to even lower levels if the company doesn't improve its profitability.

The Final Word

We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that Gujarat State Petronet maintains its low P/E on the weakness of its forecast for sliding earnings, as expected. At this stage investors feel the potential for an improvement in earnings isn't great enough to justify a higher P/E ratio. It's hard to see the share price rising strongly in the near future under these circumstances.

We don't want to rain on the parade too much, but we did also find 1 warning sign for Gujarat State Petronet that you need to be mindful of.

If these risks are making you reconsider your opinion on Gujarat State Petronet, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:GSPL

Gujarat State Petronet

Gujarat State Petronet Limited transmits natural gas through pipeline on an open access basis from supply points to demand centers in India.

Flawless balance sheet 6 star dividend payer.

Market Insights

Community Narratives