- India

- /

- Telecom Services and Carriers

- /

- NSEI:GTLINFRA

GTL Infrastructure Limited's (NSE:GTLINFRA) Low P/S No Reason For Excitement

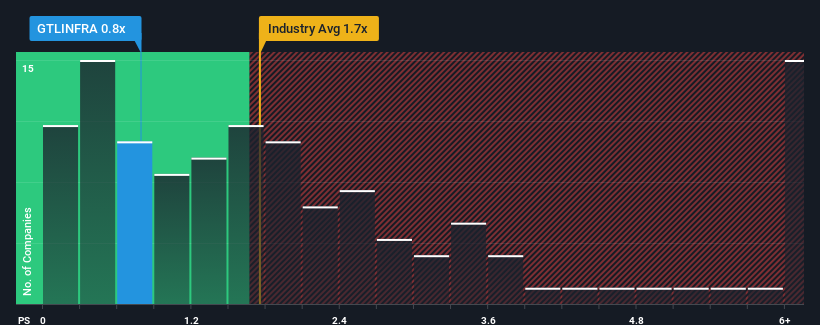

When close to half the companies operating in the Telecom industry in India have price-to-sales ratios (or "P/S") above 2.3x, you may consider GTL Infrastructure Limited (NSE:GTLINFRA) as an attractive investment with its 0.8x P/S ratio. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for GTL Infrastructure

How GTL Infrastructure Has Been Performing

It looks like revenue growth has deserted GTL Infrastructure recently, which is not something to boast about. One possibility is that the P/S is low because investors think this benign revenue growth rate will likely underperform the broader industry in the near future. Those who are bullish on GTL Infrastructure will be hoping that this isn't the case, so that they can pick up the stock at a lower valuation.

Although there are no analyst estimates available for GTL Infrastructure, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.How Is GTL Infrastructure's Revenue Growth Trending?

In order to justify its P/S ratio, GTL Infrastructure would need to produce sluggish growth that's trailing the industry.

If we review the last year of revenue, the company posted a result that saw barely any deviation from a year ago. That's essentially a continuation of what we've seen over the last three years, as its revenue growth has been virtually non-existent for that entire period. Therefore, it's fair to say that revenue growth has definitely eluded the company recently.

This is in contrast to the rest of the industry, which is expected to grow by 5.6% over the next year, materially higher than the company's recent medium-term annualised growth rates.

With this information, we can see why GTL Infrastructure is trading at a P/S lower than the industry. It seems most investors are expecting to see the recent limited growth rates continue into the future and are only willing to pay a reduced amount for the stock.

What We Can Learn From GTL Infrastructure's P/S?

Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

As we suspected, our examination of GTL Infrastructure revealed its three-year revenue trends are contributing to its low P/S, given they look worse than current industry expectations. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. If recent medium-term revenue trends continue, it's hard to see the share price experience a reversal of fortunes anytime soon.

Before you take the next step, you should know about the 2 warning signs for GTL Infrastructure that we have uncovered.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:GTLINFRA

GTL Infrastructure

An independent and neutral telecom tower company, owns, builds, operates, and maintains shared passive telecom infrastructure sites primarily in India.

Good value with imperfect balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Constellation Energy Dividends and Growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026