Legendary fund manager Li Lu (who Charlie Munger backed) once said, 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. As with many other companies DiGiSPICE Technologies Limited (NSE:DIGISPICE) makes use of debt. But the more important question is: how much risk is that debt creating?

When Is Debt Dangerous?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. When we examine debt levels, we first consider both cash and debt levels, together.

View our latest analysis for DiGiSPICE Technologies

What Is DiGiSPICE Technologies's Net Debt?

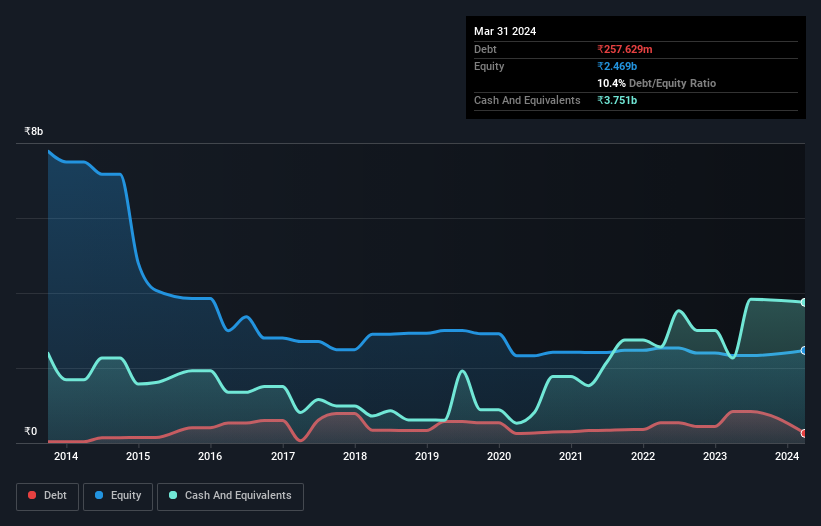

You can click the graphic below for the historical numbers, but it shows that DiGiSPICE Technologies had ₹257.6m of debt in March 2024, down from ₹837.1m, one year before. However, its balance sheet shows it holds ₹3.75b in cash, so it actually has ₹3.49b net cash.

A Look At DiGiSPICE Technologies' Liabilities

The latest balance sheet data shows that DiGiSPICE Technologies had liabilities of ₹3.71b due within a year, and liabilities of ₹317.6m falling due after that. Offsetting this, it had ₹3.75b in cash and ₹230.9m in receivables that were due within 12 months. So its total liabilities are just about perfectly matched by its shorter-term, liquid assets.

Having regard to DiGiSPICE Technologies' size, it seems that its liquid assets are well balanced with its total liabilities. So while it's hard to imagine that the ₹9.11b company is struggling for cash, we still think it's worth monitoring its balance sheet. While it does have liabilities worth noting, DiGiSPICE Technologies also has more cash than debt, so we're pretty confident it can manage its debt safely.

It was also good to see that despite losing money on the EBIT line last year, DiGiSPICE Technologies turned things around in the last 12 months, delivering and EBIT of ₹64m. When analysing debt levels, the balance sheet is the obvious place to start. But it is DiGiSPICE Technologies's earnings that will influence how the balance sheet holds up in the future. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

Finally, a business needs free cash flow to pay off debt; accounting profits just don't cut it. While DiGiSPICE Technologies has net cash on its balance sheet, it's still worth taking a look at its ability to convert earnings before interest and tax (EBIT) to free cash flow, to help us understand how quickly it is building (or eroding) that cash balance. Happily for any shareholders, DiGiSPICE Technologies actually produced more free cash flow than EBIT over the last year. There's nothing better than incoming cash when it comes to staying in your lenders' good graces.

Summing Up

We could understand if investors are concerned about DiGiSPICE Technologies's liabilities, but we can be reassured by the fact it has has net cash of ₹3.49b. The cherry on top was that in converted 511% of that EBIT to free cash flow, bringing in ₹327m. So we don't think DiGiSPICE Technologies's use of debt is risky. When analysing debt levels, the balance sheet is the obvious place to start. However, not all investment risk resides within the balance sheet - far from it. To that end, you should learn about the 2 warning signs we've spotted with DiGiSPICE Technologies (including 1 which is concerning) .

If, after all that, you're more interested in a fast growing company with a rock-solid balance sheet, then check out our list of net cash growth stocks without delay.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:DIGISPICE

DiGiSPICE Technologies

Engages in the provision of tech-enabled local payments network services in India and internationally.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Weekly Picks

The Future of Social Sharing Is Private and People Are Ready

EU#3 - From Philips Management Buyout to Europe’s Biggest Company

Booking Holdings: Why Ground-Level Travel Trends Still Favor the Platform Giants

A fully integrated LNG business seems to be ignored by the market.

Recently Updated Narratives

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

Czechoslovak Group - is it really so hot?

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

Popular Narratives

Undervalued Key Player in Magnets/Rare Earth

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The "Easy Money" Is Gone: Why Alphabet Is Now a "Show Me" Story

Trending Discussion