- India

- /

- Transportation

- /

- NSEI:SHREEOSFM

Here's Why We Think Shree OSFM E-Mobility (NSE:SHREEOSFM) Might Deserve Your Attention Today

The excitement of investing in a company that can reverse its fortunes is a big draw for some speculators, so even companies that have no revenue, no profit, and a record of falling short, can manage to find investors. Unfortunately, these high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson. A loss-making company is yet to prove itself with profit, and eventually the inflow of external capital may dry up.

In contrast to all that, many investors prefer to focus on companies like Shree OSFM E-Mobility (NSE:SHREEOSFM), which has not only revenues, but also profits. Now this is not to say that the company presents the best investment opportunity around, but profitability is a key component to success in business.

See our latest analysis for Shree OSFM E-Mobility

Shree OSFM E-Mobility's Improving Profits

In the last three years Shree OSFM E-Mobility's earnings per share took off; so much so that it's a bit disingenuous to use these figures to try and deduce long term estimates. So it would be better to isolate the growth rate over the last year for our analysis. Shree OSFM E-Mobility's EPS shot up from ₹5.37 to ₹7.46; a result that's bound to keep shareholders happy. That's a commendable gain of 39%.

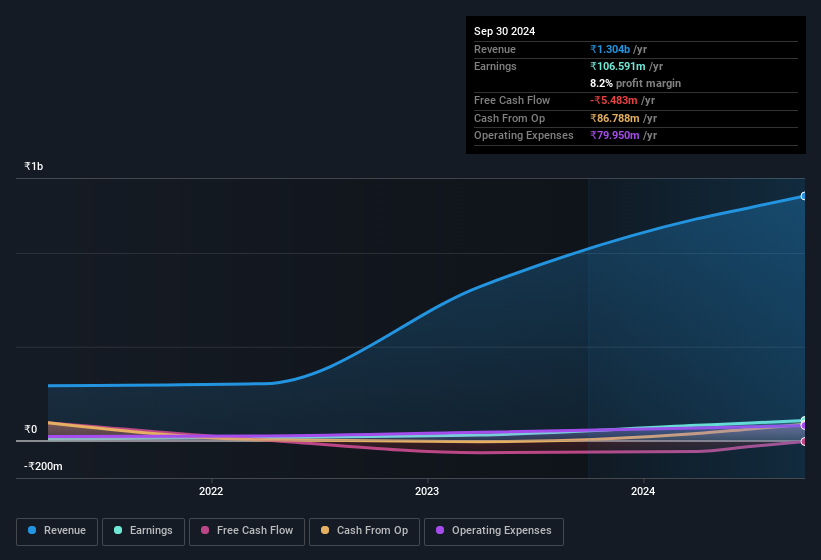

Top-line growth is a great indicator that growth is sustainable, and combined with a high earnings before interest and taxation (EBIT) margin, it's a great way for a company to maintain a competitive advantage in the market. EBIT margins for Shree OSFM E-Mobility remained fairly unchanged over the last year, however the company should be pleased to report its revenue growth for the period of 30% to ₹1.3b. That's progress.

The chart below shows how the company's bottom and top lines have progressed over time. To see the actual numbers, click on the chart.

Since Shree OSFM E-Mobility is no giant, with a market capitalisation of ₹1.6b, you should definitely check its cash and debt before getting too excited about its prospects.

Are Shree OSFM E-Mobility Insiders Aligned With All Shareholders?

Seeing insiders owning a large portion of the shares on issue is often a good sign. Their incentives will be aligned with the investors and there's less of a probability in a sudden sell-off that would impact the share price. So we're pleased to report that Shree OSFM E-Mobility insiders own a meaningful share of the business. Indeed, with a collective holding of 63%, company insiders are in control and have plenty of capital behind the venture. This makes it apparent they will be incentivised to plan for the long term - a positive for shareholders with a sit and hold strategy. Valued at only ₹1.6b Shree OSFM E-Mobility is really small for a listed company. So this large proportion of shares owned by insiders only amounts to ₹986m. That's not a huge stake in absolute terms, but it should help keep insiders aligned with other shareholders.

Is Shree OSFM E-Mobility Worth Keeping An Eye On?

You can't deny that Shree OSFM E-Mobility has grown its earnings per share at a very impressive rate. That's attractive. With EPS growth rates like that, it's hardly surprising to see company higher-ups place confidence in the company through continuing to hold a significant investment. The growth and insider confidence is looked upon well and so it's worthwhile to investigate further with a view to discern the stock's true value. Don't forget that there may still be risks. For instance, we've identified 3 warning signs for Shree OSFM E-Mobility (1 is concerning) you should be aware of.

While opting for stocks without growing earnings and absent insider buying can yield results, for investors valuing these key metrics, here is a carefully selected list of companies in IN with promising growth potential and insider confidence.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:SHREEOSFM

Excellent balance sheet and good value.

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.