Over the last 7 days, the Indian market has remained flat, but it has risen 44% in the past 12 months with earnings forecast to grow by 17% annually. In this dynamic environment, identifying high growth tech stocks that align with these robust market conditions can be crucial for investors looking to capitalize on potential opportunities.

Top 10 High Growth Tech Companies In India

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Tips Industries | 24.69% | 24.16% | ★★★★★★ |

| Newgen Software Technologies | 21.83% | 22.72% | ★★★★★★ |

| Sonata Software | 13.15% | 30.01% | ★★★★★☆ |

| Happiest Minds Technologies | 21.99% | 21.80% | ★★★★★★ |

| C. E. Info Systems | 29.94% | 26.97% | ★★★★★★ |

| Netweb Technologies India | 33.65% | 35.61% | ★★★★★★ |

| Syrma SGS Technology | 21.85% | 31.90% | ★★★★★☆ |

| Sterlite Technologies | 21.41% | 101.08% | ★★★★★☆ |

| Tejas Networks | 23.05% | 63.54% | ★★★★★☆ |

| INOX Leisure | 17.73% | 66.63% | ★★★★★☆ |

We'll examine a selection from our screener results.

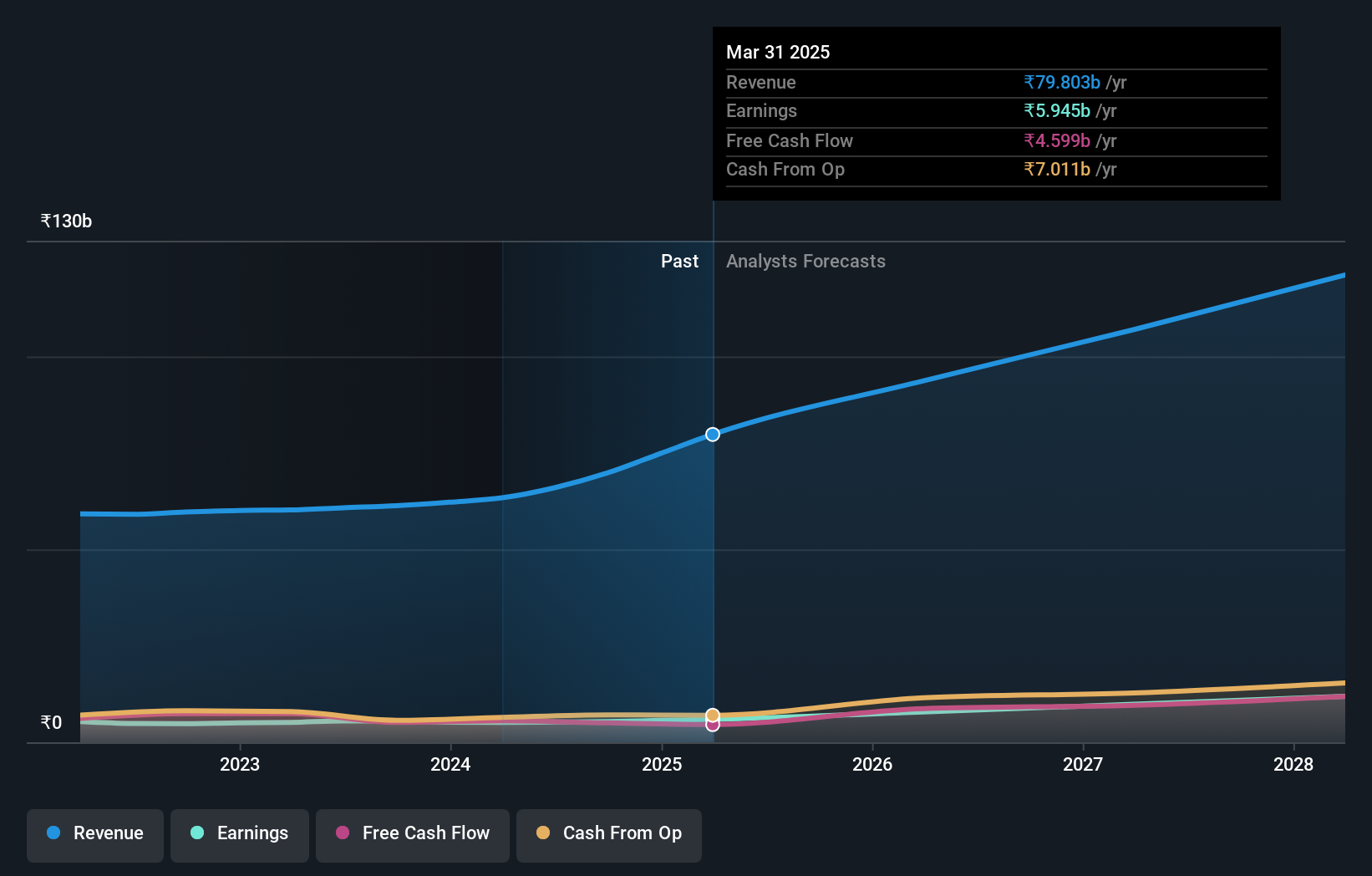

Firstsource Solutions (NSEI:FSL)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Firstsource Solutions Limited provides tech-enabled business processes in the United Kingdom, the United States, Asia, and internationally with a market cap of ₹232.74 billion.

Operations: With a market cap of ₹232.74 billion, Firstsource Solutions Limited generates revenue primarily from Banking and Financial Services (₹25.11 billion), Healthcare (₹22.27 billion), Communication, Media and Technology (₹14.76 billion), and Diverse Industries (₹3.75 billion).

Firstsource Solutions has demonstrated robust growth with its recent launch of Firstsource relAI, a suite of AI-led platforms aimed at driving digital transformation across various industries. The company's earnings are forecast to grow at 19.9% annually, outpacing the Indian market's 16.9%. Revenue is expected to increase by 12.3% per year, supported by strong R&D investments that totaled ₹1.35 billion last year, enhancing their technological capabilities and service offerings significantly.

- Click here to discover the nuances of Firstsource Solutions with our detailed analytical health report.

Understand Firstsource Solutions' track record by examining our Past report.

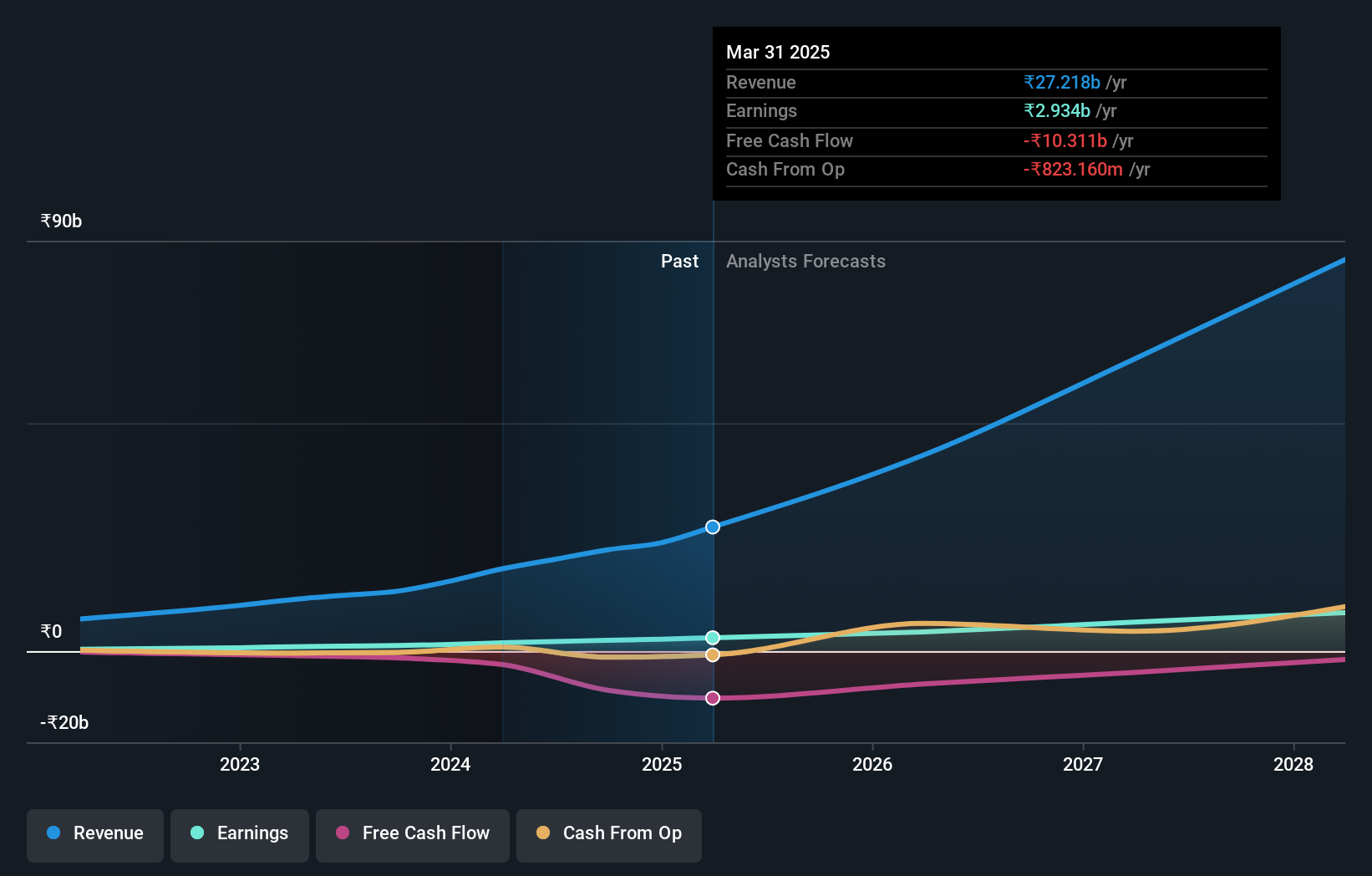

Kaynes Technology India (NSEI:KAYNES)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Kaynes Technology India Limited operates as an end-to-end and IoT solutions-enabled integrated electronics manufacturer in India and internationally, with a market cap of ₹334.68 billion.

Operations: Kaynes Technology India Limited generates revenue primarily from its Electronics System Design and Manufacturing (ESDM) segment, amounting to ₹20.11 billion. The company focuses on providing integrated electronics manufacturing solutions both domestically and internationally.

Kaynes Technology India has demonstrated impressive growth, with revenue increasing by 26.8% annually, outpacing the Indian market's 10%. The company's earnings are forecasted to grow at a robust 29.9% per year, significantly higher than the market's 16.9%. In Q1 2024, Kaynes reported sales of ₹5.04 billion and net income of ₹507.77 million compared to ₹2.97 billion and ₹246.49 million respectively from the previous year, showcasing strong performance in its electronics system design and manufacturing segment. Investing heavily in R&D with expenses contributing significantly to their technological advancements, Kaynes is well-positioned for future growth within India's tech sector. The recent establishment of a wholly-owned subsidiary in Singapore aims to expand their business presence further into electronics system design and strategic investments/acquisitions globally; this move could bolster revenue streams and enhance competitive positioning in international markets.

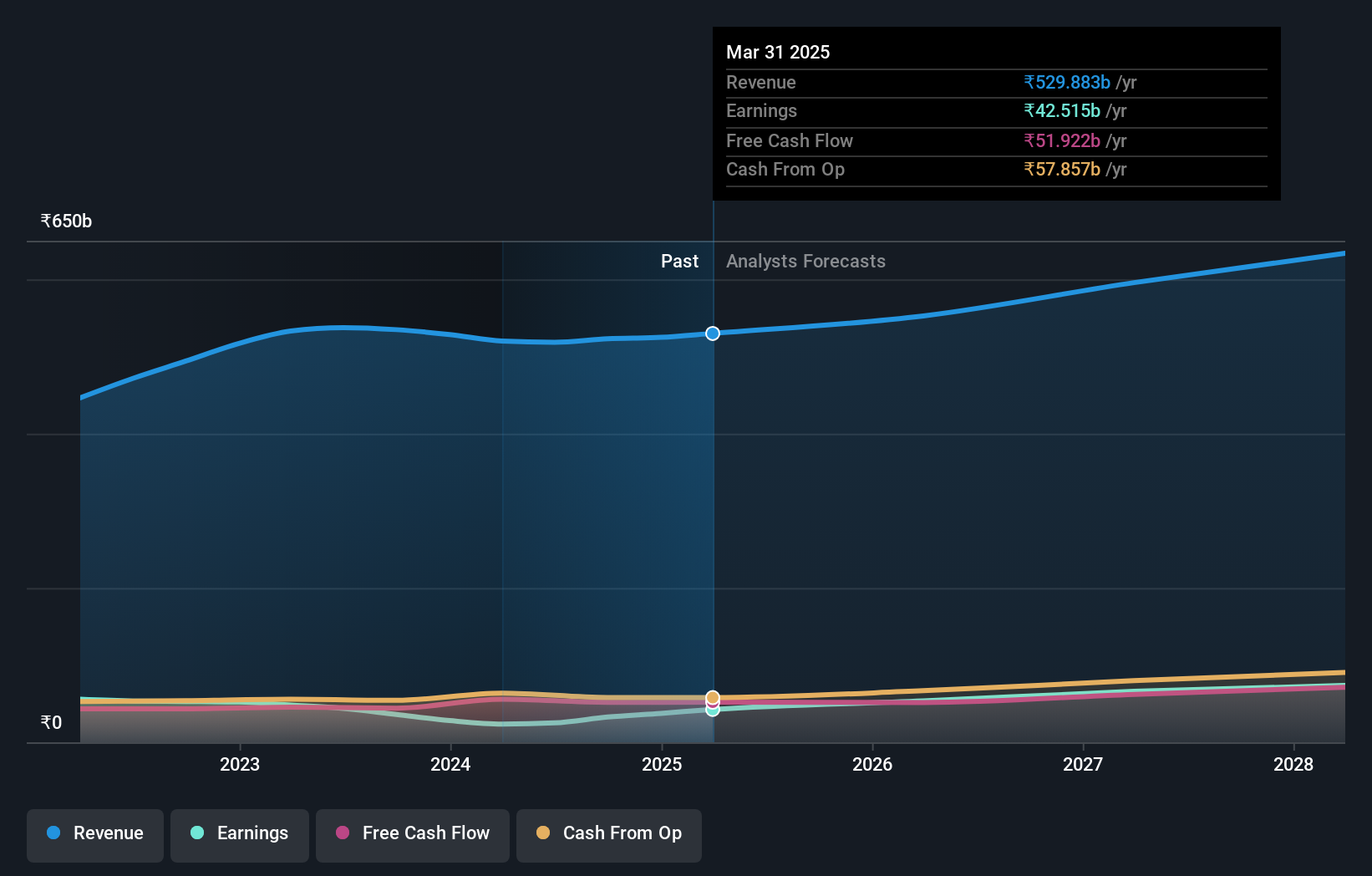

Tech Mahindra (NSEI:TECHM)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Tech Mahindra Limited provides information technology services and solutions in the Americas, Europe, India, and internationally with a market cap of ₹1.41 trillion.

Operations: The company generates revenue primarily from IT Services (₹439.48 billion) and Business Process Outsourcing (BPO) services (₹78.94 billion). Its business operations span across various international markets, including the Americas, Europe, and India.

Tech Mahindra's recent partnership with Northeastern University to innovate in ORAN and 6G connectivity underscores its commitment to cutting-edge technology. Despite a slight revenue dip to ₹130.06 billion from ₹131.59 billion, net income rose to ₹8.52 billion from ₹6.93 billion, reflecting strong operational efficiency. R&D expenses play a crucial role; the company's forecasted earnings growth of 29.3% annually highlights significant potential, especially as it leverages AI and telecom expertise for future advancements.

- Navigate through the intricacies of Tech Mahindra with our comprehensive health report here.

Assess Tech Mahindra's past performance with our detailed historical performance reports.

Taking Advantage

- Unlock our comprehensive list of 38 Indian High Growth Tech and AI Stocks by clicking here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tech Mahindra might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:TECHM

Tech Mahindra

Provides information technology services and solutions in the Americas, Europe, India, and internationally.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives