- India

- /

- Electronic Equipment and Components

- /

- NSEI:ELIN

Market Participants Recognise Elin Electronics Limited's (NSE:ELIN) Earnings Pushing Shares 25% Higher

Elin Electronics Limited (NSE:ELIN) shareholders would be excited to see that the share price has had a great month, posting a 25% gain and recovering from prior weakness. Taking a wider view, although not as strong as the last month, the full year gain of 25% is also fairly reasonable.

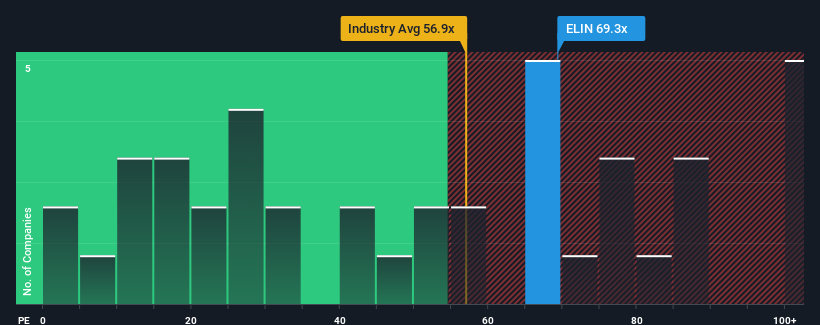

Following the firm bounce in price, given close to half the companies in India have price-to-earnings ratios (or "P/E's") below 31x, you may consider Elin Electronics as a stock to avoid entirely with its 69.3x P/E ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/E.

While the market has experienced earnings growth lately, Elin Electronics' earnings have gone into reverse gear, which is not great. It might be that many expect the dour earnings performance to recover substantially, which has kept the P/E from collapsing. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

See our latest analysis for Elin Electronics

How Is Elin Electronics' Growth Trending?

In order to justify its P/E ratio, Elin Electronics would need to produce outstanding growth well in excess of the market.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 72%. The last three years don't look nice either as the company has shrunk EPS by 72% in aggregate. So unfortunately, we have to acknowledge that the company has not done a great job of growing earnings over that time.

Shifting to the future, estimates from the only analyst covering the company suggest earnings should grow by 164% over the next year. With the market only predicted to deliver 24%, the company is positioned for a stronger earnings result.

With this information, we can see why Elin Electronics is trading at such a high P/E compared to the market. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Key Takeaway

Elin Electronics' P/E is flying high just like its stock has during the last month. While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

As we suspected, our examination of Elin Electronics' analyst forecasts revealed that its superior earnings outlook is contributing to its high P/E. At this stage investors feel the potential for a deterioration in earnings isn't great enough to justify a lower P/E ratio. Unless these conditions change, they will continue to provide strong support to the share price.

Having said that, be aware Elin Electronics is showing 3 warning signs in our investment analysis, you should know about.

You might be able to find a better investment than Elin Electronics. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Valuation is complex, but we're here to simplify it.

Discover if Elin Electronics might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:ELIN

Elin Electronics

Designs, manufactures, and sells electronics motors, tools, moulds, dies, kitchen appliances, personal care and lighting products, and automotive components in India and internationally.

Flawless balance sheet with acceptable track record.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success