- India

- /

- Renewable Energy

- /

- NSEI:GIPCL

The Returns On Capital At Gujarat Industries Power (NSE:GIPCL) Don't Inspire Confidence

If you're looking for a multi-bagger, there's a few things to keep an eye out for. Amongst other things, we'll want to see two things; firstly, a growing return on capital employed (ROCE) and secondly, an expansion in the company's amount of capital employed. Basically this means that a company has profitable initiatives that it can continue to reinvest in, which is a trait of a compounding machine. Although, when we looked at Gujarat Industries Power (NSE:GIPCL), it didn't seem to tick all of these boxes.

Return On Capital Employed (ROCE): What Is It?

For those who don't know, ROCE is a measure of a company's yearly pre-tax profit (its return), relative to the capital employed in the business. Analysts use this formula to calculate it for Gujarat Industries Power:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.056 = ₹2.3b ÷ (₹45b - ₹3.1b) (Based on the trailing twelve months to December 2022).

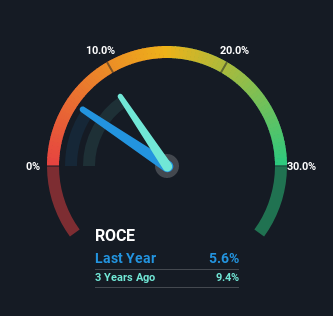

So, Gujarat Industries Power has an ROCE of 5.6%. In absolute terms, that's a low return and it also under-performs the Renewable Energy industry average of 8.6%.

Check out our latest analysis for Gujarat Industries Power

While the past is not representative of the future, it can be helpful to know how a company has performed historically, which is why we have this chart above. If you want to delve into the historical earnings, revenue and cash flow of Gujarat Industries Power, check out these free graphs here.

SWOT Analysis for Gujarat Industries Power

- Earnings growth over the past year exceeded its 5-year average.

- Debt is not viewed as a risk.

- Dividends are covered by earnings and cash flows.

- Dividend is in the top 25% of dividend payers in the market.

- Earnings growth over the past year underperformed the Renewable Energy industry.

- Trading below our estimate of fair value by more than 20%.

- Lack of analyst coverage makes it difficult to determine GIPCL's earnings prospects.

- No apparent threats visible for GIPCL.

So How Is Gujarat Industries Power's ROCE Trending?

In terms of Gujarat Industries Power's historical ROCE movements, the trend isn't fantastic. To be more specific, ROCE has fallen from 10% over the last five years. Meanwhile, the business is utilizing more capital but this hasn't moved the needle much in terms of sales in the past 12 months, so this could reflect longer term investments. It's worth keeping an eye on the company's earnings from here on to see if these investments do end up contributing to the bottom line.

In Conclusion...

In summary, Gujarat Industries Power is reinvesting funds back into the business for growth but unfortunately it looks like sales haven't increased much just yet. And investors may be recognizing these trends since the stock has only returned a total of 4.9% to shareholders over the last five years. So if you're looking for a multi-bagger, the underlying trends indicate you may have better chances elsewhere.

One more thing to note, we've identified 1 warning sign with Gujarat Industries Power and understanding this should be part of your investment process.

While Gujarat Industries Power may not currently earn the highest returns, we've compiled a list of companies that currently earn more than 25% return on equity. Check out this free list here.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:GIPCL

Gujarat Industries Power

Engages in the generation, transmission, and distribution of electricity to power purchasing companies in India.

Established dividend payer and fair value.

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success