- India

- /

- Communications

- /

- NSEI:STLTECH

Increasing losses over three years doesn't faze Sterlite Technologies (NSE:STLTECH) investors as stock spikes 13% this past week

It is a pleasure to report that the Sterlite Technologies Limited (NSE:STLTECH) is up 60% in the last quarter. But that cannot eclipse the less-than-impressive returns over the last three years. After all, the share price is down 28% in the last three years, significantly under-performing the market.

While the stock has risen 13% in the past week but long term shareholders are still in the red, let's see what the fundamentals can tell us.

Given that Sterlite Technologies didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

Over the last three years, Sterlite Technologies' revenue dropped 15% per year. That's definitely a weaker result than most pre-profit companies report. With revenue in decline, the share price decline of 9% per year is hardly undeserved. The key question now is whether the company has the capacity to fund itself to profitability, without more cash. Of course, it is possible for businesses to bounce back from a revenue drop - but we'd want to see that before getting interested.

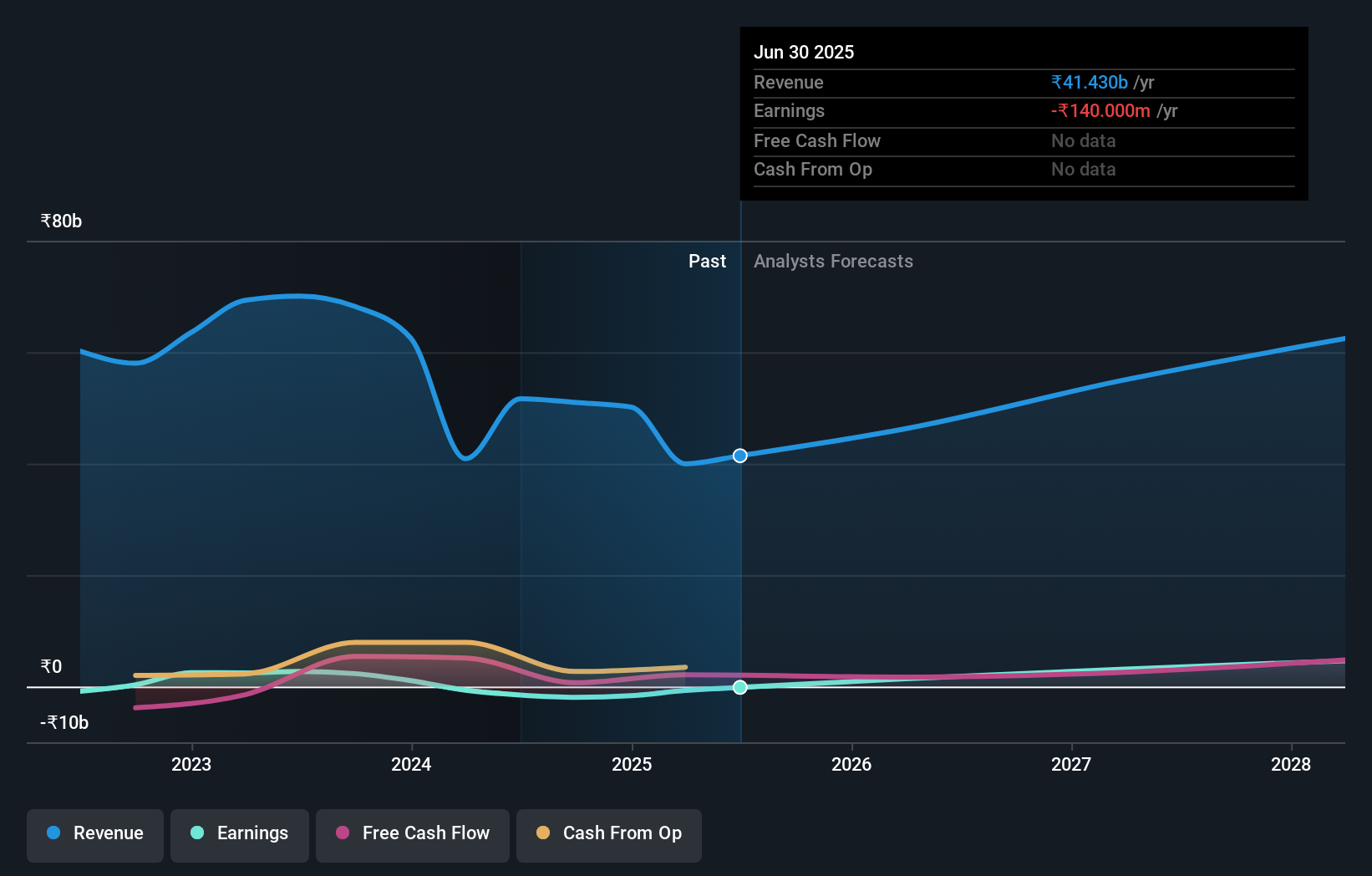

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

What About The Total Shareholder Return (TSR)?

Investors should note that there's a difference between Sterlite Technologies' total shareholder return (TSR) and its share price change, which we've covered above. The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. Dividends have been really beneficial for Sterlite Technologies shareholders, and that cash payout explains why its total shareholder loss of 1.9%, over the last 3 years, isn't as bad as the share price return.

A Different Perspective

We're pleased to report that Sterlite Technologies shareholders have received a total shareholder return of 29% over one year. That gain is better than the annual TSR over five years, which is 1.5%. Therefore it seems like sentiment around the company has been positive lately. Someone with an optimistic perspective could view the recent improvement in TSR as indicating that the business itself is getting better with time. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Take risks, for example - Sterlite Technologies has 2 warning signs we think you should be aware of.

But note: Sterlite Technologies may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Indian exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:STLTECH

Sterlite Technologies

Manufactures and sells telecom products in India and internationally.

Reasonable growth potential and fair value.

Similar Companies

Market Insights

Community Narratives