- India

- /

- Electronic Equipment and Components

- /

- NSEI:WEL

Here's Why We Think Wonder Fibromats (NSE:WFL) Might Deserve Your Attention Today

It's common for many investors, especially those who are inexperienced, to buy shares in companies with a good story even if these companies are loss-making. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses. While a well funded company may sustain losses for years, it will need to generate a profit eventually, or else investors will move on and the company will wither away.

So if this idea of high risk and high reward doesn't suit, you might be more interested in profitable, growing companies, like Wonder Fibromats (NSE:WFL). While profit isn't the sole metric that should be considered when investing, it's worth recognising businesses that can consistently produce it.

See our latest analysis for Wonder Fibromats

How Fast Is Wonder Fibromats Growing?

If you believe that markets are even vaguely efficient, then over the long term you'd expect a company's share price to follow its earnings per share (EPS) outcomes. That makes EPS growth an attractive quality for any company. Over the last three years, Wonder Fibromats has grown EPS by 6.3% per year. That might not be particularly high growth, but it does show that per-share earnings are moving steadily in the right direction.

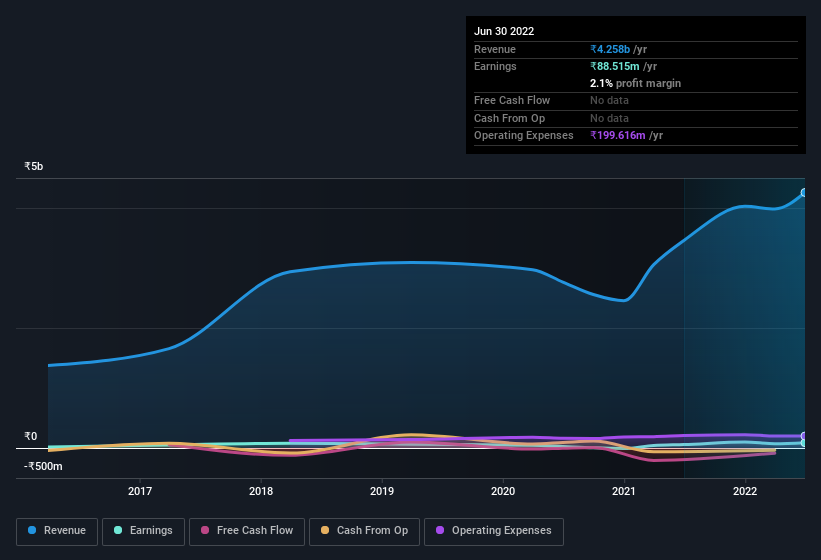

It's often helpful to take a look at earnings before interest and tax (EBIT) margins, as well as revenue growth, to get another take on the quality of the company's growth. While we note Wonder Fibromats achieved similar EBIT margins to last year, revenue grew by a solid 23% to ₹4.3b. That's a real positive.

You can take a look at the company's revenue and earnings growth trend, in the chart below. For finer detail, click on the image.

Since Wonder Fibromats is no giant, with a market capitalisation of ₹2.0b, you should definitely check its cash and debt before getting too excited about its prospects.

Are Wonder Fibromats Insiders Aligned With All Shareholders?

Many consider high insider ownership to be a strong sign of alignment between the leaders of a company and the ordinary shareholders. So we're pleased to report that Wonder Fibromats insiders own a meaningful share of the business. In fact, they own 74% of the company, so they will share in the same delights and challenges experienced by the ordinary shareholders. This makes it apparent they will be incentivised to plan for the long term - a positive for shareholders with a sit and hold strategy. In terms of absolute value, insiders have ₹1.5b invested in the business, at the current share price. That's nothing to sneeze at!

It means a lot to see insiders invested in the business, but shareholders may be wondering if remuneration policies are in their best interest. Well, based on the CEO pay, you'd argue that they are indeed. Our analysis has discovered that the median total compensation for the CEOs of companies like Wonder Fibromats with market caps under ₹16b is about ₹3.0m.

The CEO of Wonder Fibromats was paid just ₹1.1m in total compensation for the year ending March 2021. This could be considered a token amount, and indicates that the company does not need to use payment to motivate the CEO - that is often a good sign. CEO remuneration levels are not the most important metric for investors, but when the pay is modest, that does support enhanced alignment between the CEO and the ordinary shareholders. It can also be a sign of good governance, more generally.

Does Wonder Fibromats Deserve A Spot On Your Watchlist?

As previously touched on, Wonder Fibromats is a growing business, which is encouraging. The fact that EPS is growing is a genuine positive for Wonder Fibromats, but the pleasant picture gets better than that. With company insiders aligning themselves considerably with the company's success and modest CEO compensation, there's no arguments that this is a stock worth looking into. We should say that we've discovered 2 warning signs for Wonder Fibromats (1 is potentially serious!) that you should be aware of before investing here.

Although Wonder Fibromats certainly looks good, it may appeal to more investors if insiders were buying up shares. If you like to see insider buying, then this free list of growing companies that insiders are buying, could be exactly what you're looking for.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if Wonder Electricals might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:WEL

Wonder Electricals

Engages in the manufacture and supply of ceiling, exhaust, pedestal, and TPW and BLDC fans in India.

Solid track record with mediocre balance sheet.

Market Insights

Community Narratives