We Wouldn't Be Too Quick To Buy 63 moons technologies limited (NSE:FINANTECH) Before It Goes Ex-Dividend

63 moons technologies limited (NSE:FINANTECH) is about to trade ex-dividend in the next 3 days. The ex-dividend date is one business day before the record date, which is the cut-off date for shareholders to be present on the company's books to be eligible for a dividend payment. The ex-dividend date is an important date to be aware of as any purchase of the stock made on or after this date might mean a late settlement that doesn't show on the record date. This means that investors who purchase 63 moons technologies' shares on or after the 8th of September will not receive the dividend, which will be paid on the 18th of October.

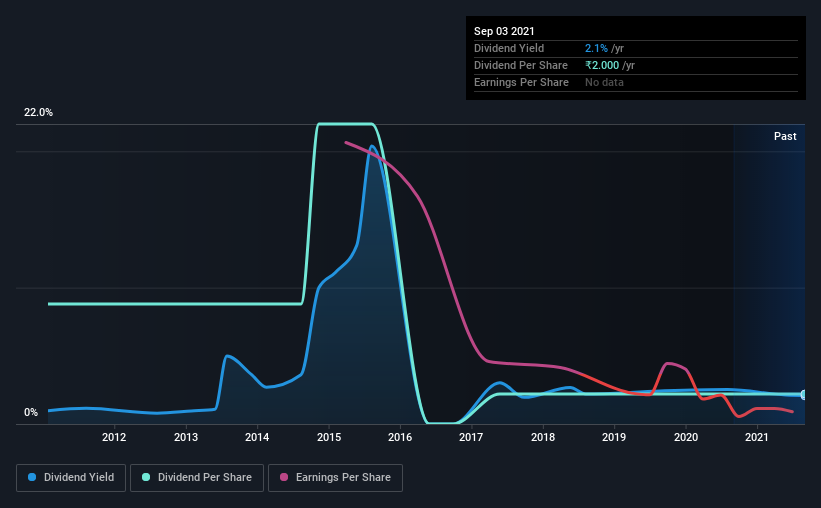

The company's next dividend payment will be ₹2.00 per share. Last year, in total, the company distributed ₹2.00 to shareholders. Last year's total dividend payments show that 63 moons technologies has a trailing yield of 2.1% on the current share price of ₹96.8. We love seeing companies pay a dividend, but it's also important to be sure that laying the golden eggs isn't going to kill our golden goose! We need to see whether the dividend is covered by earnings and if it's growing.

View our latest analysis for 63 moons technologies

Dividends are typically paid from company earnings. If a company pays more in dividends than it earned in profit, then the dividend could be unsustainable. 63 moons technologies reported a loss after tax last year, which means it's paying a dividend despite being unprofitable. While this might be a one-off event, this is unlikely to be sustainable in the long term.

Click here to see how much of its profit 63 moons technologies paid out over the last 12 months.

Have Earnings And Dividends Been Growing?

Companies with falling earnings are riskier for dividend shareholders. If earnings fall far enough, the company could be forced to cut its dividend. 63 moons technologies reported a loss last year, and the general trend suggests its earnings have also been declining in recent years, making us wonder if the dividend is at risk.

The main way most investors will assess a company's dividend prospects is by checking the historical rate of dividend growth. 63 moons technologies's dividend payments per share have declined at 13% per year on average over the past 10 years, which is uninspiring. While it's not great that earnings and dividends per share have fallen in recent years, we're encouraged by the fact that management has trimmed the dividend rather than risk over-committing the company in a risky attempt to maintain yields to shareholders.

Get our latest analysis on 63 moons technologies's balance sheet health here.

Final Takeaway

Is 63 moons technologies an attractive dividend stock, or better left on the shelf? 63 moons technologies doesn't appear to have a lot going for it, and we're not inclined to take a risk on owning it for the dividend.

Although, if you're still interested in 63 moons technologies and want to know more, you'll find it very useful to know what risks this stock faces. To that end, you should learn about the 3 warning signs we've spotted with 63 moons technologies (including 1 which is significant).

A common investment mistake is buying the first interesting stock you see. Here you can find a list of promising dividend stocks with a greater than 2% yield and an upcoming dividend.

If you’re looking to trade 63 moons technologies, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if 63 moons technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NSEI:63MOONS

63 moons technologies

Provides software solutions in India and internationally.

Mediocre balance sheet with weak fundamentals.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026