Here's Why Persistent Systems (NSE:PERSISTENT) Can Manage Its Debt Responsibly

David Iben put it well when he said, 'Volatility is not a risk we care about. What we care about is avoiding the permanent loss of capital.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. We can see that Persistent Systems Limited (NSE:PERSISTENT) does use debt in its business. But should shareholders be worried about its use of debt?

Why Does Debt Bring Risk?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Of course, plenty of companies use debt to fund growth, without any negative consequences. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

How Much Debt Does Persistent Systems Carry?

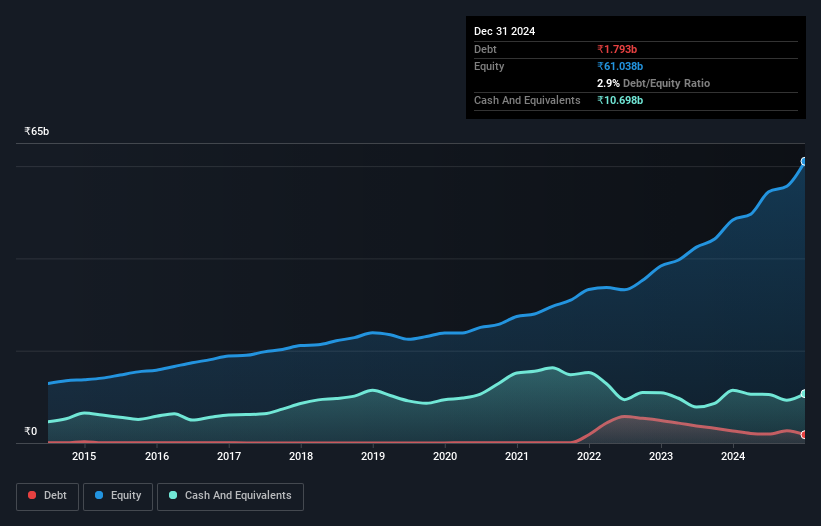

The image below, which you can click on for greater detail, shows that Persistent Systems had debt of ₹1.79b at the end of December 2024, a reduction from ₹2.62b over a year. However, its balance sheet shows it holds ₹10.7b in cash, so it actually has ₹8.90b net cash.

How Healthy Is Persistent Systems' Balance Sheet?

The latest balance sheet data shows that Persistent Systems had liabilities of ₹22.5b due within a year, and liabilities of ₹2.70b falling due after that. On the other hand, it had cash of ₹10.7b and ₹29.3b worth of receivables due within a year. So it can boast ₹14.8b more liquid assets than total liabilities.

This surplus suggests that Persistent Systems has a conservative balance sheet, and could probably eliminate its debt without much difficulty. Simply put, the fact that Persistent Systems has more cash than debt is arguably a good indication that it can manage its debt safely.

View our latest analysis for Persistent Systems

And we also note warmly that Persistent Systems grew its EBIT by 17% last year, making its debt load easier to handle. There's no doubt that we learn most about debt from the balance sheet. But it is future earnings, more than anything, that will determine Persistent Systems's ability to maintain a healthy balance sheet going forward. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

But our final consideration is also important, because a company cannot pay debt with paper profits; it needs cold hard cash. Persistent Systems may have net cash on the balance sheet, but it is still interesting to look at how well the business converts its earnings before interest and tax (EBIT) to free cash flow, because that will influence both its need for, and its capacity to manage debt. In the last three years, Persistent Systems's free cash flow amounted to 46% of its EBIT, less than we'd expect. That's not great, when it comes to paying down debt.

Summing Up

While we empathize with investors who find debt concerning, you should keep in mind that Persistent Systems has net cash of ₹8.90b, as well as more liquid assets than liabilities. And we liked the look of last year's 17% year-on-year EBIT growth. So we don't think Persistent Systems's use of debt is risky. Above most other metrics, we think its important to track how fast earnings per share is growing, if at all. If you've also come to that realization, you're in luck, because today you can view this interactive graph of Persistent Systems's earnings per share history for free.

If, after all that, you're more interested in a fast growing company with a rock-solid balance sheet, then check out our list of net cash growth stocks without delay.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:PERSISTENT

Persistent Systems

Provides software products, services, and technology solutions in India, North America, and internationally.

Outstanding track record with flawless balance sheet and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Is this the AI replacing marketing professionals?

Pro Medicus: The Market Is Confusing a Lumpy Quarter With a Broken Business

The Rising Deal Risk That Helped Sink Netflix’s $72 Billion Bid for Warner Bros. Discovery

The Infrastructure AI Cannot Be Built Without

Recently Updated Narratives

Rocket Lab: A Growth Story Trading on the Future of Space Economy

Shell PLC (SHEL): The Integrated Energy Arbitrage – Driving Record Buybacks and High-Margin LNG in 2026.

VanEck Semiconductor ETF (SMH): The Silicon Supercycle – Capturing the AI Infrastructure Multiplier in 2026.

Popular Narratives

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

Analyst Commentary Highlights Microsoft AI Momentum and Upward Valuation Amid Growth and Competitive Risks