Is Quicktouch Technologies (NSE:QUICKTOUCH) A Risky Investment?

The external fund manager backed by Berkshire Hathaway's Charlie Munger, Li Lu, makes no bones about it when he says 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. We note that Quicktouch Technologies Limited (NSE:QUICKTOUCH) does have debt on its balance sheet. But should shareholders be worried about its use of debt?

What Risk Does Debt Bring?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Of course, plenty of companies use debt to fund growth, without any negative consequences. The first step when considering a company's debt levels is to consider its cash and debt together.

See our latest analysis for Quicktouch Technologies

How Much Debt Does Quicktouch Technologies Carry?

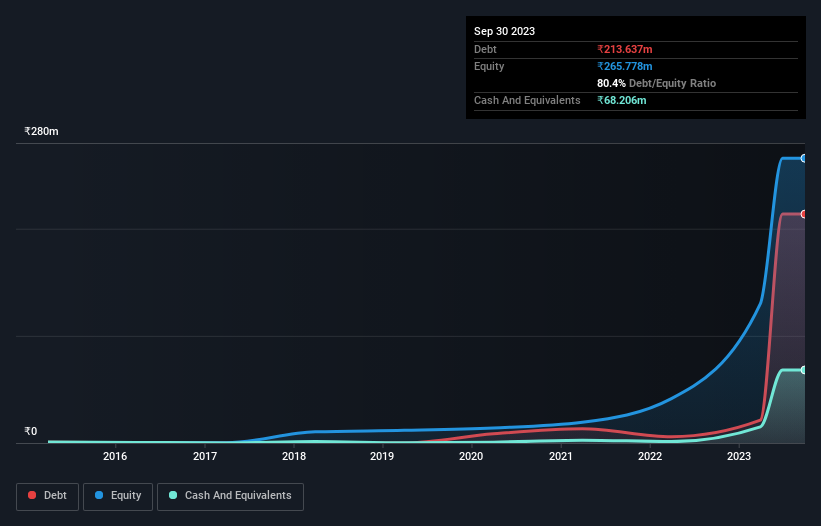

The image below, which you can click on for greater detail, shows that at September 2023 Quicktouch Technologies had debt of ₹213.6m, up from ₹21.3m in one year. However, it also had ₹68.2m in cash, and so its net debt is ₹145.4m.

A Look At Quicktouch Technologies' Liabilities

We can see from the most recent balance sheet that Quicktouch Technologies had liabilities of ₹344.8m falling due within a year, and liabilities of ₹132.2m due beyond that. Offsetting these obligations, it had cash of ₹68.2m as well as receivables valued at ₹465.4m due within 12 months. So it actually has ₹56.6m more liquid assets than total liabilities.

This surplus suggests that Quicktouch Technologies has a conservative balance sheet, and could probably eliminate its debt without much difficulty.

We use two main ratios to inform us about debt levels relative to earnings. The first is net debt divided by earnings before interest, tax, depreciation, and amortization (EBITDA), while the second is how many times its earnings before interest and tax (EBIT) covers its interest expense (or its interest cover, for short). This way, we consider both the absolute quantum of the debt, as well as the interest rates paid on it.

Quicktouch Technologies's net debt is only 1.3 times its EBITDA. And its EBIT covers its interest expense a whopping 35.3 times over. So we're pretty relaxed about its super-conservative use of debt. On top of that, Quicktouch Technologies grew its EBIT by 68% over the last twelve months, and that growth will make it easier to handle its debt. When analysing debt levels, the balance sheet is the obvious place to start. But it is Quicktouch Technologies's earnings that will influence how the balance sheet holds up in the future. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

Finally, while the tax-man may adore accounting profits, lenders only accept cold hard cash. So we always check how much of that EBIT is translated into free cash flow. Considering the last three years, Quicktouch Technologies actually recorded a cash outflow, overall. Debt is far more risky for companies with unreliable free cash flow, so shareholders should be hoping that the past expenditure will produce free cash flow in the future.

Our View

Happily, Quicktouch Technologies's impressive interest cover implies it has the upper hand on its debt. But we must concede we find its conversion of EBIT to free cash flow has the opposite effect. Taking all this data into account, it seems to us that Quicktouch Technologies takes a pretty sensible approach to debt. While that brings some risk, it can also enhance returns for shareholders. The balance sheet is clearly the area to focus on when you are analysing debt. However, not all investment risk resides within the balance sheet - far from it. Case in point: We've spotted 2 warning signs for Quicktouch Technologies you should be aware of, and 1 of them is concerning.

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

Valuation is complex, but we're here to simplify it.

Discover if Quicktouch Technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:QUICKTOUCH

Quicktouch Technologies

Engages in the development and trading of computer software and related activities primarily in India.

Excellent balance sheet with moderate risk.

Similar Companies

Market Insights

Weekly Picks

Ferrari's Intrinsic and Historical Valuation

Investment Thesis: Costco Wholesale (COST)

Undervalued Key Player in Magnets/Rare Earth

Recently Updated Narratives

Hims & Hers Health aims for three dimensional revenue expansion

A Tale of Two Engines: Coca-Cola HBC (EEE.AT)

EU#3 - From Philips Management Buyout to Europe’s Biggest Company

Popular Narratives

The "Sleeping Giant" Stumbles, Then Wakes Up

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026