Shareholders May Not Be So Generous With Dynacons Systems & Solutions Limited's (NSE:DSSL) CEO Compensation And Here's Why

CEO Shirish Anjaria has done a decent job of delivering relatively good performance at Dynacons Systems & Solutions Limited (NSE:DSSL) recently. As shareholders go into the upcoming AGM on 30 September 2022, CEO compensation will probably not be their focus, but rather the steps management will take to continue the growth momentum. However, some shareholders may still want to keep CEO compensation within reason.

Check out our latest analysis for Dynacons Systems & Solutions

How Does Total Compensation For Shirish Anjaria Compare With Other Companies In The Industry?

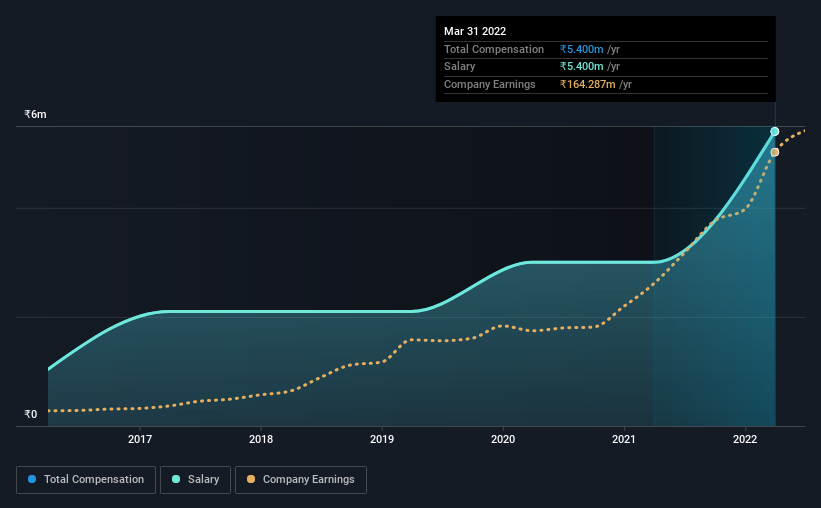

According to our data, Dynacons Systems & Solutions Limited has a market capitalization of ₹3.5b, and paid its CEO total annual compensation worth ₹5.4m over the year to March 2022. Notably, that's an increase of 80% over the year before. It is worth noting that the CEO compensation consists entirely of the salary, worth ₹5.4m.

In comparison with other companies in the industry with market capitalizations under ₹16b, the reported median total CEO compensation was ₹2.7m. This suggests that Shirish Anjaria is paid more than the median for the industry. Furthermore, Shirish Anjaria directly owns ₹447m worth of shares in the company, implying that they are deeply invested in the company's success.

| Component | 2022 | 2021 | Proportion (2022) |

| Salary | ₹5.4m | ₹3.0m | 100% |

| Other | - | - | - |

| Total Compensation | ₹5.4m | ₹3.0m | 100% |

Talking in terms of the industry, salary represented approximately 97% of total compensation out of all the companies we analyzed, while other remuneration made up 3% of the pie. Speaking on a company level, Dynacons Systems & Solutions prefers to tread along a traditional path, disbursing all compensation through a salary. If salary dominates total compensation, it suggests that CEO compensation is leaning less towards the variable component, which is usually linked with performance.

A Look at Dynacons Systems & Solutions Limited's Growth Numbers

Over the past three years, Dynacons Systems & Solutions Limited has seen its earnings per share (EPS) grow by 35% per year. It achieved revenue growth of 27% over the last year.

This demonstrates that the company has been improving recently and is good news for the shareholders. The combination of strong revenue growth with medium-term EPS improvement certainly points to the kind of growth we like to see. While we don't have analyst forecasts for the company, shareholders might want to examine this detailed historical graph of earnings, revenue and cash flow.

Has Dynacons Systems & Solutions Limited Been A Good Investment?

Boasting a total shareholder return of 1,006% over three years, Dynacons Systems & Solutions Limited has done well by shareholders. As a result, some may believe the CEO should be paid more than is normal for companies of similar size.

In Summary...

Dynacons Systems & Solutions rewards its CEO solely through a salary, ignoring non-salary benefits completely. Given that the company's overall performance has been reasonable, the CEO remuneration policy might not be shareholders' central point of focus in the upcoming AGM. Still, not all shareholders might be in favor of a pay raise to the CEO, seeing that they are already being paid higher than the industry.

It is always advisable to analyse CEO pay, along with performing a thorough analysis of the company's key performance areas. That's why we did our research, and identified 3 warning signs for Dynacons Systems & Solutions (of which 1 can't be ignored!) that you should know about in order to have a holistic understanding of the stock.

Arguably, business quality is much more important than CEO compensation levels. So check out this free list of interesting companies that have HIGH return on equity and low debt.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:DSSL

Dynacons Systems & Solutions

Provides IT solutions and related services in India and internationally.

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026