Exploring High Growth Tech Stocks In India Featuring Three Prominent Companies

Reviewed by Simply Wall St

Over the last 7 days, the Indian market has dropped 2.1%, but in the longer term, it has risen by an impressive 42% over the past year, with earnings forecasted to grow by 17% annually. In this dynamic environment, identifying high growth tech stocks involves looking for companies that are not only capitalizing on technological advancements but also demonstrating resilience and potential for sustained growth amidst fluctuating market conditions.

Top 10 High Growth Tech Companies In India

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Tips Music | 25.09% | 23.58% | ★★★★★★ |

| Newgen Software Technologies | 21.66% | 21.71% | ★★★★★★ |

| Firstsource Solutions | 12.35% | 20.03% | ★★★★★☆ |

| C. E. Info Systems | 29.31% | 26.39% | ★★★★★★ |

| Syrma SGS Technology | 21.94% | 31.74% | ★★★★★☆ |

| Netweb Technologies India | 33.74% | 39.12% | ★★★★★★ |

| GFL | 44.50% | 49.42% | ★★★★★☆ |

| Sterlite Technologies | 21.41% | 101.08% | ★★★★★☆ |

| Avalon Technologies | 20.40% | 42.79% | ★★★★★☆ |

| INOX Leisure | 17.73% | 66.63% | ★★★★★☆ |

Let's dive into some prime choices out of from the screener.

Intellect Design Arena (NSEI:INTELLECT)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Intellect Design Arena Limited offers software development and related services for banking, insurance, and financial services sectors both in India and globally, with a market cap of ₹112.04 billion.

Operations: The company generates revenue primarily from software product licenses and related services, amounting to ₹24.73 billion. This focus on software solutions caters to the banking, insurance, and financial services sectors across both domestic and international markets.

Intellect Design Arena's strategic focus on R&D has significantly bolstered its market position in high-growth tech sectors, particularly through its iGTB and eMACH.ai platforms. This commitment is evident from the 22.4% annual growth forecast in earnings and an 11.1% revenue increase, aligning with industry demands for innovative digital banking solutions. Recent partnerships, like with National Bank of Fujairah, showcase Intellect's ability to enhance digital capabilities globally using Microsoft Azure-managed services, positioning it well amidst a competitive landscape marked by rapid technological advancements and shifting market dynamics.

- Click here and access our complete health analysis report to understand the dynamics of Intellect Design Arena.

Explore historical data to track Intellect Design Arena's performance over time in our Past section.

MPS (NSEI:MPSLTD)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: MPS Limited offers platforms and services for content creation, full-service production, and distribution to various sectors globally, with a market cap of ₹35.22 billion.

Operations: The company generates revenue primarily from three segments: Content Solutions (₹3.10 billion), Platform Solutions (₹1.48 billion), and e-Learning Solutions (₹1.36 billion). These services cater to publishers, learning companies, corporate institutions, libraries, and content aggregators across India, Europe, the United States, and internationally.

MPS Limited, recently added to the S&P Global BMI Index, is navigating a transformative phase with significant board and executive changes aimed at enhancing strategic oversight and financial acumen. Despite a slight dip in net income to INR 258.9 million from last year's INR 303 million, the company's revenue growth remains robust at 19.3% annually, outpacing the Indian market's average of 10.1%. This growth is complemented by an ambitious R&D investment strategy that underpins MPS’s commitment to innovation in its sector. Moreover, with earnings expected to surge by 22.3% annually, MPS is positioning itself as a competitive entity in high-growth tech sectors within India.

- Take a closer look at MPS' potential here in our health report.

Gain insights into MPS' historical performance by reviewing our past performance report.

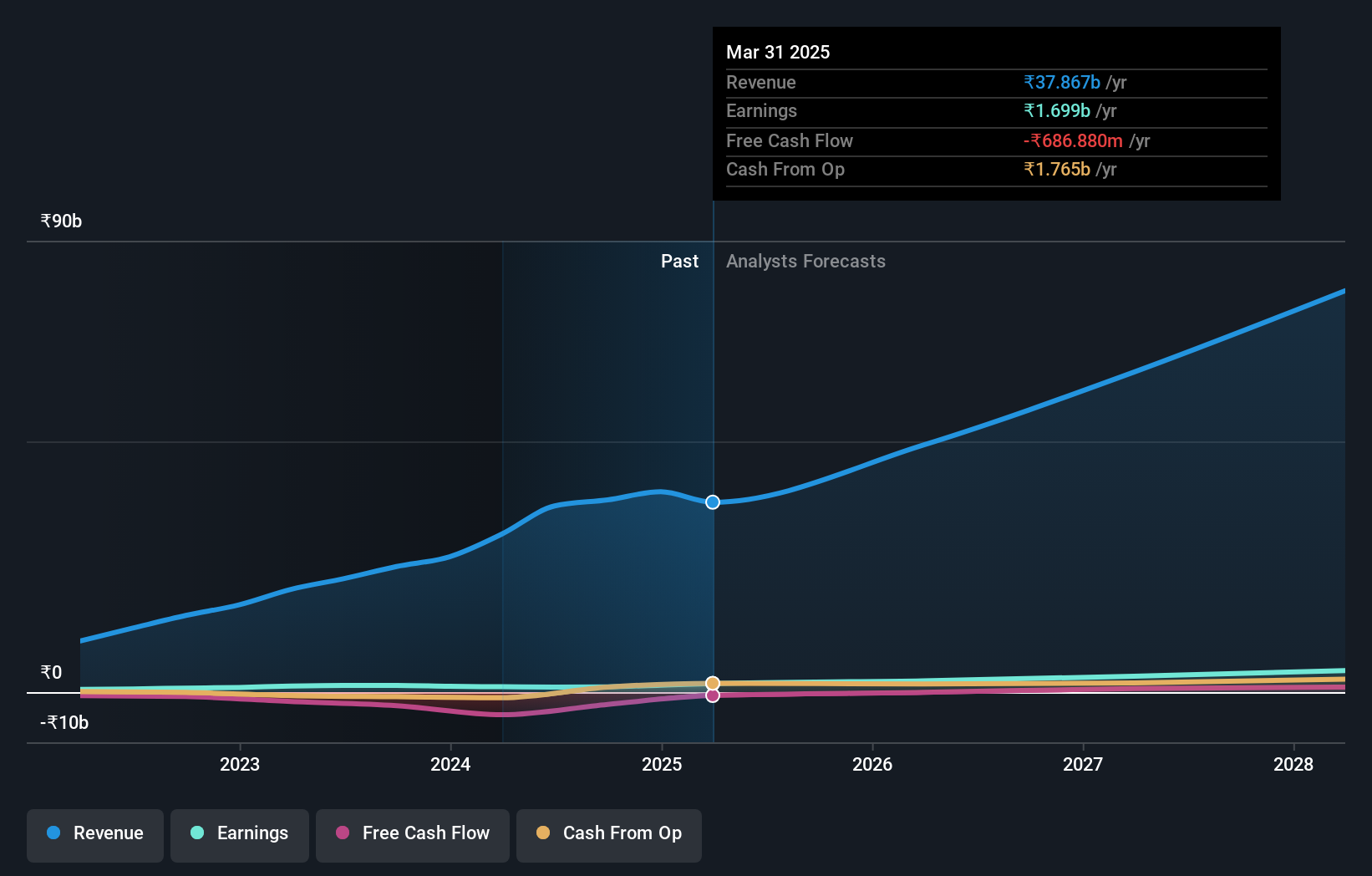

Syrma SGS Technology (NSEI:SYRMA)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Syrma SGS Technology Limited offers comprehensive electronic manufacturing services across India, the United States, Germany, and other international markets with a market capitalization of ₹70.32 billion.

Operations: With a focus on electronic manufacturing services, Syrma SGS Technology Limited generates revenue of ₹37.12 billion from this segment.

Syrma SGS Technology is navigating a vibrant expansion phase, evidenced by the recent inauguration of a new state-of-the-art manufacturing facility which underscores its commitment to scaling operations. Despite a challenging past year with net income dropping to INR 192.97 million from INR 285.18 million, the company's revenue surged impressively by nearly 95% to INR 11,751.97 million. This growth trajectory is supported by robust R&D investments that are crucial for maintaining competitiveness in the rapidly evolving tech landscape of India. With earnings expected to grow at an annual rate of 31.7%, Syrma SGS stands out for its aggressive pursuit of innovation and market expansion, setting a brisk pace in comparison to broader market trends.

- Delve into the full analysis health report here for a deeper understanding of Syrma SGS Technology.

Evaluate Syrma SGS Technology's historical performance by accessing our past performance report.

Summing It All Up

- Dive into all 39 of the Indian High Growth Tech and AI Stocks we have identified here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:MPSLTD

MPS

Provides platforms and services for content creation, full-service production, and distribution to the publishers, learning companies, corporate institutions, libraries, and content aggregators in India, Europe, the United States, and internationally.

Outstanding track record with flawless balance sheet and pays a dividend.

Market Insights

Community Narratives