- India

- /

- Electronic Equipment and Components

- /

- NSEI:PGEL

More Unpleasant Surprises Could Be In Store For PG Electroplast Limited's (NSE:PGEL) Shares After Tumbling 28%

The PG Electroplast Limited (NSE:PGEL) share price has softened a substantial 28% over the previous 30 days, handing back much of the gains the stock has made lately. The good news is that in the last year, the stock has shone bright like a diamond, gaining 276%.

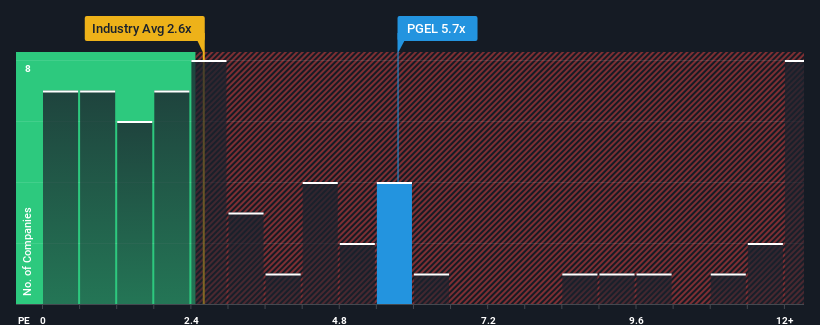

Although its price has dipped substantially, you could still be forgiven for thinking PG Electroplast is a stock to steer clear of with a price-to-sales ratios (or "P/S") of 5.7x, considering almost half the companies in India's Electronic industry have P/S ratios below 2.6x. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

Check out our latest analysis for PG Electroplast

What Does PG Electroplast's P/S Mean For Shareholders?

PG Electroplast could be doing better as it's been growing revenue less than most other companies lately. One possibility is that the P/S ratio is high because investors think this lacklustre revenue performance will improve markedly. If not, then existing shareholders may be very nervous about the viability of the share price.

Want the full picture on analyst estimates for the company? Then our free report on PG Electroplast will help you uncover what's on the horizon.Is There Enough Revenue Growth Forecasted For PG Electroplast?

The only time you'd be truly comfortable seeing a P/S as steep as PG Electroplast's is when the company's growth is on track to outshine the industry decidedly.

If we review the last year of revenue growth, the company posted a terrific increase of 48%. The latest three year period has also seen an incredible overall rise in revenue, aided by its incredible short-term performance. So we can start by confirming that the company has done a tremendous job of growing revenue over that time.

Looking ahead now, revenue is anticipated to climb by 31% each year during the coming three years according to the six analysts following the company. With the industry predicted to deliver 28% growth per year, the company is positioned for a comparable revenue result.

With this information, we find it interesting that PG Electroplast is trading at a high P/S compared to the industry. It seems most investors are ignoring the fairly average growth expectations and are willing to pay up for exposure to the stock. Although, additional gains will be difficult to achieve as this level of revenue growth is likely to weigh down the share price eventually.

What Does PG Electroplast's P/S Mean For Investors?

Even after such a strong price drop, PG Electroplast's P/S still exceeds the industry median significantly. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Analysts are forecasting PG Electroplast's revenues to only grow on par with the rest of the industry, which has lead to the high P/S ratio being unexpected. When we see revenue growth that just matches the industry, we don't expect elevates P/S figures to remain inflated for the long-term. Unless the company can jump ahead of the rest of the industry in the short-term, it'll be a challenge to maintain the share price at current levels.

Plus, you should also learn about these 2 warning signs we've spotted with PG Electroplast.

If these risks are making you reconsider your opinion on PG Electroplast, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:PGEL

PG Electroplast

Provides electronic manufacturing services for original equipment manufacturers in India and internationally.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives