- India

- /

- Electronic Equipment and Components

- /

- NSEI:SYRMA

Top High Growth Tech Stocks In India For August 2024

Reviewed by Simply Wall St

Over the last 7 days, the Indian market has risen 1.8%, and in the last year, it has climbed an impressive 46%, with earnings forecasted to grow by 17% annually. In this thriving environment, identifying high-growth tech stocks that align with these robust market conditions can offer promising opportunities for investors.

Top 10 High Growth Tech Companies In India

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Tips Industries | 24.69% | 24.16% | ★★★★★★ |

| Newgen Software Technologies | 21.83% | 22.72% | ★★★★★★ |

| Happiest Minds Technologies | 21.99% | 21.80% | ★★★★★★ |

| Coforge | 14.06% | 22.42% | ★★★★★☆ |

| C. E. Info Systems | 29.94% | 26.97% | ★★★★★★ |

| Netweb Technologies India | 33.65% | 35.61% | ★★★★★★ |

| Sterlite Technologies | 21.41% | 101.08% | ★★★★★☆ |

| Tejas Networks | 23.05% | 63.54% | ★★★★★☆ |

| Avalon Technologies | 20.12% | 41.74% | ★★★★★☆ |

| INOX Leisure | 17.73% | 66.63% | ★★★★★☆ |

Let's dive into some prime choices out of from the screener.

Intellect Design Arena (NSEI:INTELLECT)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Intellect Design Arena Limited provides software development and related services for banking, insurance, and other financial services in India and internationally with a market cap of ₹135.64 billion.

Operations: The company generates revenue primarily through software product licenses and related services, amounting to ₹24.73 billion. The focus is on providing tailored solutions for the banking, insurance, and financial sectors both domestically and internationally.

Intellect Design Arena's recent initiatives, such as the launch of Purple Fabric and the opening of a Global Partnership Office in Bengaluru, highlight its strategic focus on AI and partnership-led growth. The company forecasts earnings growth at 22.4% annually, outpacing the Indian market's 17%. Despite revenue growth being slower at 11.1%, Intellect's commitment to innovation is evident with significant R&D investments enhancing their competitive edge in financial technology solutions.

MPS (NSEI:MPSLTD)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: MPS Limited offers platforms and services for content creation, full-service production, and distribution to publishers, learning companies, corporate institutions, libraries, and content aggregators globally with a market cap of ₹40.64 billion.

Operations: MPS Limited generates revenue from three primary segments: Content Solutions (₹3.10 billion), Platform Solutions (₹1.48 billion), and e-Learning Solutions (₹1.36 billion). The company serves clients in India, Europe, the United States, and internationally.

MPS Limited's revenue is forecast to grow at 19.3% annually, surpassing the Indian market's 10%. Despite a recent earnings decrease of 3.8%, the company's projected annual profit growth of 22.3% indicates strong future potential. Significant investments in R&D, with expenses contributing substantially to their innovation pipeline, bolster this outlook. Recent financial results show Q1 sales rising to ₹1,807 million from ₹1,325 million year-over-year, reflecting robust operational performance amidst industry challenges.

- Click here and access our complete health analysis report to understand the dynamics of MPS.

Explore historical data to track MPS' performance over time in our Past section.

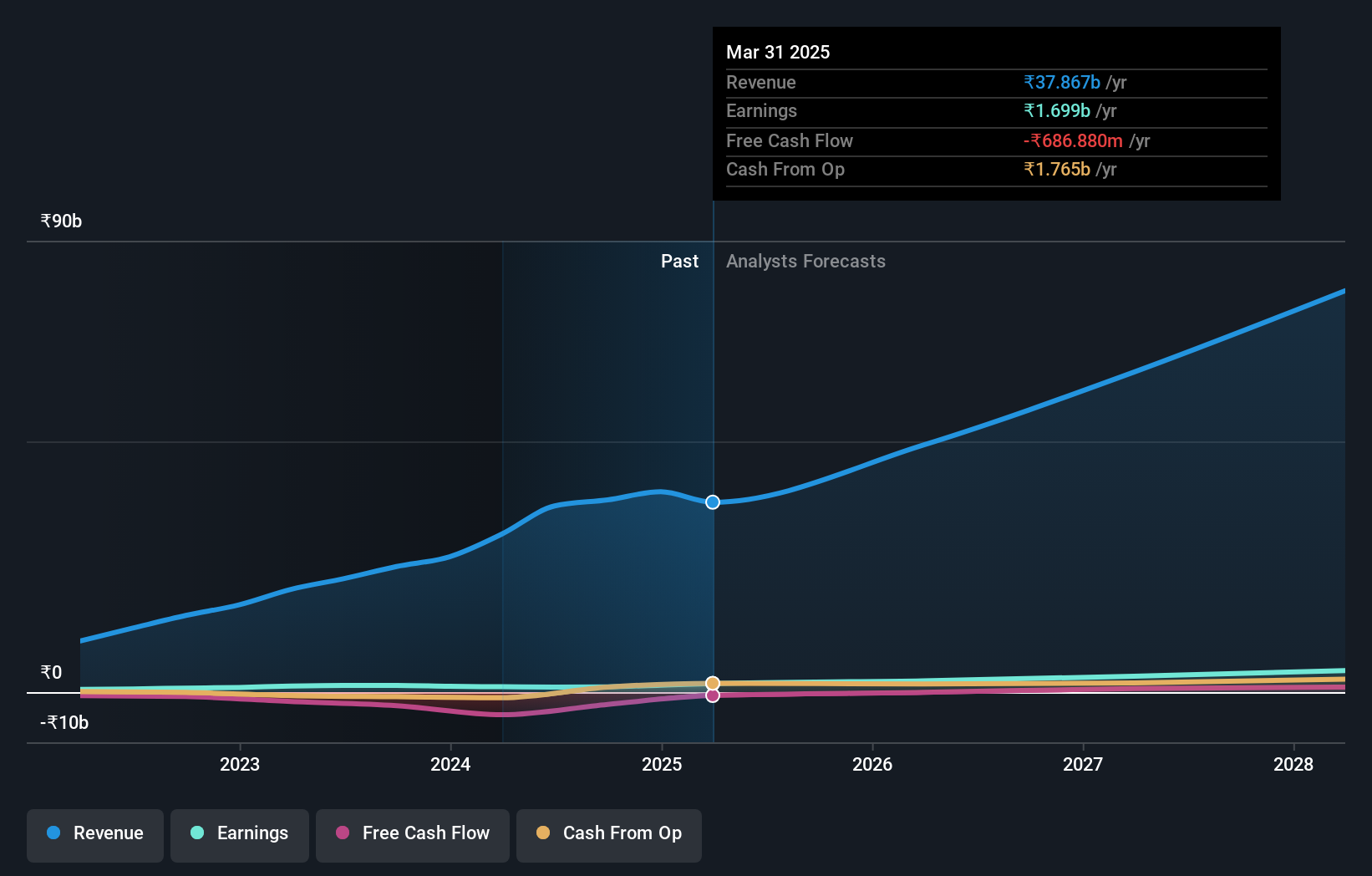

Syrma SGS Technology (NSEI:SYRMA)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Syrma SGS Technology Limited offers comprehensive electronic manufacturing services across India, the United States, Germany, and internationally with a market cap of ₹80.68 billion.

Operations: Syrma SGS Technology Limited generates revenue primarily from its electronic manufacturing services, amounting to ₹37.12 billion. The company operates across multiple regions, including India, the United States, and Germany.

Syrma SGS Technology's revenue surged to ₹11.75 billion in Q1 2024 from ₹6.22 billion a year ago, reflecting a robust 21.8% annual growth forecast, outpacing the Indian market's 10%. Despite net income dipping to ₹192.97 million from ₹285.18 million last year, the company projects earnings growth of 31.9% annually over the next three years, underscoring its potential amidst industry challenges. Significant R&D investments drive innovation and competitiveness in this high-growth tech landscape.

- Unlock comprehensive insights into our analysis of Syrma SGS Technology stock in this health report.

Turning Ideas Into Actions

- Discover the full array of 38 Indian High Growth Tech and AI Stocks right here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:SYRMA

Syrma SGS Technology

Provides turnkey electronic manufacturing services in India, the United States, Germany, and internationally.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion