- India

- /

- Electronic Equipment and Components

- /

- NSEI:CEREBRAINT

Here's Why Cerebra Integrated Technologies (NSE:CEREBRAINT) Can Manage Its Debt Responsibly

David Iben put it well when he said, 'Volatility is not a risk we care about. What we care about is avoiding the permanent loss of capital.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. As with many other companies Cerebra Integrated Technologies Limited (NSE:CEREBRAINT) makes use of debt. But the real question is whether this debt is making the company risky.

Why Does Debt Bring Risk?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Having said that, the most common situation is where a company manages its debt reasonably well - and to its own advantage. When we examine debt levels, we first consider both cash and debt levels, together.

Check out our latest analysis for Cerebra Integrated Technologies

What Is Cerebra Integrated Technologies's Debt?

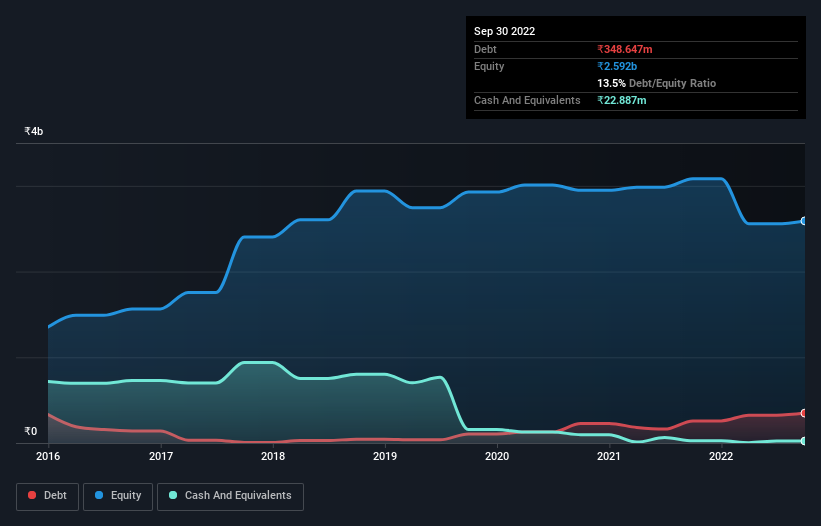

The image below, which you can click on for greater detail, shows that at September 2022 Cerebra Integrated Technologies had debt of ₹348.6m, up from ₹257.9m in one year. However, it does have ₹22.9m in cash offsetting this, leading to net debt of about ₹325.8m.

How Strong Is Cerebra Integrated Technologies' Balance Sheet?

The latest balance sheet data shows that Cerebra Integrated Technologies had liabilities of ₹1.78b due within a year, and liabilities of ₹8.99m falling due after that. Offsetting this, it had ₹22.9m in cash and ₹1.77b in receivables that were due within 12 months. So its total liabilities are just about perfectly matched by its shorter-term, liquid assets.

Having regard to Cerebra Integrated Technologies' size, it seems that its liquid assets are well balanced with its total liabilities. So it's very unlikely that the ₹3.19b company is short on cash, but still worth keeping an eye on the balance sheet.

In order to size up a company's debt relative to its earnings, we calculate its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and its earnings before interest and tax (EBIT) divided by its interest expense (its interest cover). Thus we consider debt relative to earnings both with and without depreciation and amortization expenses.

While Cerebra Integrated Technologies's low debt to EBITDA ratio of 0.97 suggests only modest use of debt, the fact that EBIT only covered the interest expense by 4.3 times last year does give us pause. So we'd recommend keeping a close eye on the impact financing costs are having on the business. Also relevant is that Cerebra Integrated Technologies has grown its EBIT by a very respectable 21% in the last year, thus enhancing its ability to pay down debt. The balance sheet is clearly the area to focus on when you are analysing debt. But you can't view debt in total isolation; since Cerebra Integrated Technologies will need earnings to service that debt. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

Finally, a business needs free cash flow to pay off debt; accounting profits just don't cut it. So it's worth checking how much of that EBIT is backed by free cash flow. During the last three years, Cerebra Integrated Technologies burned a lot of cash. While that may be a result of expenditure for growth, it does make the debt far more risky.

Our View

Cerebra Integrated Technologies's conversion of EBIT to free cash flow was a real negative on this analysis, although the other factors we considered were considerably better. There's no doubt that its ability to to grow its EBIT is pretty flash. When we consider all the elements mentioned above, it seems to us that Cerebra Integrated Technologies is managing its debt quite well. But a word of caution: we think debt levels are high enough to justify ongoing monitoring. The balance sheet is clearly the area to focus on when you are analysing debt. However, not all investment risk resides within the balance sheet - far from it. We've identified 3 warning signs with Cerebra Integrated Technologies (at least 2 which shouldn't be ignored) , and understanding them should be part of your investment process.

At the end of the day, it's often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:CEREBRAINT

Cerebra Integrated Technologies

Together with its subsidiary, trades in computer systems and peripherals in India.

Excellent balance sheet with slight risk.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success