Here's What's Concerning About SoftTech Engineers' (NSE:SOFTTECH) Returns On Capital

If you're looking for a multi-bagger, there's a few things to keep an eye out for. Amongst other things, we'll want to see two things; firstly, a growing return on capital employed (ROCE) and secondly, an expansion in the company's amount of capital employed. Basically this means that a company has profitable initiatives that it can continue to reinvest in, which is a trait of a compounding machine. However, after investigating SoftTech Engineers (NSE:SOFTTECH), we don't think it's current trends fit the mold of a multi-bagger.

Understanding Return On Capital Employed (ROCE)

If you haven't worked with ROCE before, it measures the 'return' (pre-tax profit) a company generates from capital employed in its business. Analysts use this formula to calculate it for SoftTech Engineers:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.13 = ₹118m ÷ (₹1.1b - ₹204m) (Based on the trailing twelve months to September 2020).

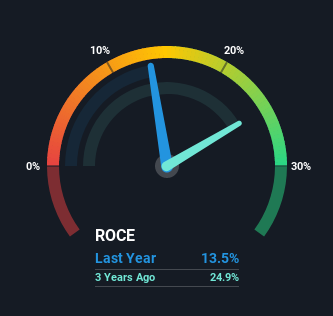

Thus, SoftTech Engineers has an ROCE of 13%. By itself that's a normal return on capital and it's in line with the industry's average returns of 13%.

View our latest analysis for SoftTech Engineers

While the past is not representative of the future, it can be helpful to know how a company has performed historically, which is why we have this chart above. If you're interested in investigating SoftTech Engineers' past further, check out this free graph of past earnings, revenue and cash flow.

What The Trend Of ROCE Can Tell Us

Unfortunately, the trend isn't great with ROCE falling from 18% five years ago, while capital employed has grown 167%. Usually this isn't ideal, but given SoftTech Engineers conducted a capital raising before their most recent earnings announcement, that would've likely contributed, at least partially, to the increased capital employed figure. SoftTech Engineers probably hasn't received a full year of earnings yet from the new funds it raised, so these figures should be taken with a grain of salt.

On a side note, SoftTech Engineers has done well to pay down its current liabilities to 19% of total assets. So we could link some of this to the decrease in ROCE. What's more, this can reduce some aspects of risk to the business because now the company's suppliers or short-term creditors are funding less of its operations. Some would claim this reduces the business' efficiency at generating ROCE since it is now funding more of the operations with its own money.

The Bottom Line

We're a bit apprehensive about SoftTech Engineers because despite more capital being deployed in the business, returns on that capital and sales have both fallen. The market must be rosy on the stock's future because even though the underlying trends aren't too encouraging, the stock has soared 113%. Regardless, we don't feel too comfortable with the fundamentals so we'd be steering clear of this stock for now.

If you'd like to know more about SoftTech Engineers, we've spotted 4 warning signs, and 2 of them don't sit too well with us.

While SoftTech Engineers may not currently earn the highest returns, we've compiled a list of companies that currently earn more than 25% return on equity. Check out this free list here.

When trading SoftTech Engineers or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NSEI:SOFTTECH

SoftTech Engineers

Develops software products and solutions for the architecture, engineering, operations, and construction sectors in India and internationally.

Excellent balance sheet with low risk.

Similar Companies

Market Insights

Weekly Picks

The Future of Social Sharing Is Private and People Are Ready

EU#3 - From Philips Management Buyout to Europe’s Biggest Company

Booking Holdings: Why Ground-Level Travel Trends Still Favor the Platform Giants

A fully integrated LNG business seems to be ignored by the market.

Recently Updated Narratives

Palantir: Redefining Enterprise Software for the AI Era

Microsoft - A Fundamental and Historical Valuation

The Oncology Anchor: Why Merck’s 46% Discount Defies the Keytruda Cliff

Popular Narratives

Undervalued Key Player in Magnets/Rare Earth

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

AMZN: Acceleration In Cloud And AI Will Drive Margin Expansion Ahead

Trending Discussion

<b>Reported:</b> Revenue growth: 2024 → 2025 sharp increase of approx. 165%. Assuming moderate annual growth of 40%, a fair value in three years would be approx. $170. Given the customer base and the story, this should be possible. I find the most valuable “property” particularly interesting, as it solves the electricity problem.