SoftTech Engineers (NSE:SOFTTECH) Has A Pretty Healthy Balance Sheet

Howard Marks put it nicely when he said that, rather than worrying about share price volatility, 'The possibility of permanent loss is the risk I worry about... and every practical investor I know worries about.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. Importantly, SoftTech Engineers Limited (NSE:SOFTTECH) does carry debt. But the more important question is: how much risk is that debt creating?

When Is Debt Dangerous?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. By replacing dilution, though, debt can be an extremely good tool for businesses that need capital to invest in growth at high rates of return. When we think about a company's use of debt, we first look at cash and debt together.

View our latest analysis for SoftTech Engineers

What Is SoftTech Engineers's Net Debt?

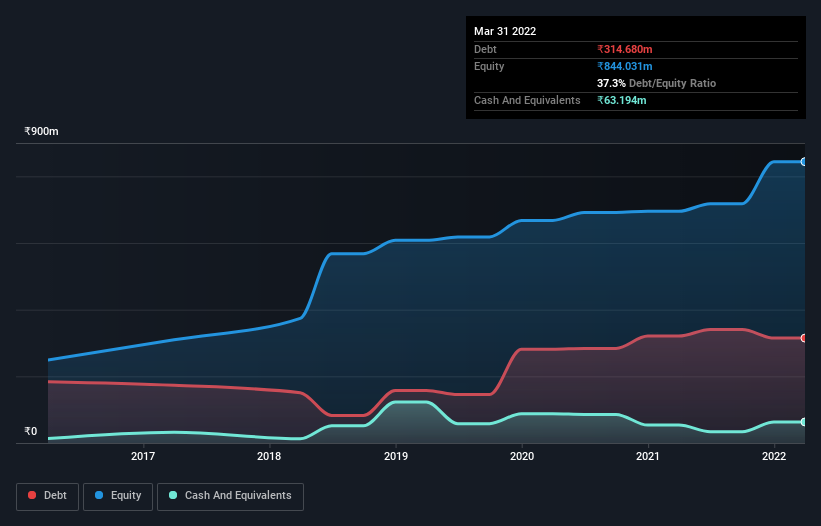

As you can see below, SoftTech Engineers had ₹314.7m of debt, at March 2022, which is about the same as the year before. You can click the chart for greater detail. On the flip side, it has ₹63.2m in cash leading to net debt of about ₹251.5m.

How Healthy Is SoftTech Engineers' Balance Sheet?

Zooming in on the latest balance sheet data, we can see that SoftTech Engineers had liabilities of ₹288.7m due within 12 months and liabilities of ₹202.3m due beyond that. Offsetting this, it had ₹63.2m in cash and ₹740.8m in receivables that were due within 12 months. So it can boast ₹312.9m more liquid assets than total liabilities.

This surplus liquidity suggests that SoftTech Engineers' balance sheet could take a hit just as well as Homer Simpson's head can take a punch. Having regard to this fact, we think its balance sheet is as strong as an ox.

In order to size up a company's debt relative to its earnings, we calculate its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and its earnings before interest and tax (EBIT) divided by its interest expense (its interest cover). This way, we consider both the absolute quantum of the debt, as well as the interest rates paid on it.

SoftTech Engineers's net debt is sitting at a very reasonable 1.6 times its EBITDA, while its EBIT covered its interest expense just 2.7 times last year. It seems that the business incurs large depreciation and amortisation charges, so maybe its debt load is heavier than it would first appear, since EBITDA is arguably a generous measure of earnings. It is well worth noting that SoftTech Engineers's EBIT shot up like bamboo after rain, gaining 34% in the last twelve months. That'll make it easier to manage its debt. When analysing debt levels, the balance sheet is the obvious place to start. But you can't view debt in total isolation; since SoftTech Engineers will need earnings to service that debt. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

Finally, a business needs free cash flow to pay off debt; accounting profits just don't cut it. So we always check how much of that EBIT is translated into free cash flow. During the last three years, SoftTech Engineers burned a lot of cash. While investors are no doubt expecting a reversal of that situation in due course, it clearly does mean its use of debt is more risky.

Our View

Happily, SoftTech Engineers's impressive EBIT growth rate implies it has the upper hand on its debt. But the stark truth is that we are concerned by its conversion of EBIT to free cash flow. All these things considered, it appears that SoftTech Engineers can comfortably handle its current debt levels. On the plus side, this leverage can boost shareholder returns, but the potential downside is more risk of loss, so it's worth monitoring the balance sheet. There's no doubt that we learn most about debt from the balance sheet. But ultimately, every company can contain risks that exist outside of the balance sheet. For instance, we've identified 4 warning signs for SoftTech Engineers (1 is a bit unpleasant) you should be aware of.

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:SOFTTECH

SoftTech Engineers

Develops software products and solutions for the architecture, engineering, operations, and construction sectors in India and internationally.

Excellent balance sheet with low risk.

Similar Companies

Market Insights

Weekly Picks

Ferrari's Intrinsic and Historical Valuation

Investment Thesis: Costco Wholesale (COST)

Undervalued Key Player in Magnets/Rare Earth

Recently Updated Narratives

The silent giant behind virtually every advanced chip powering AI, smartphones, and modern infrastructure.

Booking Holdings: Why Ground-Level Travel Trends Still Favor the Platform Giants

Looking to be second time lucky with a game-changing new product

Popular Narratives

The "Sleeping Giant" Stumbles, Then Wakes Up

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026