The Indian stock market has been navigating a complex landscape influenced by global economic shifts, including the potential impact of the 2024 US presidential election on trade policies, foreign direct investment, and currency strength. In this dynamic environment, high-growth tech stocks in India are particularly attractive to investors seeking opportunities that align with evolving market conditions and strategic international partnerships.

Top 10 High Growth Tech Companies In India

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Tips Music | 25.09% | 23.58% | ★★★★★★ |

| Newgen Software Technologies | 21.66% | 21.71% | ★★★★★★ |

| Coforge | 14.32% | 25.13% | ★★★★★☆ |

| Sonata Software | 13.45% | 29.64% | ★★★★★☆ |

| Firstsource Solutions | 12.35% | 20.03% | ★★★★★☆ |

| C. E. Info Systems | 29.31% | 26.39% | ★★★★★★ |

| Netweb Technologies India | 33.74% | 39.12% | ★★★★★★ |

| GFL | 44.50% | 49.42% | ★★★★★☆ |

| Sterlite Technologies | 21.41% | 101.08% | ★★★★★☆ |

| INOX Leisure | 17.73% | 66.63% | ★★★★★☆ |

Let's explore several standout options from the results in the screener.

Avalon Technologies (NSEI:AVALON)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Avalon Technologies Limited, along with its subsidiaries, offers integrated electronic manufacturing services across India, the United States, and internationally, with a market capitalization of ₹37.75 billion.

Operations: Avalon Technologies, with a market cap of ₹37.75 billion, generates revenue primarily from its Electronics Manufacturing Services (EMS) segment, amounting to ₹8.32 billion. The company operates extensively across India and the United States, providing a range of electronic manufacturing solutions internationally.

Avalon Technologies, amidst a challenging financial landscape with a net loss of INR 23.07 million this quarter compared to last year's net income of INR 70.7 million, still shows promising growth prospects. With revenue expected to surge by 20.4% annually, outpacing the Indian market's growth rate of 10%, and earnings projected to expand by an impressive 42.8% per year, Avalon is navigating through its current volatility towards potentially lucrative horizons. The recent executive shifts, including the appointment of Suresh Veerappan as CFO, signify strategic realignments aimed at bolstering governance and financial strategies critical for sustaining long-term growth in India's tech sector.

Dish TV India (NSEI:DISHTV)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Dish TV India Limited operates as a provider of direct to home (DTH) and teleport services in India, with a market capitalization of ₹23.51 billion.

Operations: The company generates revenue primarily from its direct to home (DTH) and teleport services, amounting to ₹18.12 billion.

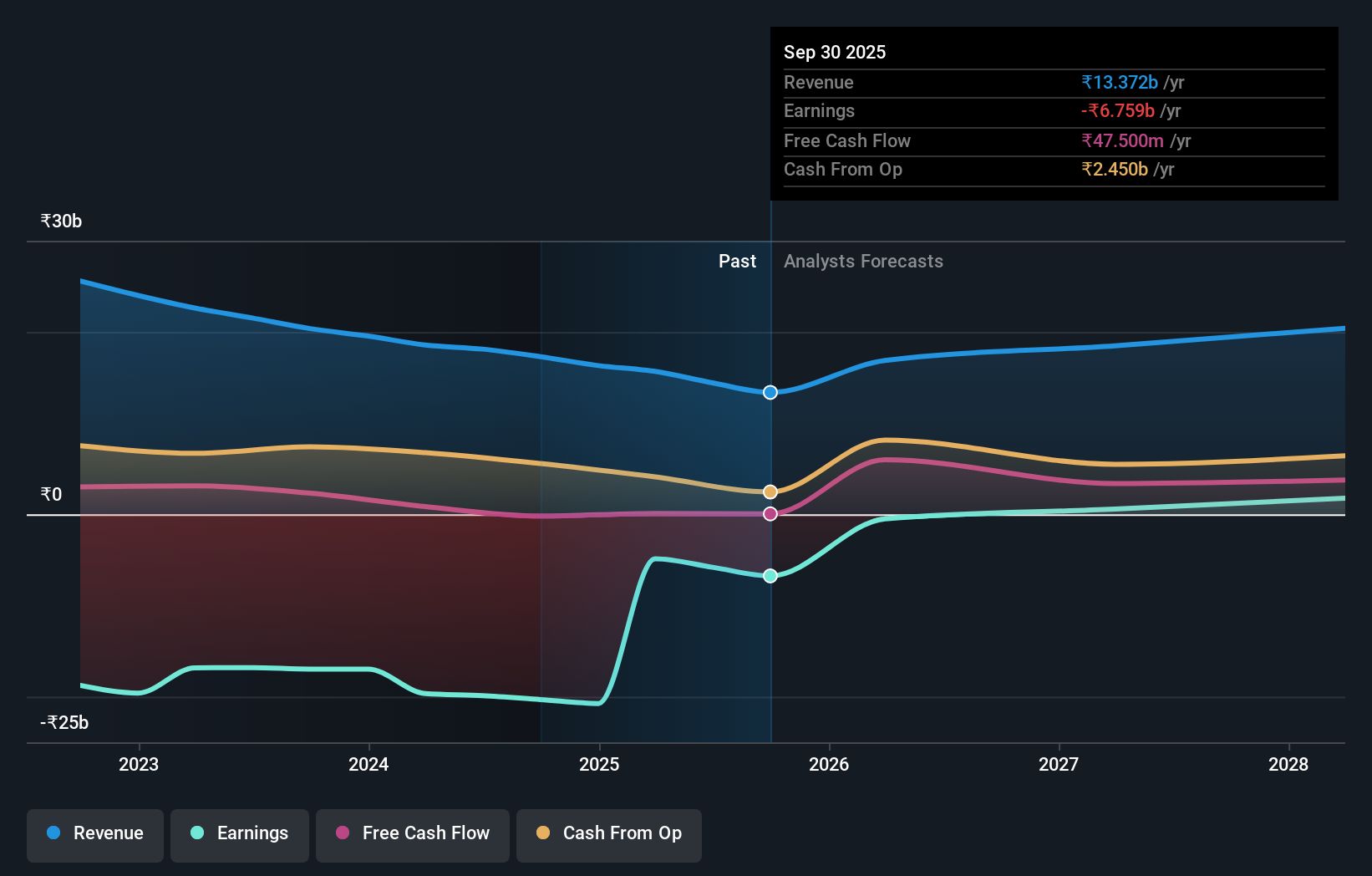

Dish TV India, amidst a challenging financial landscape, is steering towards profitability with its earnings forecast to surge by 109.5% annually. The company's strategic move to incorporate Dish Bharat Ventures Private Limited reflects its commitment to expanding digital distribution and services, signaling robust growth prospects in the tech-driven media sector. With revenue growth projected at 10.8% annually—slightly above the Indian market's average—Dish TV is aligning its operations to capitalize on emerging digital trends while navigating current unprofitability and negative shareholder equity issues effectively.

- Navigate through the intricacies of Dish TV India with our comprehensive health report here.

Understand Dish TV India's track record by examining our Past report.

RateGain Travel Technologies (NSEI:RATEGAIN)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: RateGain Travel Technologies Limited is a Software as a Service (SaaS) company offering solutions for the hospitality and travel industries across India, North America, the Asia-Pacific, Europe, and internationally with a market cap of ₹86.51 billion.

Operations: RateGain Travel Technologies Limited specializes in providing SaaS solutions tailored for the hospitality and travel sectors, generating revenue primarily from its innovative offerings in these industries.

RateGain Travel Technologies, amidst a dynamic tech landscape in India, is carving out a niche with its innovative solutions and strategic alliances. The company's revenue is expected to grow at 17% annually, outpacing the Indian market average of 10%. This growth is bolstered by recent technology integrations like the one with TCA Software Solutions, enhancing hotel operational efficiencies across Latin America. Additionally, RateGain's commitment to R&D has positioned it well for sustained innovation; however, it's important to note that earnings are also expected to see significant growth at an annual rate of 24.5%. This dual focus on top-line growth and continuous product enhancement through substantial R&D investments underlines RateGain’s potential in a competitive sector.

Key Takeaways

- Get an in-depth perspective on all 39 Indian High Growth Tech and AI Stocks by using our screener here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:DISHTV

Dish TV India

Provides direct to home (DTH) television and teleport services in India.

Undervalued with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion