- India

- /

- Electronic Equipment and Components

- /

- NSEI:AVALON

Results: Avalon Technologies Limited Exceeded Expectations And The Consensus Has Updated Its Estimates

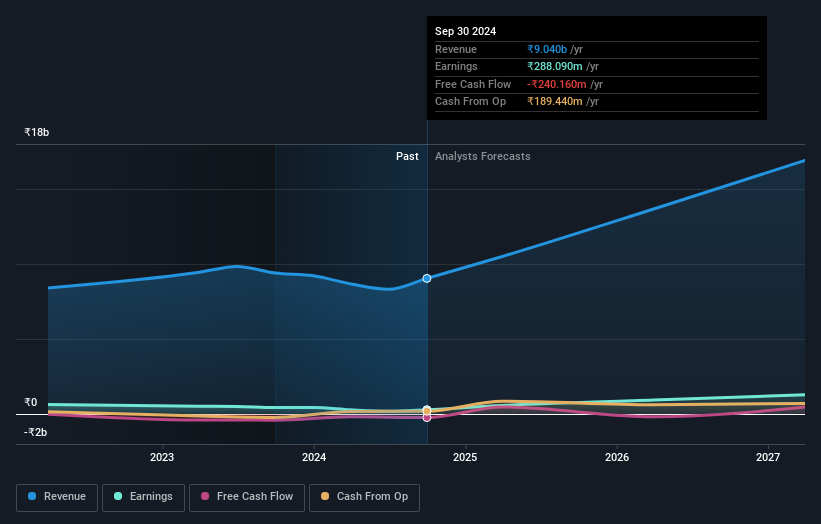

A week ago, Avalon Technologies Limited (NSE:AVALON) came out with a strong set of second-quarter numbers that could potentially lead to a re-rate of the stock. It was a solid earnings report, with revenues and statutory earnings per share (EPS) both coming in strong. Revenues were 16% higher than the analysts had forecast, at ₹2.8b, while EPS were ₹2.61 beating analyst models by 93%. This is an important time for investors, as they can track a company's performance in its report, look at what experts are forecasting for next year, and see if there has been any change to expectations for the business. We've gathered the most recent statutory forecasts to see whether the analysts have changed their earnings models, following these results.

Check out our latest analysis for Avalon Technologies

After the latest results, the ten analysts covering Avalon Technologies are now predicting revenues of ₹10.5b in 2025. If met, this would reflect a meaningful 16% improvement in revenue compared to the last 12 months. Per-share earnings are expected to surge 89% to ₹8.24. Yet prior to the latest earnings, the analysts had been anticipated revenues of ₹10.2b and earnings per share (EPS) of ₹6.63 in 2025. So it seems there's been a definite increase in optimism about Avalon Technologies' future following the latest results, with a great increase in the earnings per share forecasts in particular.

With these upgrades, we're not surprised to see that the analysts have lifted their price target 8.6% to ₹548per share. There's another way to think about price targets though, and that's to look at the range of price targets put forward by analysts, because a wide range of estimates could suggest a diverse view on possible outcomes for the business. Currently, the most bullish analyst values Avalon Technologies at ₹825 per share, while the most bearish prices it at ₹410. This is a fairly broad spread of estimates, suggesting that analysts are forecasting a wide range of possible outcomes for the business.

Taking a look at the bigger picture now, one of the ways we can understand these forecasts is to see how they compare to both past performance and industry growth estimates. For example, we noticed that Avalon Technologies' rate of growth is expected to accelerate meaningfully, with revenues forecast to exhibit 35% growth to the end of 2025 on an annualised basis. That is well above its historical decline of 3.8% a year over the past year. By contrast, our data suggests that other companies (with analyst coverage) in the industry are forecast to see their revenue grow 25% per year. So it looks like Avalon Technologies is expected to grow faster than its competitors, at least for a while.

The Bottom Line

The biggest takeaway for us is the consensus earnings per share upgrade, which suggests a clear improvement in sentiment around Avalon Technologies' earnings potential next year. Happily, they also upgraded their revenue estimates, and are forecasting them to grow faster than the wider industry. There was also a nice increase in the price target, with the analysts clearly feeling that the intrinsic value of the business is improving.

With that said, the long-term trajectory of the company's earnings is a lot more important than next year. At Simply Wall St, we have a full range of analyst estimates for Avalon Technologies going out to 2027, and you can see them free on our platform here..

It is also worth noting that we have found 2 warning signs for Avalon Technologies (1 shouldn't be ignored!) that you need to take into consideration.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:AVALON

Avalon Technologies

Provides integrated electronic manufacturing services in India, the United States, and internationally.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Automotive Electronics Manufacturer Consistent and Stable

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion