Infosys Limited's (NSE:INFY) Business And Shares Still Trailing The Market

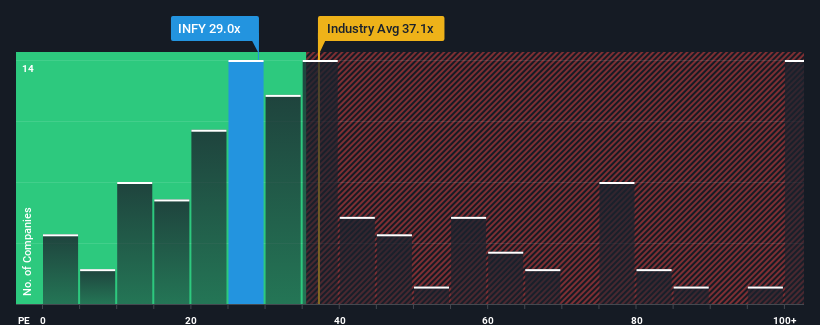

With a price-to-earnings (or "P/E") ratio of 29x Infosys Limited (NSE:INFY) may be sending bullish signals at the moment, given that almost half of all companies in India have P/E ratios greater than 33x and even P/E's higher than 63x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/E.

With earnings growth that's inferior to most other companies of late, Infosys has been relatively sluggish. The P/E is probably low because investors think this lacklustre earnings performance isn't going to get any better. If you still like the company, you'd be hoping earnings don't get any worse and that you could pick up some stock while it's out of favour.

See our latest analysis for Infosys

What Are Growth Metrics Telling Us About The Low P/E?

Infosys' P/E ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the market.

Taking a look back first, we see that the company managed to grow earnings per share by a handy 7.4% last year. The latest three year period has also seen a 16% overall rise in EPS, aided somewhat by its short-term performance. So we can start by confirming that the company has actually done a good job of growing earnings over that time.

Shifting to the future, estimates from the analysts covering the company suggest earnings should grow by 7.9% each year over the next three years. Meanwhile, the rest of the market is forecast to expand by 19% per annum, which is noticeably more attractive.

With this information, we can see why Infosys is trading at a P/E lower than the market. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

The Bottom Line On Infosys' P/E

Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

We've established that Infosys maintains its low P/E on the weakness of its forecast growth being lower than the wider market, as expected. At this stage investors feel the potential for an improvement in earnings isn't great enough to justify a higher P/E ratio. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

You always need to take note of risks, for example - Infosys has 1 warning sign we think you should be aware of.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:INFY

Infosys

Provides consulting, technology, outsourcing, and digital services in North America, Europe, India, and internationally.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

The "Sleeping Giant" Wakes Up – Efficiency & Monetization

The "Rate Cut" Supercycle Winner – Profitable & Accelerating

The Industrialist of the Skies – Scaling with "Automotive DNA

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026