- India

- /

- Electronic Equipment and Components

- /

- NSEI:RPTECH

Improved Earnings Required Before Rashi Peripherals Limited (NSE:RPTECH) Stock's 37% Jump Looks Justified

Rashi Peripherals Limited (NSE:RPTECH) shares have had a really impressive month, gaining 37% after a shaky period beforehand. While recent buyers may be laughing, long-term holders might not be as pleased since the recent gain only brings the stock back to where it started a year ago.

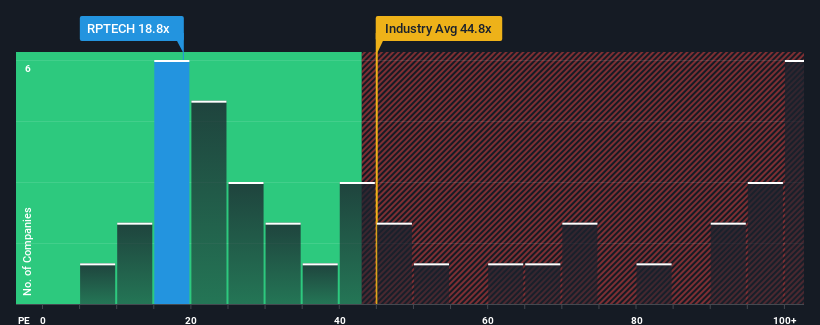

Although its price has surged higher, Rashi Peripherals' price-to-earnings (or "P/E") ratio of 18.8x might still make it look like a buy right now compared to the market in India, where around half of the companies have P/E ratios above 34x and even P/E's above 66x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/E.

Earnings have risen at a steady rate over the last year for Rashi Peripherals, which is generally not a bad outcome. One possibility is that the P/E is low because investors think this good earnings growth might actually underperform the broader market in the near future. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Check out our latest analysis for Rashi Peripherals

Does Growth Match The Low P/E?

The only time you'd be truly comfortable seeing a P/E as low as Rashi Peripherals' is when the company's growth is on track to lag the market.

Taking a look back first, we see that the company managed to grow earnings per share by a handy 5.6% last year. However, this wasn't enough as the latest three year period has seen an unpleasant 31% overall drop in EPS. Accordingly, shareholders would have felt downbeat about the medium-term rates of earnings growth.

Weighing that medium-term earnings trajectory against the broader market's one-year forecast for expansion of 25% shows it's an unpleasant look.

In light of this, it's understandable that Rashi Peripherals' P/E would sit below the majority of other companies. Nonetheless, there's no guarantee the P/E has reached a floor yet with earnings going in reverse. Even just maintaining these prices could be difficult to achieve as recent earnings trends are already weighing down the shares.

What We Can Learn From Rashi Peripherals' P/E?

The latest share price surge wasn't enough to lift Rashi Peripherals' P/E close to the market median. It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

As we suspected, our examination of Rashi Peripherals revealed its shrinking earnings over the medium-term are contributing to its low P/E, given the market is set to grow. At this stage investors feel the potential for an improvement in earnings isn't great enough to justify a higher P/E ratio. If recent medium-term earnings trends continue, it's hard to see the share price moving strongly in either direction in the near future under these circumstances.

We don't want to rain on the parade too much, but we did also find 1 warning sign for Rashi Peripherals that you need to be mindful of.

If these risks are making you reconsider your opinion on Rashi Peripherals, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:RPTECH

Rashi Peripherals

Operates as a distribution partner for information and communications technology (ICT) products of various brands in India.

Adequate balance sheet with acceptable track record.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success