Over the last 7 days, the Indian market has dropped 4.9%, yet it remains up by an impressive 37% over the past year, with earnings forecasted to grow by 18% annually. In this context of fluctuating yet promising growth, identifying high-growth tech stocks involves looking for companies with strong fundamentals and innovative potential that can capitalize on these dynamic market conditions.

Top 10 High Growth Tech Companies In India

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Tips Music | 25.09% | 23.58% | ★★★★★★ |

| Newgen Software Technologies | 21.66% | 21.71% | ★★★★★★ |

| Coforge | 17.13% | 27.34% | ★★★★★☆ |

| Firstsource Solutions | 12.35% | 20.03% | ★★★★★☆ |

| C. E. Info Systems | 29.31% | 26.39% | ★★★★★★ |

| Syrma SGS Technology | 22.96% | 32.91% | ★★★★★☆ |

| Netweb Technologies India | 34.85% | 39.12% | ★★★★★★ |

| Sterlite Technologies | 21.41% | 101.08% | ★★★★★☆ |

| Avalon Technologies | 20.40% | 42.79% | ★★★★★☆ |

| INOX Leisure | 17.73% | 66.63% | ★★★★★☆ |

Let's uncover some gems from our specialized screener.

Coforge (NSEI:COFORGE)

Simply Wall St Growth Rating: ★★★★★☆

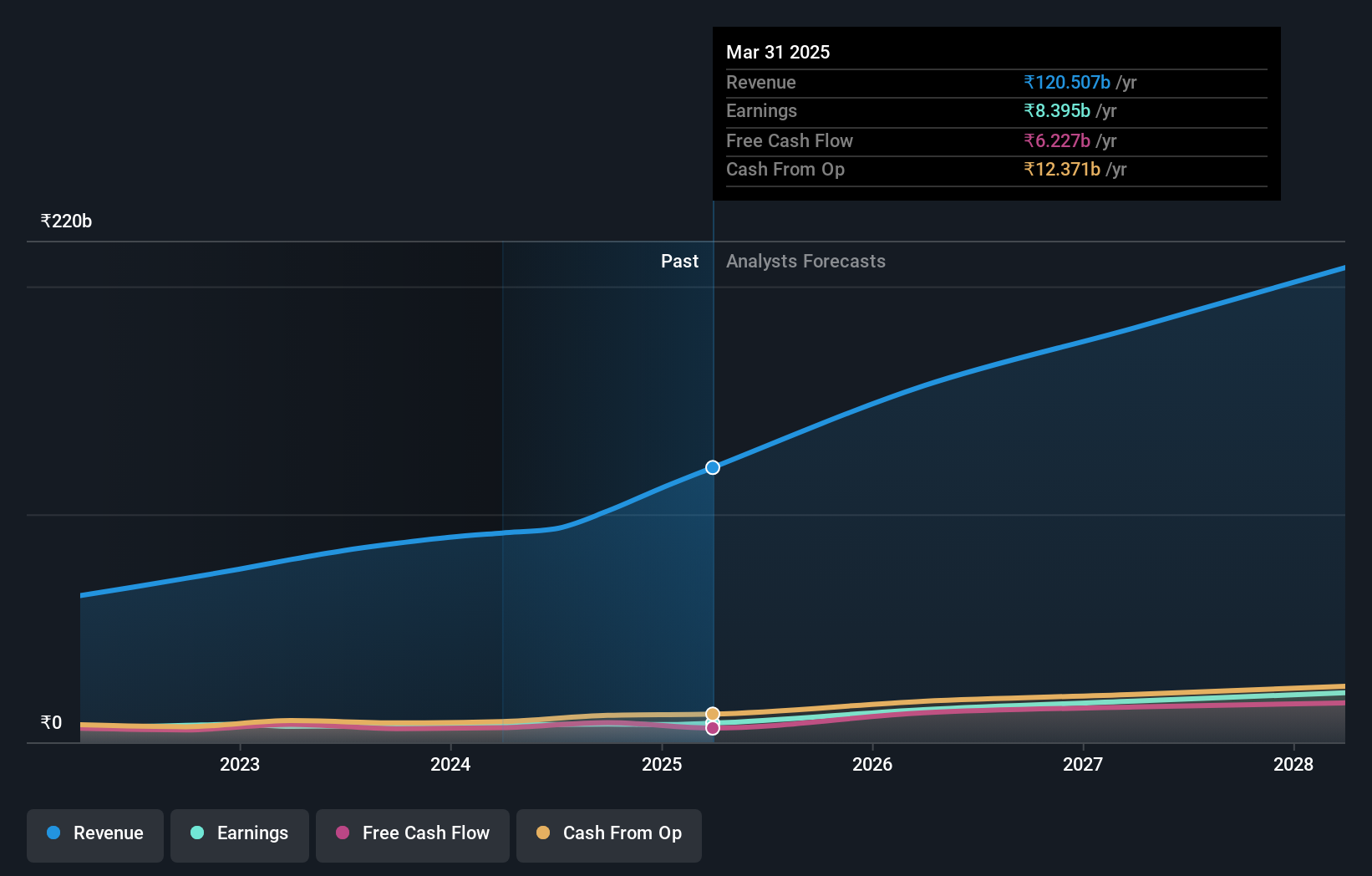

Overview: Coforge Limited is a company that offers information technology and IT-enabled services across various regions including India, the Americas, Europe, the Middle East and Africa, and the Asia Pacific with a market cap of ₹516.43 billion.

Operations: The company generates revenue primarily through its Software Solutions segment, which accounts for ₹101.45 billion.

Coforge's recent financial performance underscores its robust position in the tech sector, with a notable 34% increase in quarterly sales to INR 30.62 billion. This growth is complemented by a strategic partnership with Salesforce, launching the ENZO platform to enhance sustainability measures across businesses—an innovation that not only broadens its service offering but also taps into the growing demand for environmental technology solutions. The firm's commitment to R&D is evident from its substantial investment in this area, aligning with industry trends where significant R&D spending is critical for maintaining technological leadership and driving future growth. Moreover, Coforge's dividend strategy remains strong, as evidenced by a recent declaration of an INR 19 per share interim dividend, reinforcing its shareholder value proposition amidst expanding operations and revenue streams.

- Take a closer look at Coforge's potential here in our health report.

Gain insights into Coforge's historical performance by reviewing our past performance report.

Tech Mahindra (NSEI:TECHM)

Simply Wall St Growth Rating: ★★★★☆☆

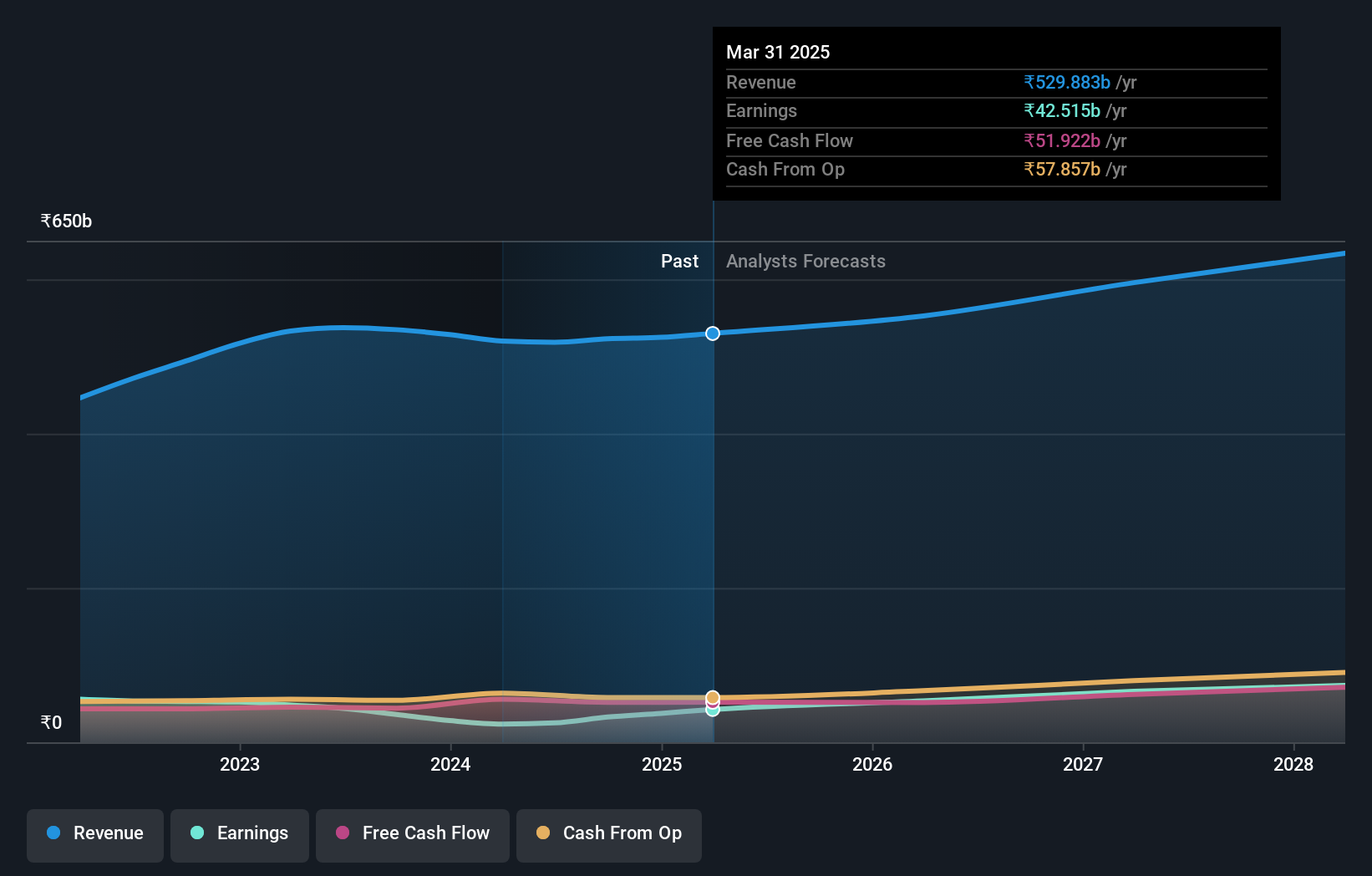

Overview: Tech Mahindra Limited offers information technology services and solutions across the Americas, Europe, India, and globally, with a market capitalization of ₹1.52 trillion.

Operations: Tech Mahindra generates revenue primarily from IT Services, contributing ₹441.41 billion, and Business Process Outsourcing (BPO), adding ₹81.51 billion.

Tech Mahindra's recent strategic initiatives, including a notable Center of Excellence in collaboration with NVIDIA, underscore its commitment to integrating advanced AI technologies across diverse sectors. This move is particularly significant as it leverages NVIDIA’s platforms for developing enterprise-grade AI applications and digital twins, enhancing productivity and operational efficiencies in industries like manufacturing and healthcare. Financially, Tech Mahindra has demonstrated robust growth with a 7.5% revenue increase per year, although slightly below the broader Indian market growth rate of 10%. Impressively, its earnings are expected to surge by approximately 24.9% annually over the next three years, outpacing the market's 17.8%, reflecting strong profit scalability potential despite previous challenges of a -9.1% earnings contraction over the past year.

- Dive into the specifics of Tech Mahindra here with our thorough health report.

Explore historical data to track Tech Mahindra's performance over time in our Past section.

Zaggle Prepaid Ocean Services (NSEI:ZAGGLE)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Zaggle Prepaid Ocean Services Limited develops financial products and solutions to streamline business expense management for corporates, SMEs, and startups using automated workflows, with a market cap of ₹498.83 billion.

Operations: Zaggle Prepaid Ocean Services generates revenue primarily from program fees, gift card sales through the Propel platform, and platform or service fees. The program fee segment contributes ₹4.01 billion, while the Propel platform revenue from gift cards amounts to ₹4.76 billion, and platform/service fees add ₹326.27 million to its earnings structure.

Zaggle Prepaid Ocean Services has recently demonstrated significant strategic growth, highlighted by a robust 28.2% annual revenue increase, outpacing the broader Indian market's 10% growth rate. This surge is supported by innovative expansions like their recent agreement with HDFC ERGO for channel rewards and recognition, leveraging their Zaggle Propel platform to enhance partner engagement until at least 2025. Additionally, their earnings have skyrocketed by 108.5% over the past year, well above the software industry's average of 36.1%. With R&D investments sharply focused on enhancing their technological offerings and service platforms, Zaggle is not just keeping pace but setting new benchmarks in India’s tech sector. Their forward-looking approach is expected to sustain an impressive earnings growth rate of 35.9% annually, promising continued innovation and market adaptability in a rapidly evolving digital landscape.

Make It Happen

- Unlock more gems! Our Indian High Growth Tech and AI Stocks screener has unearthed 35 more companies for you to explore.Click here to unveil our expertly curated list of 38 Indian High Growth Tech and AI Stocks.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Zaggle Prepaid Ocean Services might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:ZAGGLE

Zaggle Prepaid Ocean Services

Zaggle Prepaid Ocean Services Limited builds financial products and solutions to manage the business expenses of corporates, small and medium-sized enterprises, and startups through automated workflows.

High growth potential with proven track record.

Similar Companies

Market Insights

Community Narratives