Amidst the ebbs and flows of political currents, India's stock market has demonstrated resilience, buoyed by optimistic electoral forecasts and robust economic fundamentals. As investors navigate this landscape, dividend stocks like D-Link India emerge as focal points due to their potential for steady returns in a dynamic market environment.

Top 10 Dividend Stocks In India

| Name | Dividend Yield | Dividend Rating |

| Balmer Lawrie Investments (BSE:532485) | 3.93% | ★★★★★★ |

| Bhansali Engineering Polymers (BSE:500052) | 4.26% | ★★★★★★ |

| Castrol India (BSE:500870) | 3.85% | ★★★★★☆ |

| HCL Technologies (NSEI:HCLTECH) | 3.92% | ★★★★★☆ |

| ITC (NSEI:ITC) | 3.22% | ★★★★★☆ |

| D-Link (India) (NSEI:DLINKINDIA) | 3.11% | ★★★★★☆ |

| Indian Oil (NSEI:IOC) | 8.62% | ★★★★★☆ |

| VST Industries (BSE:509966) | 3.72% | ★★★★★☆ |

| Redington (NSEI:REDINGTON) | 3.63% | ★★★★★☆ |

| PTC India (NSEI:PTC) | 3.72% | ★★★★★☆ |

Click here to see the full list of 23 stocks from our Top Dividend Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

D-Link (India) (NSEI:DLINKINDIA)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: D-Link (India) Limited specializes in marketing and distributing D-Link branded networking products across various sectors including consumers, small businesses, and enterprises in India, with a market capitalization of ₹14.85 billion.

Operations: D-Link (India) Limited generates its revenue primarily from networking products, which amounted to ₹12.36 billion.

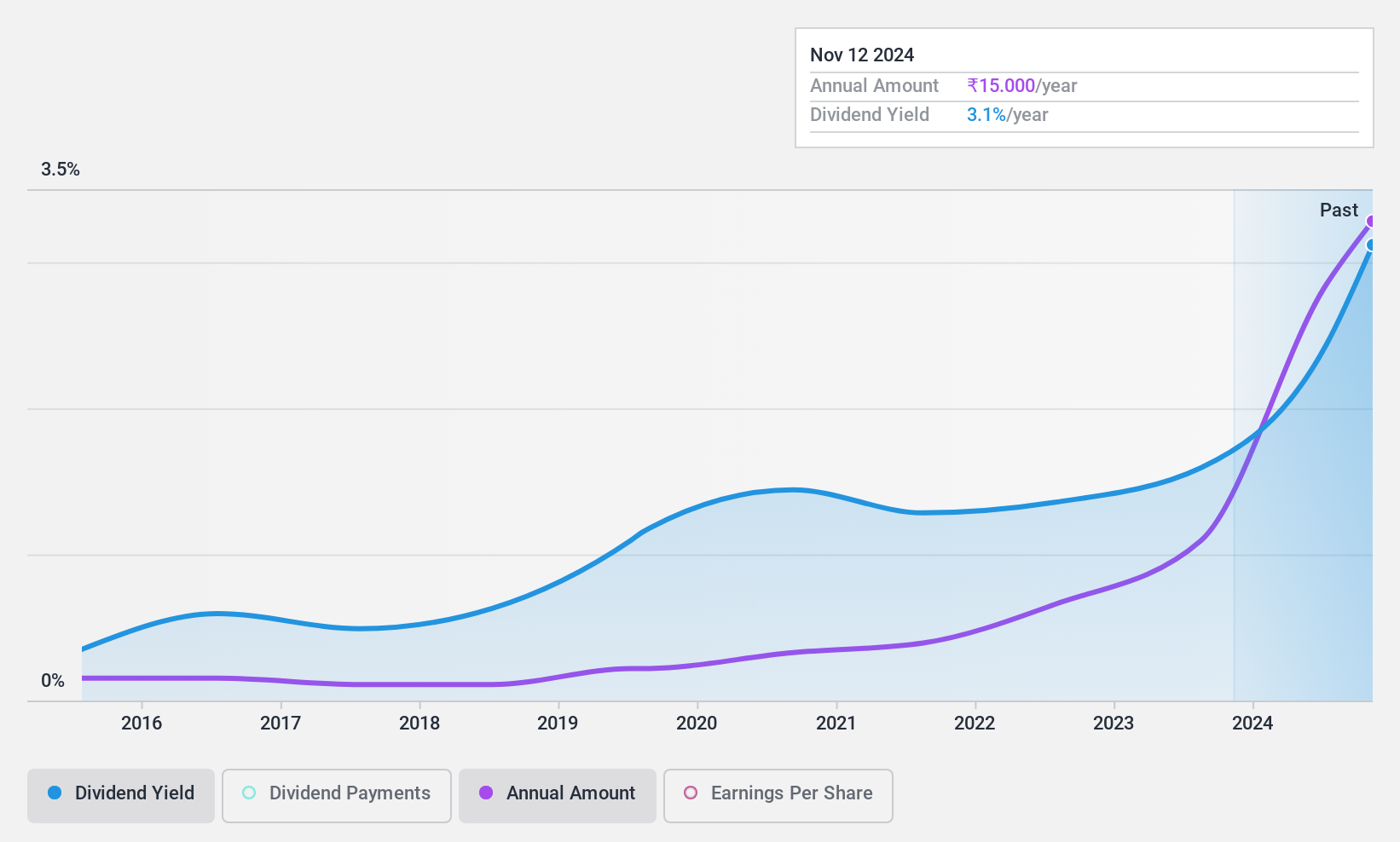

Dividend Yield: 3.1%

D-Link (India) has recently announced a dividend of INR 8 per share and a special dividend of INR 5 per share for FY2024, pending shareholder approval. This reflects an increase in dividends alongside a positive earnings trajectory, with net income rising to INN 926.3 million from INR 863.61 million the previous year. However, despite these positives, the company's dividend history has been marked by volatility over the past decade, raising questions about the sustainability and reliability of its payouts.

- Click here and access our complete dividend analysis report to understand the dynamics of D-Link (India).

- The valuation report we've compiled suggests that D-Link (India)'s current price could be quite moderate.

MPS (NSEI:MPSLTD)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: MPS Limited operates in content creation, production, and distribution services across India, Europe, the U.S., and globally with a market capitalization of ₹29.57 billion.

Operations: MPS Limited generates its revenue by offering content creation, production, and distribution services to a diverse clientele including publishers, learning companies, corporate institutions, libraries, and content aggregators across multiple regions.

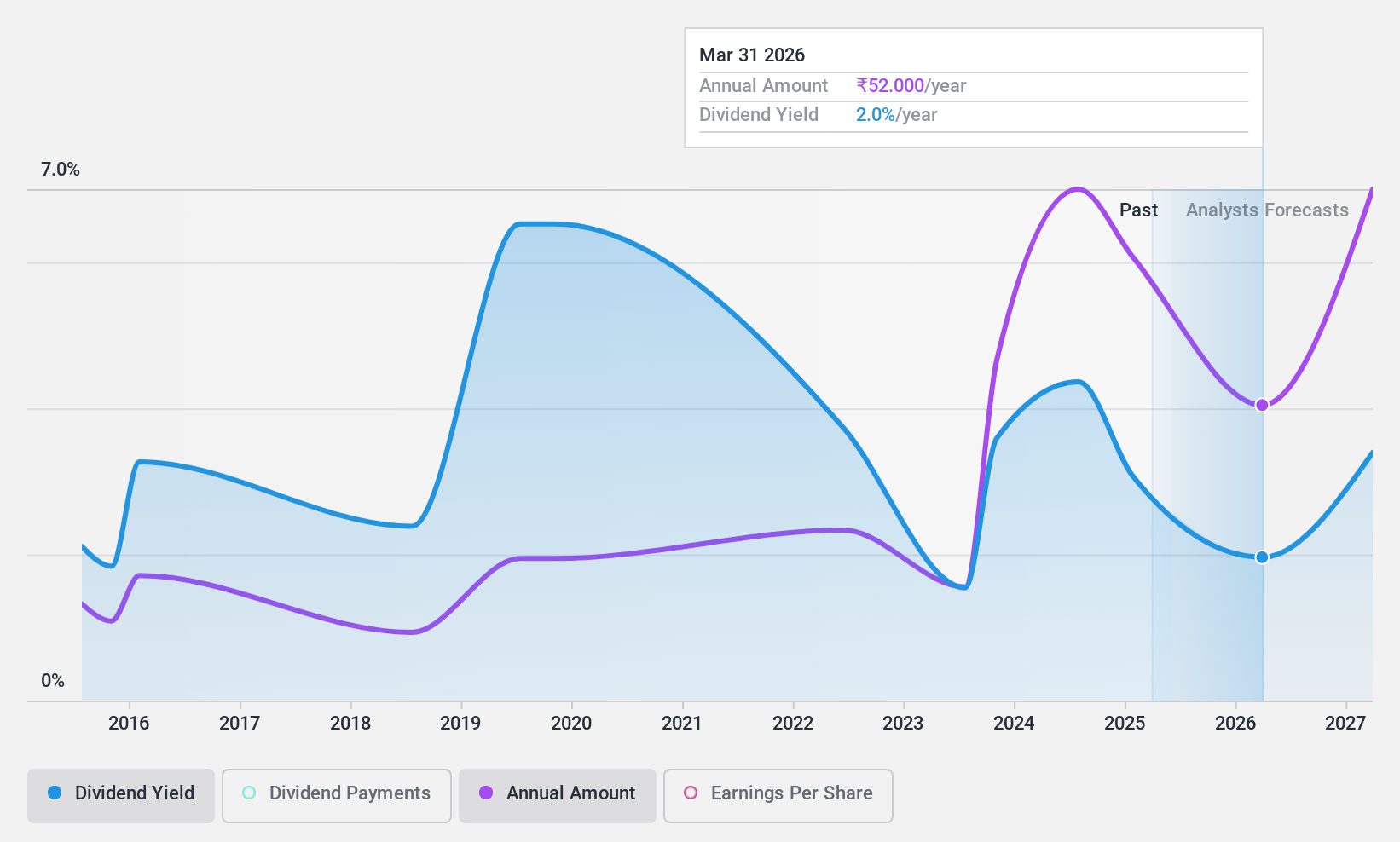

Dividend Yield: 3.4%

MPS Limited has recommended a final dividend of INR 45 for FY2023-24, subject to shareholder approval at the upcoming AGM. Despite this increase, MPS's dividends face sustainability issues with a high cash payout ratio of 91.7% and earnings coverage concerns. However, the company’s earnings have shown consistent growth, increasing by 14.4% annually over the past five years and are expected to grow by 20.32% yearly going forward. This growth could support future dividends if maintained.

- Get an in-depth perspective on MPS' performance by reading our dividend report here.

- The valuation report we've compiled suggests that MPS' current price could be inflated.

Swaraj Engines (NSEI:SWARAJENG)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Swaraj Engines Limited, based in India, specializes in manufacturing and selling diesel engines, diesel engine components, and spare parts for tractors, boasting a market capitalization of approximately ₹29.97 billion.

Operations: Swaraj Engines Limited generates revenue primarily through the sale of diesel engines, engine components, and tractor spare parts, totaling ₹14.19 billion.

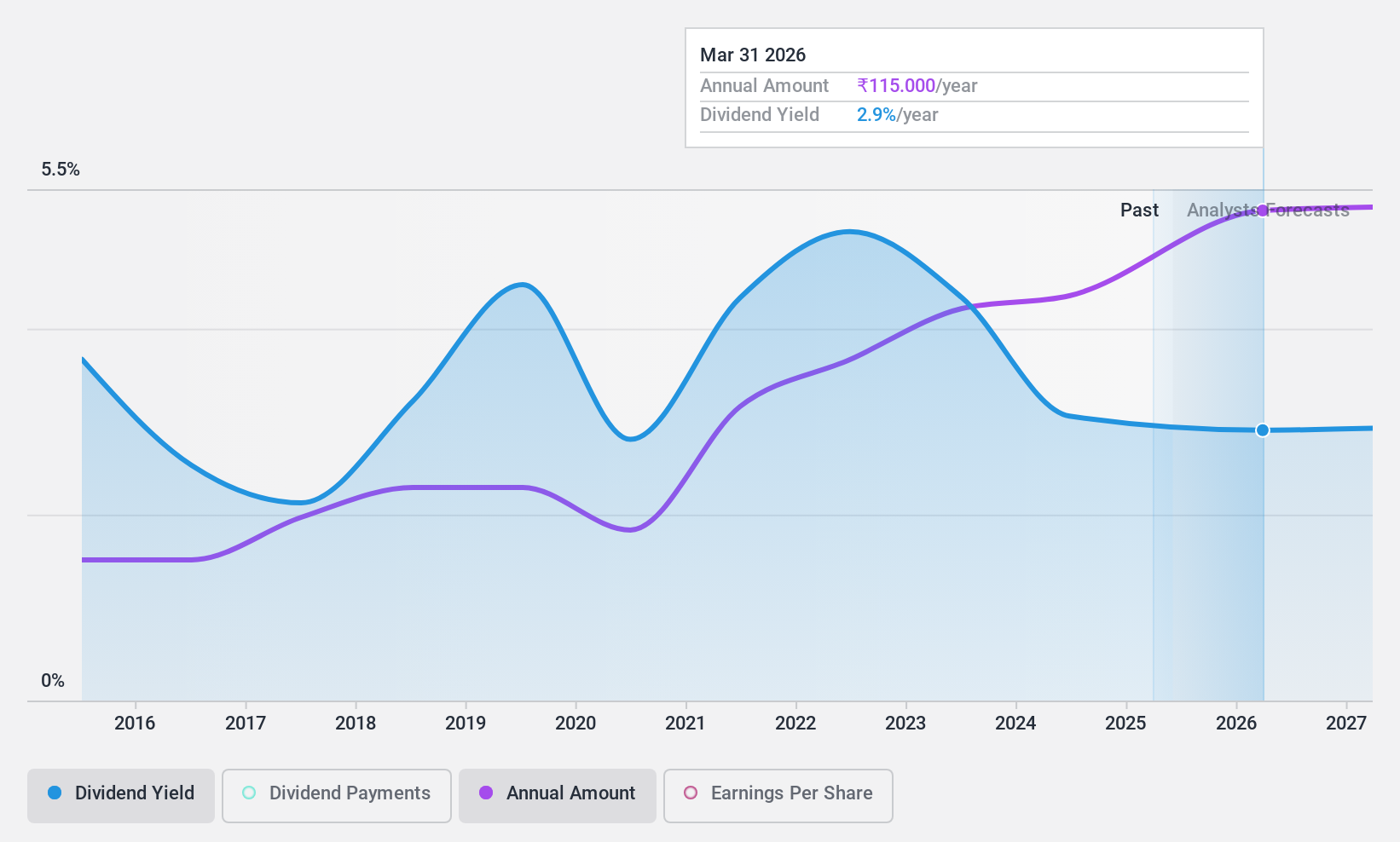

Dividend Yield: 3.9%

Swaraj Engines has a dividend yield of 3.85%, ranking in the top 25% in the Indian market. Despite this, its dividends have shown volatility over the past decade and are currently under pressure with a cash payout ratio of 122%. Earnings have grown by 15.4% annually over the last five years, and future growth is projected at 9.13% per year. Additionally, Swaraj Engines announced a substantial dividend of INR 95 per share for FY2023-24, although this level of payout may not be sustainable given current earnings and cash flow coverage issues.

- Take a closer look at Swaraj Engines' potential here in our dividend report.

- Upon reviewing our latest valuation report, Swaraj Engines' share price might be too pessimistic.

Key Takeaways

- Unlock more gems! Our Top Dividend Stocks screener has unearthed 20 more companies for you to explore.Click here to unveil our expertly curated list of 23 Top Dividend Stocks.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:MPSLTD

MPS

Provides platforms and services for content creation, full-service production, and distribution to the publishers, learning companies, corporate institutions, libraries, and content aggregators in India, Europe, the United States, and internationally.

Outstanding track record with flawless balance sheet and pays a dividend.

Market Insights

Community Narratives