- India

- /

- Telecom Services and Carriers

- /

- NSEI:TTML

Tata Teleservices (Maharashtra) Limited's (NSE:TTML) Shares Climb 27% But Its Business Is Yet to Catch Up

Those holding Tata Teleservices (Maharashtra) Limited (NSE:TTML) shares would be relieved that the share price has rebounded 27% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. But the gains over the last month weren't enough to make shareholders whole, as the share price is still down 6.4% in the last twelve months.

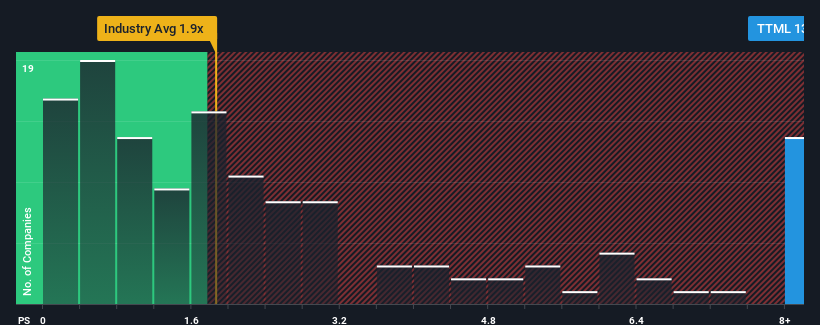

Since its price has surged higher, you could be forgiven for thinking Tata Teleservices (Maharashtra) is a stock to steer clear of with a price-to-sales ratios (or "P/S") of 13x, considering almost half the companies in India's Telecom industry have P/S ratios below 3.8x. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for Tata Teleservices (Maharashtra)

How Tata Teleservices (Maharashtra) Has Been Performing

The revenue growth achieved at Tata Teleservices (Maharashtra) over the last year would be more than acceptable for most companies. Perhaps the market is expecting this decent revenue performance to beat out the industry over the near term, which has kept the P/S propped up. If not, then existing shareholders may be a little nervous about the viability of the share price.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Tata Teleservices (Maharashtra)'s earnings, revenue and cash flow.Do Revenue Forecasts Match The High P/S Ratio?

Tata Teleservices (Maharashtra)'s P/S ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the industry.

If we review the last year of revenue growth, the company posted a worthy increase of 13%. The latest three year period has also seen a 19% overall rise in revenue, aided somewhat by its short-term performance. Therefore, it's fair to say the revenue growth recently has been respectable for the company.

Comparing that to the industry, which is predicted to deliver 4.9% growth in the next 12 months, the company's momentum is pretty similar based on recent medium-term annualised revenue results.

In light of this, it's curious that Tata Teleservices (Maharashtra)'s P/S sits above the majority of other companies. Apparently many investors in the company are more bullish than recent times would indicate and aren't willing to let go of their stock right now. Nevertheless, they may be setting themselves up for future disappointment if the P/S falls to levels more in line with recent growth rates.

The Key Takeaway

Tata Teleservices (Maharashtra)'s P/S has grown nicely over the last month thanks to a handy boost in the share price. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Our look into Tata Teleservices (Maharashtra) has shown that it currently trades on a higher than expected P/S since its recent three-year growth is only in line with the wider industry forecast. When we see average revenue with industry-like growth combined with a high P/S, we suspect the share price is at risk of declining, bringing the P/S back in line with the industry too. Unless there is a significant improvement in the company's medium-term trends, it will be difficult to prevent the P/S ratio from declining to a more reasonable level.

It is also worth noting that we have found 1 warning sign for Tata Teleservices (Maharashtra) that you need to take into consideration.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if Tata Teleservices (Maharashtra) might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:TTML

Tata Teleservices (Maharashtra)

Provides wire line voice, data, and managed telecom services to enterprise customers in Maharashtra and Goa.

Imperfect balance sheet with minimal risk.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Engineered for Stability. Positioned for Growth.

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026