- India

- /

- Electronic Equipment and Components

- /

- NSEI:HONAUT

What Does Honeywell Automation India's (NSE:HONAUT) CEO Pay Reveal?

Ashish Gaikwad has been the CEO of Honeywell Automation India Limited (NSE:HONAUT) since 2016, and this article will examine the executive's compensation with respect to the overall performance of the company. This analysis will also assess whether Honeywell Automation India pays its CEO appropriately, considering recent earnings growth and total shareholder returns.

See our latest analysis for Honeywell Automation India

Comparing Honeywell Automation India Limited's CEO Compensation With the industry

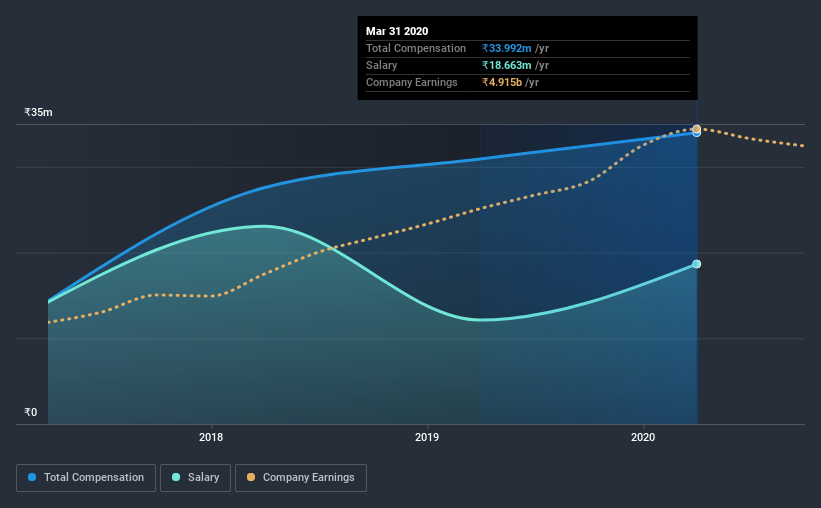

Our data indicates that Honeywell Automation India Limited has a market capitalization of ₹359b, and total annual CEO compensation was reported as ₹34m for the year to March 2020. That's a notable increase of 9.9% on last year. We note that the salary portion, which stands at ₹18.7m constitutes the majority of total compensation received by the CEO.

On examining similar-sized companies in the industry with market capitalizations between ₹292b and ₹877b, we discovered that the median CEO total compensation of that group was ₹38m. From this we gather that Ashish Gaikwad is paid around the median for CEOs in the industry. What's more, Ashish Gaikwad holds ₹8.1m worth of shares in the company in their own name, indicating that they have a lot of skin in the game.

| Component | 2020 | 2019 | Proportion (2020) |

| Salary | ₹19m | ₹12m | 55% |

| Other | ₹15m | ₹19m | 45% |

| Total Compensation | ₹34m | ₹31m | 100% |

Talking in terms of the industry, salary represents all of total compensation among the companies we analyzed, while other remuneration is, interestingly, completely ignored. It's interesting to note that Honeywell Automation India allocates a smaller portion of compensation to salary in comparison to the broader industry. If total compensation veers towards salary, it suggests that the variable portion - which is generally tied to performance, is lower.

Honeywell Automation India Limited's Growth

Honeywell Automation India Limited's earnings per share (EPS) grew 29% per year over the last three years. In the last year, its revenue is down 6.2%.

This demonstrates that the company has been improving recently and is good news for the shareholders. While it would be good to see revenue growth, profits matter more in the end. We don't have analyst forecasts, but you could get a better understanding of its growth by checking out this more detailed historical graph of earnings, revenue and cash flow.

Has Honeywell Automation India Limited Been A Good Investment?

We think that the total shareholder return of 130%, over three years, would leave most Honeywell Automation India Limited shareholders smiling. So they may not be at all concerned if the CEO were to be paid more than is normal for companies around the same size.

To Conclude...

As previously discussed, Ashish is compensated close to the median for companies of its size, and which belong to the same industry. Investors would surely be happy to see that returns have been great, and that EPS is up. Although the pay is close to the industry median, overall performance is excellent, so we don't think the CEO is paid too generously. In fact, shareholders might even think the CEO deserves a raise as a reward due to the fantastic returns generated.

While CEO pay is an important factor to be aware of, there are other areas that investors should be mindful of as well. We did our research and spotted 1 warning sign for Honeywell Automation India that investors should look into moving forward.

Arguably, business quality is much more important than CEO compensation levels. So check out this free list of interesting companies that have HIGH return on equity and low debt.

When trading Honeywell Automation India or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Honeywell Automation India might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NSEI:HONAUT

Honeywell Automation India

Manufactures and sells industrial process control and automation systems in India and internationally.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion