- India

- /

- Electric Utilities

- /

- NSEI:DPSCLTD

India Power (NSE:DPSCLTD) Share Prices Have Dropped 65% In The Last Three Years

If you are building a properly diversified stock portfolio, the chances are some of your picks will perform badly. But the long term shareholders of India Power Corporation Limited (NSE:DPSCLTD) have had an unfortunate run in the last three years. Regrettably, they have had to cope with a 65% drop in the share price over that period. The falls have accelerated recently, with the share price down 18% in the last three months.

Check out our latest analysis for India Power

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

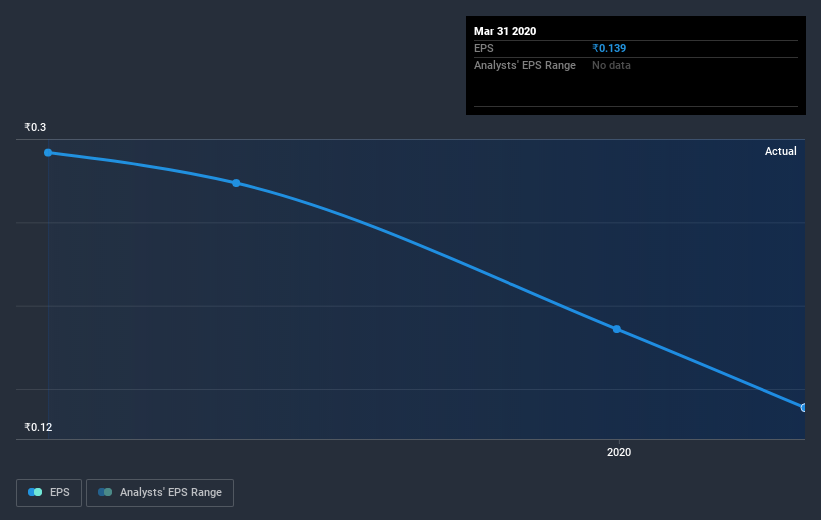

India Power saw its EPS decline at a compound rate of 25% per year, over the last three years. This fall in EPS isn't far from the rate of share price decline, which was 30% per year. So it seems like sentiment towards the stock hasn't changed all that much over time. It seems like the share price is reflecting the declining earnings per share.

The company's earnings per share (over time) is depicted in the image below (click to see the exact numbers).

Before buying or selling a stock, we always recommend a close examination of historic growth trends, available here.

A Different Perspective

We're pleased to report that India Power shareholders have received a total shareholder return of 27% over one year. And that does include the dividend. That certainly beats the loss of about 1.7% per year over the last half decade. We generally put more weight on the long term performance over the short term, but the recent improvement could hint at a (positive) inflection point within the business. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. For instance, we've identified 3 warning signs for India Power (1 is concerning) that you should be aware of.

We will like India Power better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on IN exchanges.

If you decide to trade India Power, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About NSEI:DPSCLTD

India Power

Engages in the generation and distribution of electricity in India.

Adequate balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives