- India

- /

- Gas Utilities

- /

- NSEI:ATGL

Returns On Capital Signal Tricky Times Ahead For Adani Total Gas (NSE:ATGL)

If we want to find a potential multi-bagger, often there are underlying trends that can provide clues. Firstly, we'll want to see a proven return on capital employed (ROCE) that is increasing, and secondly, an expanding base of capital employed. Put simply, these types of businesses are compounding machines, meaning they are continually reinvesting their earnings at ever-higher rates of return. However, after investigating Adani Total Gas (NSE:ATGL), we don't think it's current trends fit the mold of a multi-bagger.

What Is Return On Capital Employed (ROCE)?

Just to clarify if you're unsure, ROCE is a metric for evaluating how much pre-tax income (in percentage terms) a company earns on the capital invested in its business. Analysts use this formula to calculate it for Adani Total Gas:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.15 = ₹9.2b ÷ (₹77b - ₹15b) (Based on the trailing twelve months to June 2025).

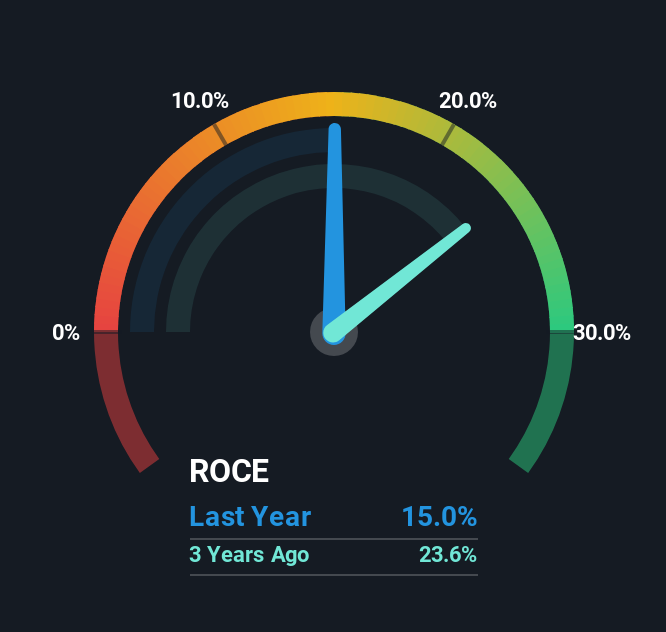

Therefore, Adani Total Gas has an ROCE of 15%. In absolute terms, that's a pretty normal return, and it's somewhat close to the Gas Utilities industry average of 13%.

Check out our latest analysis for Adani Total Gas

Historical performance is a great place to start when researching a stock so above you can see the gauge for Adani Total Gas' ROCE against it's prior returns. If you're interested in investigating Adani Total Gas' past further, check out this free graph covering Adani Total Gas' past earnings, revenue and cash flow.

What Does the ROCE Trend For Adani Total Gas Tell Us?

We weren't thrilled with the trend because Adani Total Gas' ROCE has reduced by 42% over the last five years, while the business employed 225% more capital. Usually this isn't ideal, but given Adani Total Gas conducted a capital raising before their most recent earnings announcement, that would've likely contributed, at least partially, to the increased capital employed figure. The funds raised likely haven't been put to work yet so it's worth watching what happens in the future with Adani Total Gas' earnings and if they change as a result from the capital raise. Also, we found that by looking at the company's latest EBIT, the figure is within 10% of the previous year's EBIT so you can basically assign the ROCE drop primarily to that capital raise.

The Bottom Line On Adani Total Gas' ROCE

In summary, despite lower returns in the short term, we're encouraged to see that Adani Total Gas is reinvesting for growth and has higher sales as a result. And the stock has done incredibly well with a 237% return over the last five years, so long term investors are no doubt ecstatic with that result. So while investors seem to be recognizing these promising trends, we would look further into this stock to make sure the other metrics justify the positive view.

One more thing, we've spotted 1 warning sign facing Adani Total Gas that you might find interesting.

While Adani Total Gas may not currently earn the highest returns, we've compiled a list of companies that currently earn more than 25% return on equity. Check out this free list here.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:ATGL

Adani Total Gas

Engages in the city gas distribution (CGD) business in India.

Mediocre balance sheet with questionable track record.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Engineered for Stability. Positioned for Growth.

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026