Legendary fund manager Li Lu (who Charlie Munger backed) once said, 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. We note that Mphasis Limited (NSE:MPHASIS) does have debt on its balance sheet. But the real question is whether this debt is making the company risky.

When Is Debt A Problem?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. The first step when considering a company's debt levels is to consider its cash and debt together.

View our latest analysis for Mphasis

How Much Debt Does Mphasis Carry?

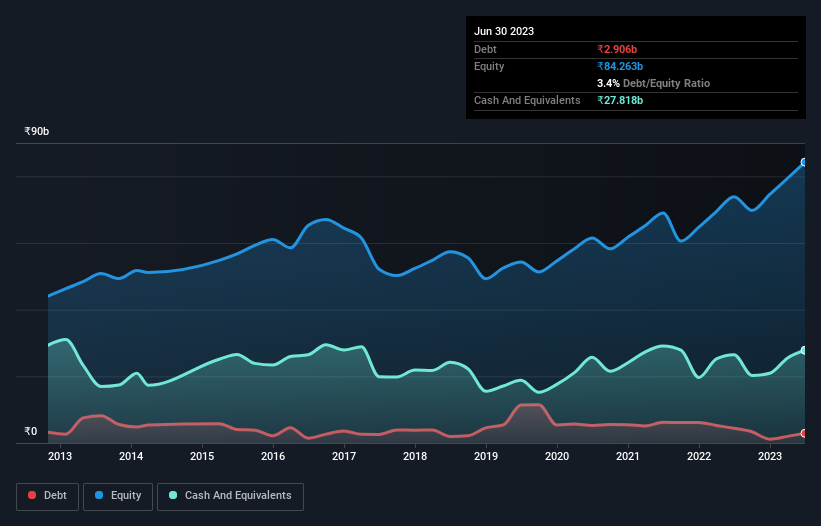

The image below, which you can click on for greater detail, shows that Mphasis had debt of ₹2.91b at the end of June 2023, a reduction from ₹4.41b over a year. However, it does have ₹27.8b in cash offsetting this, leading to net cash of ₹24.9b.

How Healthy Is Mphasis' Balance Sheet?

According to the last reported balance sheet, Mphasis had liabilities of ₹29.7b due within 12 months, and liabilities of ₹11.0b due beyond 12 months. On the other hand, it had cash of ₹27.8b and ₹26.1b worth of receivables due within a year. So it can boast ₹13.3b more liquid assets than total liabilities.

This surplus suggests that Mphasis has a conservative balance sheet, and could probably eliminate its debt without much difficulty. Succinctly put, Mphasis boasts net cash, so it's fair to say it does not have a heavy debt load!

The good news is that Mphasis has increased its EBIT by 8.7% over twelve months, which should ease any concerns about debt repayment. There's no doubt that we learn most about debt from the balance sheet. But ultimately the future profitability of the business will decide if Mphasis can strengthen its balance sheet over time. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

Finally, a business needs free cash flow to pay off debt; accounting profits just don't cut it. While Mphasis has net cash on its balance sheet, it's still worth taking a look at its ability to convert earnings before interest and tax (EBIT) to free cash flow, to help us understand how quickly it is building (or eroding) that cash balance. During the last three years, Mphasis produced sturdy free cash flow equating to 75% of its EBIT, about what we'd expect. This cold hard cash means it can reduce its debt when it wants to.

Summing Up

While it is always sensible to investigate a company's debt, in this case Mphasis has ₹24.9b in net cash and a decent-looking balance sheet. The cherry on top was that in converted 75% of that EBIT to free cash flow, bringing in ₹12b. So is Mphasis's debt a risk? It doesn't seem so to us. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately, every company can contain risks that exist outside of the balance sheet. To that end, you should be aware of the 2 warning signs we've spotted with Mphasis .

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:MPHASIS

Mphasis

Operates as an information technology solutions provider that specializes in cloud and cognitive services in the United States, India, Europe, the Middle East, Africa, and internationally.

Excellent balance sheet established dividend payer.

Similar Companies

Market Insights

Weekly Picks

An Undervalued 3.3Moz Gold Project in Canada

Coca-Cola’s Enduring Moat in a Health-Conscious World: Steady Compounder Poised for 5-10% Annual Returns Through Emerging Market Dominance

Xero: Growth Was Priced In — Execution Is Not

Nu holdings will continue to disrupt the South American banking market

Recently Updated Narratives

Is this the AI replacing marketing professionals?

Taiwan Semiconductor Manufacturing Company (TSM) The Silicon Sovereign: Orchestrating the 2nm AI Revolution

Advanced Micro Devices (AMD) The Power of Open-Source AI: Challenging the Data Center Monopoly

Popular Narratives

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

Analyst Commentary Highlights Microsoft AI Momentum and Upward Valuation Amid Growth and Competitive Risks