Shareholders May Not Be So Generous With Total Transport Systems Limited's (NSE:TOTAL) CEO Compensation And Here's Why

Key Insights

- Total Transport Systems will host its Annual General Meeting on 14th of September

- CEO Makarand Pradhan's total compensation includes salary of ₹14.2m

- The total compensation is 238% higher than the average for the industry

- Total Transport Systems' EPS declined by 63% over the past three years while total shareholder return over the past three years was 86%

Despite strong share price growth of 86% for Total Transport Systems Limited (NSE:TOTAL) over the last few years, earnings growth has been disappointing, which suggests something is amiss. Some of these issues will occupy shareholders' minds as the AGM rolls around on 14th of September. One way that shareholders can influence managerial decisions is through voting on CEO and executive remuneration packages, which studies show could impact company performance. In our analysis below, we show why shareholders may consider holding off a raise for the CEO's compensation until company performance improves.

View our latest analysis for Total Transport Systems

How Does Total Compensation For Makarand Pradhan Compare With Other Companies In The Industry?

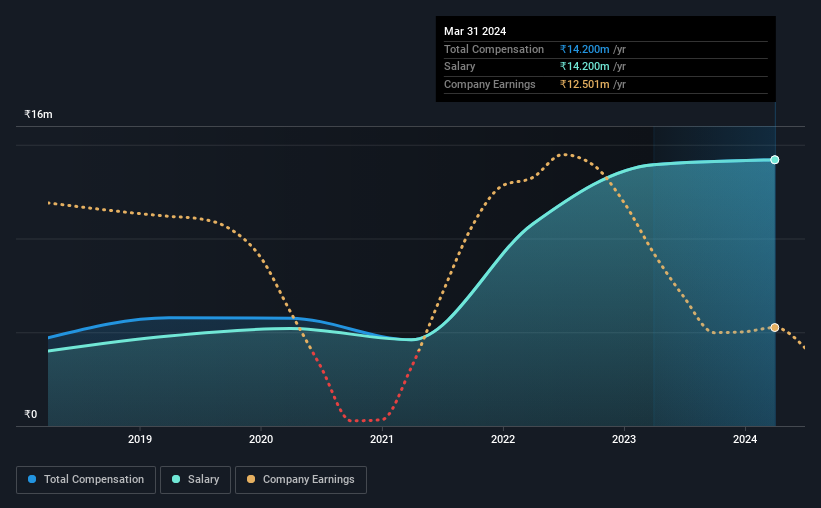

According to our data, Total Transport Systems Limited has a market capitalization of ₹1.6b, and paid its CEO total annual compensation worth ₹14m over the year to March 2024. That is, the compensation was roughly the same as last year. Notably, the salary of ₹14m is the entirety of the CEO compensation.

In comparison with other companies in the Indian Logistics industry with market capitalizations under ₹17b, the reported median total CEO compensation was ₹4.2m. Accordingly, our analysis reveals that Total Transport Systems Limited pays Makarand Pradhan north of the industry median. Moreover, Makarand Pradhan also holds ₹250m worth of Total Transport Systems stock directly under their own name, which reveals to us that they have a significant personal stake in the company.

| Component | 2024 | 2023 | Proportion (2024) |

| Salary | ₹14m | ₹14m | 100% |

| Other | - | - | - |

| Total Compensation | ₹14m | ₹14m | 100% |

Talking in terms of the industry, salary represented approximately 55% of total compensation out of all the companies we analyzed, while other remuneration made up 45% of the pie. Speaking on a company level, Total Transport Systems prefers to tread along a traditional path, disbursing all compensation through a salary. If salary dominates total compensation, it suggests that CEO compensation is leaning less towards the variable component, which is usually linked with performance.

Total Transport Systems Limited's Growth

Over the last three years, Total Transport Systems Limited has shrunk its earnings per share by 63% per year. Its revenue is down 1.5% over the previous year.

The decline in EPS is a bit concerning. This is compounded by the fact revenue is actually down on last year. So given this relatively weak performance, shareholders would probably not want to see high compensation for the CEO. Although we don't have analyst forecasts, you might want to assess this data-rich visualization of earnings, revenue and cash flow.

Has Total Transport Systems Limited Been A Good Investment?

Most shareholders would probably be pleased with Total Transport Systems Limited for providing a total return of 86% over three years. This strong performance might mean some shareholders don't mind if the CEO were to be paid more than is normal for a company of its size.

To Conclude...

Total Transport Systems rewards its CEO solely through a salary, ignoring non-salary benefits completely. Although shareholders would be quite happy with the returns they have earned on their initial investment, earnings have failed to grow and this could mean returns may be hard to keep up. The upcoming AGM will provide shareholders the opportunity to revisit the company’s remuneration policies and evaluate if the board’s judgement and decision-making is aligned with that of the company’s shareholders.

CEO compensation can have a massive impact on performance, but it's just one element. That's why we did some digging and identified 3 warning signs for Total Transport Systems that you should be aware of before investing.

Switching gears from Total Transport Systems, if you're hunting for a pristine balance sheet and premium returns, this free list of high return, low debt companies is a great place to look.

Valuation is complex, but we're here to simplify it.

Discover if Total Transport Systems might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:TOTAL

Total Transport Systems

Provides logistic services in India and internationally.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Engineered for Stability. Positioned for Growth.

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026