- India

- /

- Gas Utilities

- /

- NSEI:ATGL

Shareholders Should Be Pleased With Adani Total Gas Limited's (NSE:ATGL) Price

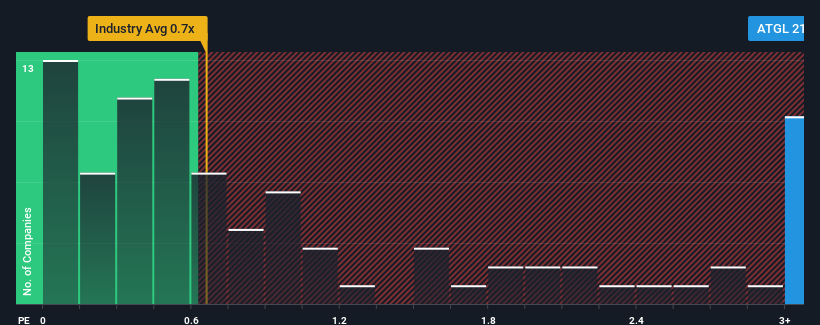

Adani Total Gas Limited's (NSE:ATGL) price-to-sales (or "P/S") ratio of 21.9x may look like a poor investment opportunity when you consider close to half the companies in the Gas Utilities industry in India have P/S ratios below 2.7x. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

See our latest analysis for Adani Total Gas

How Has Adani Total Gas Performed Recently?

Adani Total Gas has been doing a decent job lately as it's been growing revenue at a reasonable pace. One possibility is that the P/S ratio is high because investors think this good revenue growth will be enough to outperform the broader industry in the near future. However, if this isn't the case, investors might get caught out paying too much for the stock.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Adani Total Gas' earnings, revenue and cash flow.Is There Enough Revenue Growth Forecasted For Adani Total Gas?

There's an inherent assumption that a company should far outperform the industry for P/S ratios like Adani Total Gas' to be considered reasonable.

Taking a look back first, we see that the company managed to grow revenues by a handy 3.9% last year. Pleasingly, revenue has also lifted 129% in aggregate from three years ago, partly thanks to the last 12 months of growth. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Weighing the recent medium-term upward revenue trajectory against the broader industry's one-year forecast for contraction of 1.7% shows it's a great look while it lasts.

In light of this, it's understandable that Adani Total Gas' P/S sits above the majority of other companies. Investors are willing to pay more for a stock they hope will buck the trend of the broader industry going backwards. Nonetheless, with most other businesses facing an uphill battle, staying on its current revenue path is no certainty.

What Does Adani Total Gas' P/S Mean For Investors?

Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We see that Adani Total Gas justifiably maintains its high P/S on the merits of its recentthree-year revenue growth beating forecasts amidst struggling industry. Right now shareholders are comfortable with the P/S as they are quite confident revenues aren't under threat. Our only concern is whether its revenue trajectory can keep outperforming under these tough industry conditions. Although, if the company's relative performance doesn't change it will continue to provide strong support to the share price.

Many other vital risk factors can be found on the company's balance sheet. You can assess many of the main risks through our free balance sheet analysis for Adani Total Gas with six simple checks.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:ATGL

Adani Total Gas

Engages in the city gas distribution (CGD) business in India.

Mediocre balance sheet with questionable track record.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Meta’s Bold Bet on AI Pays Off

ADP Stock: Solid Fundamentals, But AI Investments Test Its Margin Resilience

Visa Stock: The Toll Booth at the Center of Global Commerce

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion