Take Care Before Jumping Onto Mahindra Logistics Limited (NSE:MAHLOG) Even Though It's 28% Cheaper

To the annoyance of some shareholders, Mahindra Logistics Limited (NSE:MAHLOG) shares are down a considerable 28% in the last month, which continues a horrid run for the company. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 38% in that time.

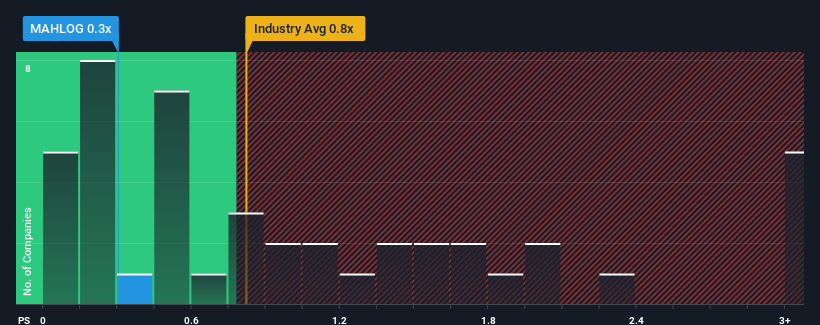

Following the heavy fall in price, it would be understandable if you think Mahindra Logistics is a stock with good investment prospects with a price-to-sales ratios (or "P/S") of 0.3x, considering almost half the companies in India's Logistics industry have P/S ratios above 0.8x. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for Mahindra Logistics

How Mahindra Logistics Has Been Performing

There hasn't been much to differentiate Mahindra Logistics' and the industry's revenue growth lately. Perhaps the market is expecting future revenue performance to dive, which has kept the P/S suppressed. If not, then existing shareholders have reason to be optimistic about the future direction of the share price.

Keen to find out how analysts think Mahindra Logistics' future stacks up against the industry? In that case, our free report is a great place to start.Do Revenue Forecasts Match The Low P/S Ratio?

The only time you'd be truly comfortable seeing a P/S as low as Mahindra Logistics' is when the company's growth is on track to lag the industry.

If we review the last year of revenue growth, the company posted a worthy increase of 12%. The latest three year period has also seen an excellent 50% overall rise in revenue, aided somewhat by its short-term performance. So we can start by confirming that the company has done a great job of growing revenues over that time.

Shifting to the future, estimates from the eleven analysts covering the company suggest revenue should grow by 14% per annum over the next three years. Meanwhile, the rest of the industry is forecast to expand by 12% each year, which is not materially different.

In light of this, it's peculiar that Mahindra Logistics' P/S sits below the majority of other companies. Apparently some shareholders are doubtful of the forecasts and have been accepting lower selling prices.

The Bottom Line On Mahindra Logistics' P/S

The southerly movements of Mahindra Logistics' shares means its P/S is now sitting at a pretty low level. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've seen that Mahindra Logistics currently trades on a lower than expected P/S since its forecast growth is in line with the wider industry. Despite average revenue growth estimates, there could be some unobserved threats keeping the P/S low. At least the risk of a price drop looks to be subdued, but investors seem to think future revenue could see some volatility.

Before you take the next step, you should know about the 2 warning signs for Mahindra Logistics (1 doesn't sit too well with us!) that we have uncovered.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:MAHLOG

Mahindra Logistics

Provides integrated logistics and mobility solutions in India and internationally.

Undervalued with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success