High Growth Tech Stocks in India to Watch This September 2024

Reviewed by Simply Wall St

The Indian market has shown remarkable resilience, with the Utilities sector gaining 3.5% while the overall market remained flat over the last week and a significant 44% increase over the past year. With earnings forecasted to grow by 17% annually, identifying high-growth tech stocks that can capitalize on this momentum is crucial for investors looking to maximize their returns in September 2024.

Top 10 High Growth Tech Companies In India

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Tips Music | 24.69% | 24.16% | ★★★★★★ |

| Newgen Software Technologies | 21.66% | 22.51% | ★★★★★★ |

| Sonata Software | 13.29% | 29.79% | ★★★★★☆ |

| Happiest Minds Technologies | 22.15% | 22.22% | ★★★★★★ |

| Netweb Technologies India | 33.65% | 35.61% | ★★★★★★ |

| C. E. Info Systems | 29.94% | 26.97% | ★★★★★★ |

| GFL | 44.50% | 49.42% | ★★★★★☆ |

| Sterlite Technologies | 21.41% | 101.08% | ★★★★★☆ |

| Tejas Networks | 23.05% | 63.54% | ★★★★★☆ |

| INOX Leisure | 17.73% | 66.63% | ★★★★★☆ |

Underneath we present a selection of stocks filtered out by our screen.

Avalon Technologies (NSEI:AVALON)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Avalon Technologies Limited, along with its subsidiaries, offers integrated electronic manufacturing services across India, the United States, and internationally, with a market cap of ₹41.55 billion.

Operations: Avalon Technologies Limited, through its subsidiaries, generates revenue primarily from Electronics Manufacturing Services (EMS), which amounted to ₹8.32 billion. The company operates in India, the United States, and internationally.

Avalon Technologies, amidst a challenging fiscal quarter with a net loss of INR 23.07 million from a prior net income of INR 70.7 million, still projects robust future growth. The company's revenue growth is anticipated at 20.1% annually, outpacing the Indian market's average of 10.2%. Significantly, earnings are expected to surge by 42.5% per year, reflecting strong market confidence despite recent setbacks including the resignation of CFO RM Subramanian. This optimism is underpinned by Avalon's commitment to innovation and strategic market positioning in the high-growth tech sector in India.

- Get an in-depth perspective on Avalon Technologies' performance by reading our health report here.

Assess Avalon Technologies' past performance with our detailed historical performance reports.

Dish TV India (NSEI:DISHTV)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Dish TV India Limited offers direct to home (DTH) and teleport services in India, with a market cap of ₹24.99 billion.

Operations: Dish TV India Limited generates revenue primarily from its direct to home (DTH) and teleport services, amounting to ₹18.12 billion. The company operates within the Indian market, focusing on providing satellite television services directly to consumers' homes.

Dish TV India, amidst a backdrop of executive reshuffles, including the recent CFO transition, is navigating through challenging financial waters with a reported net loss of INR 15.6 million in Q1 2024 from a previous net income. Despite this setback, the company's revenue growth forecast at 10.8% per year hints at resilience and potential recovery. Notably, earnings are expected to soar by an impressive 109.5% annually over the next three years, signaling optimism for profitability and strategic realignment within India’s dynamic tech landscape.

- Take a closer look at Dish TV India's potential here in our health report.

Evaluate Dish TV India's historical performance by accessing our past performance report.

RateGain Travel Technologies (NSEI:RATEGAIN)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: RateGain Travel Technologies Limited, a Software as a Service (SaaS) company, provides solutions for hospitality and travel industries in India, North America, the Asia-Pacific, Europe, and internationally with a market cap of ₹86.68 billion.

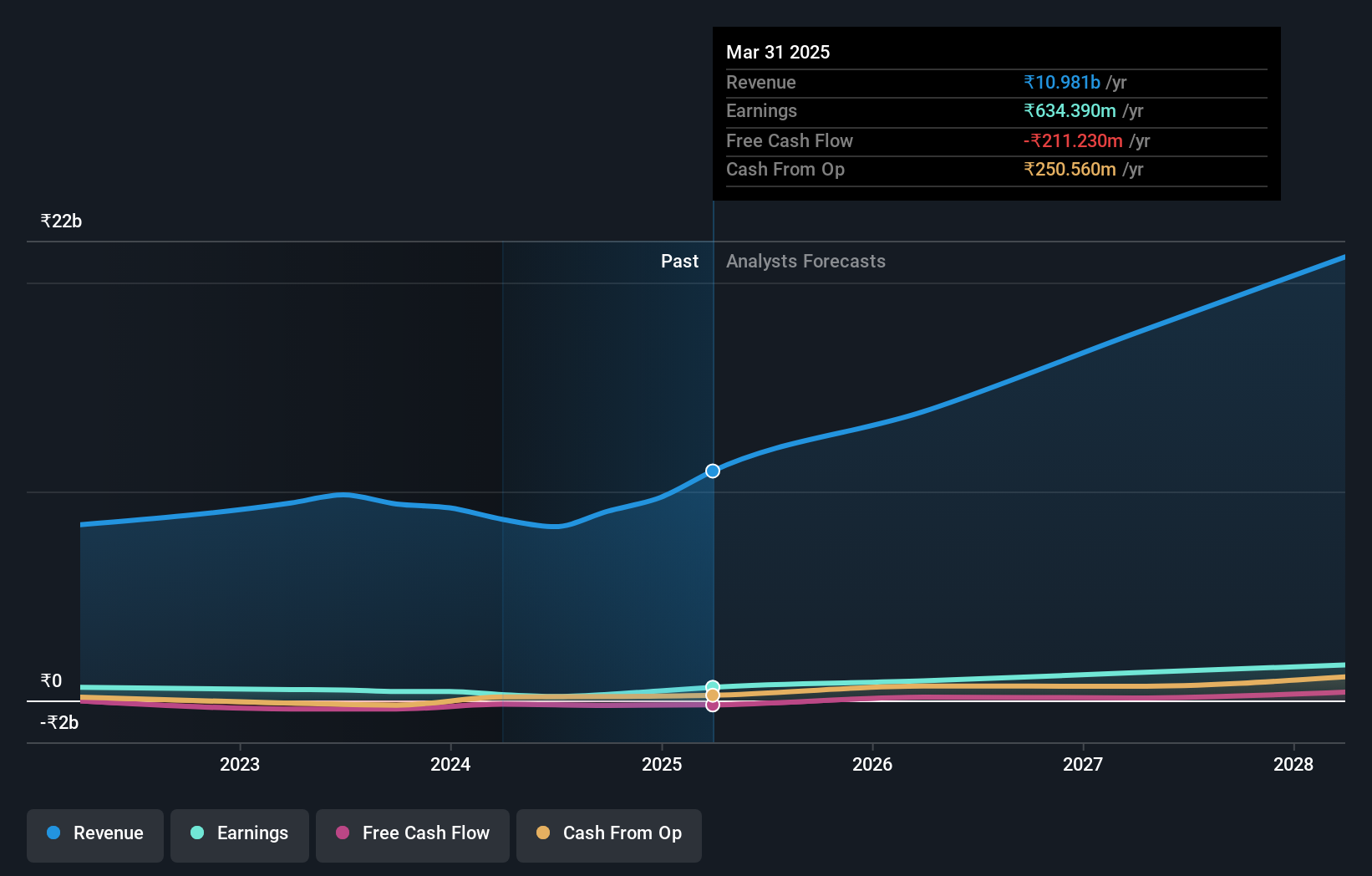

Operations: RateGain Travel Technologies generates revenue primarily from providing innovative SaaS solutions tailored to the hospitality and travel industry, amounting to ₹10.03 billion. The company operates across various regions including India, North America, the Asia-Pacific, and Europe.

RateGain Travel Technologies, amid India's burgeoning tech landscape, stands out with a robust 17% annual revenue growth and an even more impressive 24.5% expected earnings growth over the next three years. The company's strategic emphasis on R&D has led to a significant allocation of resources towards innovation, with recent figures showcasing an expenditure increase to enhance its competitive edge in software solutions for the travel industry. This focus is further exemplified by its recent partnership with Thai Airways through its AirGain platform, aimed at optimizing airline pricing strategies—a move that not only boosts RateGain’s market presence but also underscores its commitment to advancing technological applications in travel and tourism sectors.

Make It Happen

- Navigate through the entire inventory of 39 Indian High Growth Tech and AI Stocks here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:DISHTV

Dish TV India

Provides direct to home (DTH) television and teleport services in India.

Undervalued with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion