- India

- /

- Electronic Equipment and Components

- /

- NSEI:KAYNES

Kaynes Technology India's (NSE:KAYNES) Performance Raises Some Questions

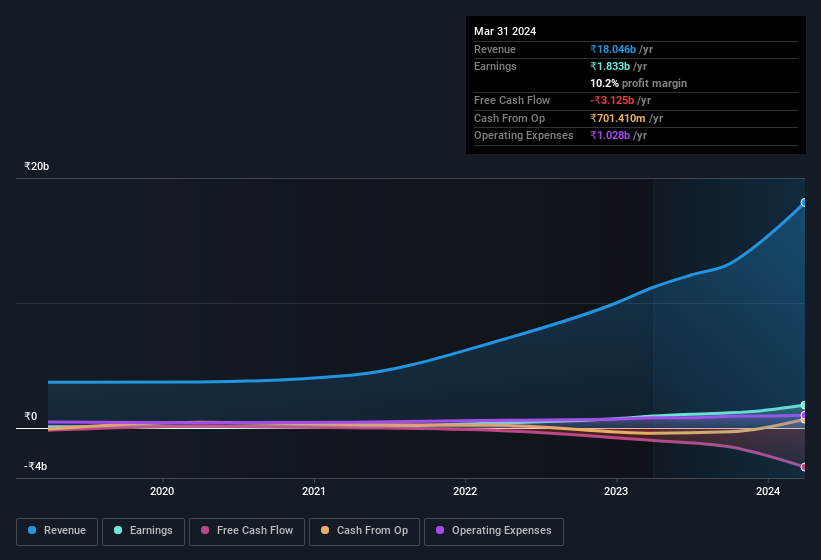

Kaynes Technology India Limited's (NSE:KAYNES) stock rose after it released a robust earnings report. While the headline numbers were strong, we found some underlying problems once we started looking at what drove earnings.

View our latest analysis for Kaynes Technology India

A Closer Look At Kaynes Technology India's Earnings

Many investors haven't heard of the accrual ratio from cashflow, but it is actually a useful measure of how well a company's profit is backed up by free cash flow (FCF) during a given period. In plain english, this ratio subtracts FCF from net profit, and divides that number by the company's average operating assets over that period. You could think of the accrual ratio from cashflow as the 'non-FCF profit ratio'.

As a result, a negative accrual ratio is a positive for the company, and a positive accrual ratio is a negative. While it's not a problem to have a positive accrual ratio, indicating a certain level of non-cash profits, a high accrual ratio is arguably a bad thing, because it indicates paper profits are not matched by cash flow. Notably, there is some academic evidence that suggests that a high accrual ratio is a bad sign for near-term profits, generally speaking.

Kaynes Technology India has an accrual ratio of 0.53 for the year to March 2024. As a general rule, that bodes poorly for future profitability. To wit, the company did not generate one whit of free cashflow in that time. Over the last year it actually had negative free cash flow of ₹3.1b, in contrast to the aforementioned profit of ₹1.83b. Coming off the back of negative free cash flow last year, we imagine some shareholders might wonder if its cash burn of ₹3.1b, this year, indicates high risk. Unfortunately for shareholders, the company has also been issuing new shares, diluting their share of future earnings.

That might leave you wondering what analysts are forecasting in terms of future profitability. Luckily, you can click here to see an interactive graph depicting future profitability, based on their estimates.

To understand the value of a company's earnings growth, it is imperative to consider any dilution of shareholders' interests. Kaynes Technology India expanded the number of shares on issue by 9.9% over the last year. That means its earnings are split among a greater number of shares. To talk about net income, without noticing earnings per share, is to be distracted by the big numbers while ignoring the smaller numbers that talk to per share value. Check out Kaynes Technology India's historical EPS growth by clicking on this link.

A Look At The Impact Of Kaynes Technology India's Dilution On Its Earnings Per Share (EPS)

Kaynes Technology India has improved its profit over the last three years, with an annualized gain of 1,783% in that time. In comparison, earnings per share only gained 1,197% over the same period. And at a glance the 93% gain in profit over the last year impresses. On the other hand, earnings per share are only up 54% in that time. Therefore, the dilution is having a noteworthy influence on shareholder returns.

In the long term, earnings per share growth should beget share price growth. So it will certainly be a positive for shareholders if Kaynes Technology India can grow EPS persistently. But on the other hand, we'd be far less excited to learn profit (but not EPS) was improving. For that reason, you could say that EPS is more important that net income in the long run, assuming the goal is to assess whether a company's share price might grow.

Our Take On Kaynes Technology India's Profit Performance

As it turns out, Kaynes Technology India couldn't match its profit with cashflow and its dilution means that earnings per share growth is lagging net income growth. Considering all this we'd argue Kaynes Technology India's profits probably give an overly generous impression of its sustainable level of profitability. With this in mind, we wouldn't consider investing in a stock unless we had a thorough understanding of the risks. Case in point: We've spotted 3 warning signs for Kaynes Technology India you should be mindful of and 1 of these is concerning.

In this article we've looked at a number of factors that can impair the utility of profit numbers, and we've come away cautious. But there is always more to discover if you are capable of focussing your mind on minutiae. Some people consider a high return on equity to be a good sign of a quality business. While it might take a little research on your behalf, you may find this free collection of companies boasting high return on equity, or this list of stocks with significant insider holdings to be useful.

Valuation is complex, but we're here to simplify it.

Discover if Kaynes Technology India might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:KAYNES

Kaynes Technology India

Operates as an end-to-end and IoT solutions-enabled integrated electronics manufacturer in India and internationally.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives