- India

- /

- Transportation

- /

- NSEI:GICL

Investors Appear Satisfied With Globe International Carriers Limited's (NSE:GICL) Prospects As Shares Rocket 35%

Those holding Globe International Carriers Limited (NSE:GICL) shares would be relieved that the share price has rebounded 35% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. Looking further back, the 19% rise over the last twelve months isn't too bad notwithstanding the strength over the last 30 days.

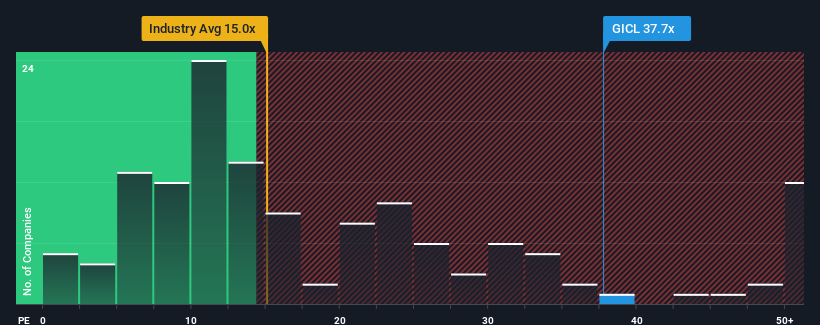

Following the firm bounce in price, Globe International Carriers may be sending bearish signals at the moment with its price-to-earnings (or "P/E") ratio of 37.7x, since almost half of all companies in India have P/E ratios under 33x and even P/E's lower than 19x are not unusual. However, the P/E might be high for a reason and it requires further investigation to determine if it's justified.

The recent earnings growth at Globe International Carriers would have to be considered satisfactory if not spectacular. It might be that many expect the reasonable earnings performance to beat most other companies over the coming period, which has increased investors’ willingness to pay up for the stock. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Check out our latest analysis for Globe International Carriers

Is There Enough Growth For Globe International Carriers?

In order to justify its P/E ratio, Globe International Carriers would need to produce impressive growth in excess of the market.

Taking a look back first, we see that the company managed to grow earnings per share by a handy 7.3% last year. This was backed up an excellent period prior to see EPS up by 183% in total over the last three years. So we can start by confirming that the company has done a great job of growing earnings over that time.

Comparing that to the market, which is only predicted to deliver 25% growth in the next 12 months, the company's momentum is stronger based on recent medium-term annualised earnings results.

With this information, we can see why Globe International Carriers is trading at such a high P/E compared to the market. Presumably shareholders aren't keen to offload something they believe will continue to outmanoeuvre the bourse.

What We Can Learn From Globe International Carriers' P/E?

Globe International Carriers shares have received a push in the right direction, but its P/E is elevated too. Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

As we suspected, our examination of Globe International Carriers revealed its three-year earnings trends are contributing to its high P/E, given they look better than current market expectations. Right now shareholders are comfortable with the P/E as they are quite confident earnings aren't under threat. Unless the recent medium-term conditions change, they will continue to provide strong support to the share price.

Don't forget that there may be other risks. For instance, we've identified 4 warning signs for Globe International Carriers (1 is a bit unpleasant) you should be aware of.

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:GICL

Globe International Carriers

Provides logistics solutions in India and Nepal.

Solid track record with excellent balance sheet.

Market Insights

Community Narratives

Recently Updated Narratives

Q3 Outlook modestly optimistic

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success